The market wiped out nearly 90 percent of the previous week's gains in the week that ended on May 8, as bears seemed to have taken charge of Dalal Street. This came after rising risks on multiple fronts which resulted in sharp increase in volatility.

Sentiments were hit by the delay in announcement of a fiscal stimulus package amid fiscal deficit and credit rating worries, reports of a possible lockdown extension, concerns over the lockdown's impact on the economy and earnings, rise in the number of COVID-19 case and reports of United States-China trade tensions. However, the rally in Reliance Industries (RIL) amid two Jio deals helped limit market losses.

While the BSE Sensex and Nifty50 fell nearly 6.2 percent during last week, Nifty Smallcap and Midcap indices were down 4-5 percent.

This week, the market will first react to ICICI Bank's numbers on May 11 (Monday). But overall, it is expected to remain volatile with negative bias.

"Although IIP and inflation numbers are not expected to surprise the market in any way, investors will be looking out for any silver lining in the commentary. Market rallies do not look sustainable and volatility is likely to rule the markets. Investors will also take cues from any reduction in the number of infections," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

Here are 10 key factors that will keep traders busy this week:

COVID-19 risk rising?

Confirmed cases of COVID-19 rose sharply last week, especially in Maharashtra, Gujarat, Delhi and Tamil Nadu.

While the recovery rate is around 30 percent and many districts are no more affected by the novel coronavirus pandemic, confirmed cases in India are nearing the 60,000-mark, including nearly 2,000 deaths.

Globally, there have been over 40.2 lakh confirmed cases of COVID-19. At least 2.79 lakh people have died so far. The United States, Spain, Italy, UK, France and Germany are the most-affected countries. However, some states in the US and some countries in Europe have reopened their economies.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

Lockdown extension?

We would have completed 53 days of lockdown by end of next week. We will soon come to know if the government is planning to extend the nationwide lockdown beyond May 17.

Reports suggest that the Centre could extend lockdown further in red zones. However, experts feel that any extension of lockdown beyond May 17 could be a big risk for the economy.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Stimulus?

The market has been eagerly waiting for a bigger stimulus package since April. It was one of reasons for the rally seen in April.

Hopes for a package remain, given the economic loss due to the novel coronavirus pandemic. However, experts have some doubts over the quantum of the package due to the fiscal deficit and credit rating risks.

"Government stimulus seems to be a never-ending wait, but if it comes will be welcomed with open arms," Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote told Moneycontrol.

The March quarter earnings season will be long this time due to the COVID-19 crisis. Around 50 companies will announce their earnings this week. The key earnings to look at would be Maruti Suzuki, Kotak Mahindra Bank, Dr Reddy's Labs, Cipla, Biocon, Bandhan Bank, Havells India, ABB India, Siemens, Godrej Consumer Products and M&M Financial Services.

Among others, Wockhardt, Piramal Enterprises, Motilal Oswal, Godrej Properties, Godrej Agrovet, Syngene International, Sterlite Technologies, Indiamart Intermesh, Blue Star, MphasiS, Tata Consumer Products, Manappuram Finance, L&T Technology Services, Nippon Life India Asset Management, CDSL and Crompton Greaves Consumer Electricals will also announce quarterly earnings this week.

US-China trade relations and oil prices

Globally, the markets were cautious last week due to the likely collapse of phase 1 trade agreement between US and China (signed in February). But, reports suggest that the meeting between officials of both countries was positive. This could support equity markets.

"Both sides agreed that in spite of the current global health emergency, both countries fully expect to meet their obligations under the agreement in a timely manner," Reuters said, quoting the joint statement of two Trump Cabinet officials.

The news agency further quoted China's Commerce Ministry as saying that the two sides have agreed to improve the atmosphere for implementation of the phase 1 deal, which calls for Beijing to boost its purchases of American farm and manufactured goods, energy and services by $200 billion over two years compared to the 2017 baseline.

Meanwhile, oil prices finally stabilised above $30 a barrel, giving a relief to oil producing and processing countries, and companies. But the key thing to watch out for would be its further uptrend amid low demand globally, though there could be relaxations to lockdowns.

The international Brent crude futures rose 17 percent during last week to close at $30.97 a barrel on May 8, continuing an uptrend for the second consecutive week after shut down of production by US producers and ahead of relaxation of lockdown in some US states.

CPI, IIP data

On the macro front, industrial production data for March and CPI inflation for April will be released on May 12. WPI inflation will be announced on May 14.

Industrial production in February grew to seven-month high of 4.5 percent, but March is expected to see some lockdown impact.

Foreign exchange reserves for the week ended May 8 and balance of trade data for April will be released on May 15.

Technical view

The Nifty50 on May 8 formed a bearish candle on daily, weekly and monthly charts, indicating bears have upper hand now though bulls had made a comeback in previous week.

The index lost 6 percent in the passing week and negated the formation of a higher top and higher bottom pattern on the weekly scale.

The overall trend for Nifty continues to remain sideways to negative until it reclaims 9,400-9,500 levels decisively, experts feel.

"Looking at overall chart structure, we maintain our negative to range bound stance till it holds below 9,400 and expect the Nifty to fall towards 9,000 then 8,800 zone in coming days. On the upside, immediate resistance is placed at 9,400 and then 9,550-9,600 zone," Chandan Taparia, Derivatives & Technical Analyst at Motilal Oswal Financial Services said.

F&O cues

Maximum Call open interest was at 10,000 then 9,500 strike while maximum Put open interest was at 9,000 then 8,000 strike. There was no noticeable built up on Put side while Call writing was seen at 10,000 then 9,500 strike. This Option data indicates an immediate trading range for Nifty could be 9,000 to 9,500 levels.

"The Options data indicates that the maximum Put base has shifted to 9,000 strike, which can be a support for the Nifty. Continuous Call writing at 9,500 strike hints that Nifty is unlikely to surpass 9,500 in the coming week," Nilesh Ramesh Jain, Derivative Analyst - Equity Research at Anand Rathi told Moneycontrol.

The sentiment indicator India VIX has broken its five-week losing streak and surged 13 percent last week to near 38 levels, which is a cause of concern for the bull and it has to cool down below 30 levels, experts feel.

"The rise in India VIX with decline in Put Call Ratio with negative basis suggests bearish market stance," Taparia said.

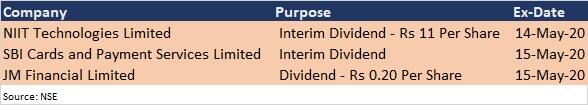

Corporate action

Here are key corporate actions taking place this week:

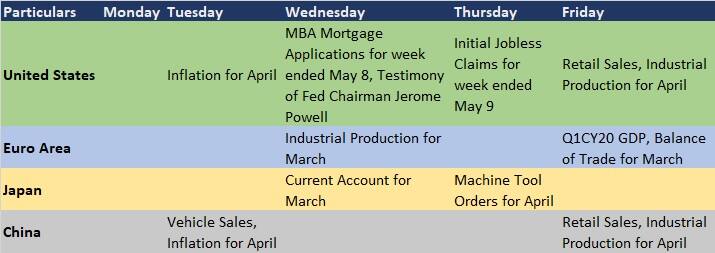

Global cues

Here are key global data points to watch out for this week:

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.