Shreesh BiradarCapitalmind

Linde India is part of the global Linde Group and owned by BOC UK. It is a major player in India for industrial gases with more than 20 production facilities that can produce different mixtures of gases. It also offers consultancy services with project management.

Linde India has 5,260 tpd air separation unit (ASU) built for Tata's steel plant and another 2,220 tpd ASU for Jindal Steels. Linde Group was recently acquired by Praxair and in India, Praxair had planned to delist their India business from the exchanges.

Linde India was earlier owned by BOC UK Plc. In 2006, Linde AG (Germany) took over BOC in a GBP 8.2 billion takeover. BOC at that time was much larger in size than Linde. Prior to that, Linde AG had made some failed attempt to takeover BOC. Linde and BOC have a history of working together for more than 130 years.

After the takeover, until 2013, Linde India was known as BOC India. As part of a global rebranding process, BOC India was rechristened as Linde India, but currently has BOC as its promoter with 75 percent stake.

Linde India and Praxair merger

Praxair and Linde group last year initiated a merger process after an approval from the US federal trade commission and European Commission. The market cap of the combined entities is believed to be at $90 billion and combined revenue at $27 billion (considering 2017 revenue). Linde India being a subsidiary of Linde group was also absorbed in the merger.

The global merger concluded in the last week of October 2018.

Praxair and Linde have working relations for many decades and have been pitched against each other in some verticals.

As part of a new strategy by Praxair, the management wanted to take Linde India private by delisting it from stock exchanges.

How delisting works

The BOC group which is the majority stakeholder in Linde India will take the full ownership. The earlier process of delisting was to put an open offer for the public shareholders. The open offer would be usually above the current market price (premium), to lure public shareholders to tender their shares. If the promoters were unable to buyback all intended shares in the first offer then they make a second open offer at a higher price. The process would be repeated until 90 percent of the public shareholders tendered the shares making it time-consuming and yet not ensuring a full buyback.

SEBI issued new guidelines for voluntary delisting to streamline the delisting process. In the new process, promoters will engage in reverse book building to determine the price they need to pay for all the remaining shareholders if they intend to take the company private. Here is how the delisting process works;

Assume a promoter has 75 percent stake in the firm to be delisted and the total shares outstanding is one crore. Promoters need to acquire 25 percent (25 lakh shares) to complete the delisting.

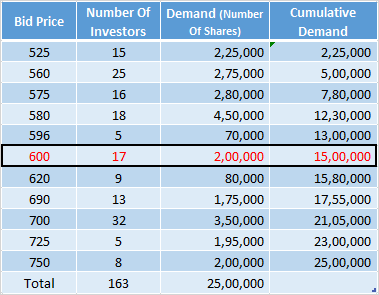

- Promoters will set a floor price at Rs 525 (which in most cases involves some premium). The bidding can start at Rs 525.

- Public shareholders will start placing their bids at different prices with different quantities.

- For the promoters to finalise the offer price (discovery price), they should be able to acquire a minimum of 90 percent of outstanding shares.

(Image source: Capitalmind)

(Image source: Capitalmind)

- In the above case, 90 percent of stake can be held only when the promoter is able to buy 15 lakh more shares.

- The minimum price to buy a total of 15 lakh shares stands at Rs 600.

- Thus the final offer price stands at Rs 600.

- If promoters are ready to buy the shares at Rs 600, then they can process the buyback of shares and go ahead with delisting.

In earlier cases, investors were given an open offer at a fixed price, which was determined by promoter itself. This meant smaller retail investors didn’t have much of a say. The new process brings in the price discovery mechanism, which will ensure a fair price for the shareholders.

The case of Linde India

Due to the takeover, BOC is by law required to provide an open offer for a minimum 26 percent stake. Given that only 25 percent of the current shareholding is with the public, BOC instead went ahead with a voluntary delisting offer.

As part of the process, BOC opened the bidding on January 15, 2019, at a floor price of Rs 428.50. The bidding concluded a couple of days back. The price discovered during reverse bidding was at Rs 2,025.

The promoter rejected the price and is unwilling to buyback at Rs 2,025. The discovered price is nearly 4.7 times higher than floor price offered. The stock cratered the day the information on the price became public as there were doubts if the company will be willing to buy back shares at such a high price.

Today, the company decided against following up on desisting and instead is persisting with its buyback. According to SEBI guidelines, BOC can't offer to delist for another six months.

Reliance Mutual Fund – The deal breaker

Reliance Capital Trustee through Reliance Multi Cap Fund and Reliance Tax Saver (ELSS) Fund is a major stake owner in terms of public shareholders. Reliance funds own around 9.85 percent of the total stake. For promoters to reach 90 percent of threshold, Reliance funds' bid plays a major role. In the reverse bidding process, Reliance placed its bid above Rs 2,000, taking the final offer price (or discovery price ) to Rs 2,025.

For a stock that was traded at Rs 400 levels just a few months back, Rs 2,025 is a price that is unlikely to be seen for a very long period of time. This isn’t the first instance of minority shareholders asking for a price that is way above current market price. In 2012, Alfa Laval went for delisting with floor price set at Rs 2,850. The discovered price was Rs 3,000 but not many shareholders participated in the offer. The offer was then raised to Rs 4,000 and the stock was delisted from exchanges.

Another stock that comes to mind where a major stockholder tried to push the company to offer a much higher price than the one it was willing to offer was Blue Dart.

Promoters of Blue Dart wanted to delist in 2011. Radhakishan Damani held a 5.5 percent stake and asked for a price of Rs 2,300 for his stake which was well above the market price which were trading at around Rs 1,400. DHL did not proceed with the delisting and over time has reduced its holding to 75 percent to comply with SEBI norms.

The stock performance in the subsequent years showed that Damani was right in asking for that price with the stock peaking in 2015 at Rs 7,850, nearly three times Damani's own asking price.

The Road Ahead

As part of SEBI regulations on open offer, promoters will do an open offer for the price Linde India was acquired for by Praxair. The open offer is at Rs 328.21 which can be enhanced by 10 percent according to SEBI guidelines. The open offer will close on April 11, 2019.

Considering the stock is currently trading at Rs 560 a piece and floor piece was pegged at Rs 428.50, it's doubtful to see it being successful in which case, Linde will continue to be listed for the forthcoming future. As for the unitholders of Reliance MF holding those shares, only time will tell if the decision of the fund manager to ask for such a high price was worthwhile given the stock’s own history.

The author is a market analyst with Capitalmind.in.

The article was first appeared on Capitalmind. It has been reproduced with their permission. You can read the original article here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.