ITC shares briefly slipped below the psychological Rs 400-mark to a 10-month low as the market worries about the impending 4 percent stake sale by British American Tobacco (BAT), the largest shareholder in the company.

Analysts and traders tracking ITC said the proposed stake sale does not change the fundamental picture but could put pressure on the stock in the short term because of a supply overhang.

It can also create an attractive buying opportunity for investors due to ITC's strong brand presence and growth prospects in its FMCG business, broking firm Jefferies, which recently downgraded the stock to "hold" from "buy", said.

Also Read | Jefferies downgrades ITC on BAT stake sale update

BAT plans to pare its stake in ITC from 29.03 percent to 25 percent. The four percent it is looking to sell translates to around 50 crore shares worth Rs 20,000 crore at the current market price.

The availability of such a huge block of shares means that prospective investors looking to buy a large quantity need not buy it from the open market and risk driving up the price.

The floating stock in the system will increase after the stake sale, as some of the new investors would look to sell the stock at the first opportunity if they get a decent profit.

BAT’s moves

BAT has tapped Wall Street banks such as Bank of America and Citi to help trim its stake in the hotels-to-cigarette conglomerate.

So, who could be prospective buyers?

A key challenge BAT faces in offloading a 4 percent stake in ITC is navigating the regulatory hurdles imposed by the Reserve Bank of India on foreign ownership in tobacco firms, which limits who can buy those shares.

The complexity of divesting ITC’s shares is immense, BAT CEO Tadeu Marroco said in December. “There are specific RBI approvals that are required in respect of any action-taking about our stake, and this adds a significant level of additional bureaucracy," he said.

As a result, “the universe of buyers is limited'' for ITC shares, the CEO said.

But potential buyers also include large domestic institutions such as life insurance companies, mutual funds, sovereign wealth funds, global FMCG giants such as Unilever or Nestle, and private equity firms, said Atul Parakh, CEO of trading platform Bigul.

Hemal Shah, Fund Manager, Torus Oro, a PMS, said BAT could have a long list of prospective buyers, considering the strengths of ITC’s businesses.

Impact on tobacco, FMCG arms

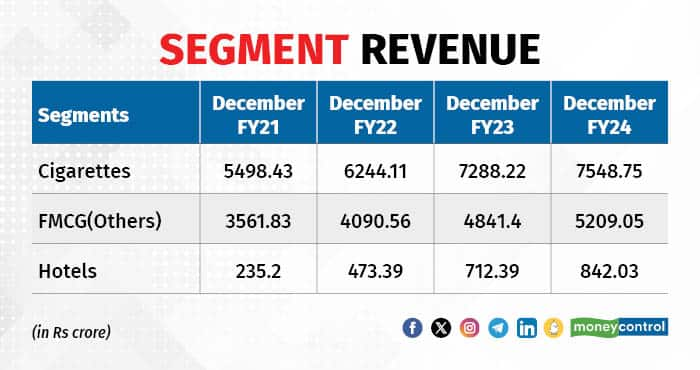

Investors are betting on ITC’s FMCG business to drive growth over the medium-to-long term. The FMCG division has been showing good revenue growth, and ITC watchers are hopeful of an expansion in profit margins.

“ITC's strong brand presence and market leadership are likely to continue attracting investors, regardless of the change in shareholding pattern,” added Parakh.

The upcoming elections could be a short-term earnings driver for FMCG business, as it could lead to strong demand from the rural sector, said Shah.

But there are challenges as well. Volume growth in the mainstay tobacco business is moderating.

While the company’s focus on premiumisation and diversification could mitigate the impact, Sheersham Gupta, Director, Rupeezy, said, “The divestment is not likely to have an impact on these future projections for either segment.”

ITC Hotels to be divested by BAT?

Marroco also announced that the firm had no interest in remaining invested in a hotel company and might divest its entire stake in ITC Hotels once the arm was spun-off into a separate entity.

Also Read | ITC stock down 4% as BAT prepares to pare stake

Analysts see no major impact on the hotels arm following BAT’s stake sale, as the tourism and hospitality sector in India is seeing massive growth. “ITC is the second largest hotel chain in India. Even if BAT divests its holding, it will not hamper ITC Hotels’ growth,” said Avinash Gorakshkar, Head of Research, Profitmart Securities.

Instead, depending on the potential buyers of the ITC Hotels stake, it could benefit both companies: BAT receives additional capital, while ITC Hotels is provided with more autonomy, said Atul Parakh.

Attractive valuations

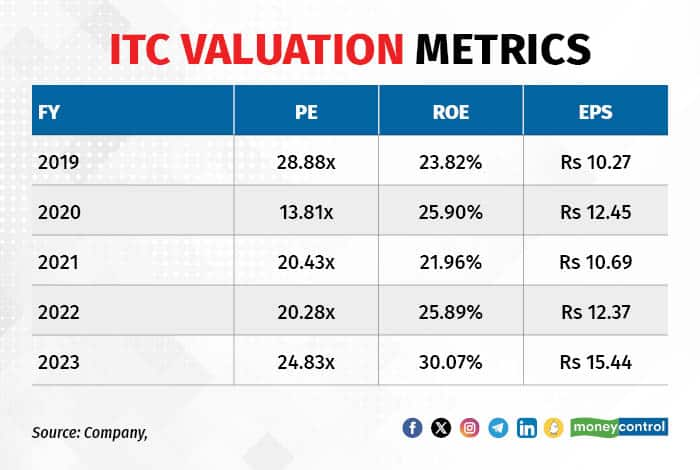

ITC shares hit a peak of Rs 499.70 in July 2023, but have since been underperforming. With the stock now 20 percent below its recent peak, analysts feel lot of the bad news has already been factored in.

“ITC shares are now available at attractive valuations as the company posted one of the strongest quarterly results. There are a few opportunities for investors in the form of ITC Hotels' demerger and growth in the FMCG arm. However, Investors should not expect the kind of returns the stock gave in the past two years,” said Sheersham Gupta.

On February 8, Jefferies downgraded the ITC stock to "hold" from "buy" as the international brokerage expects the hotels-to-cigarettes player to remain range-bound. The international brokerage also slashed ITC target price to Rs 430 from Rs 520 a share.

At 1.41 pm, the stock was trading at Rs 407.20 on the National Stock Exchange, up 0.82 percent from the previous close.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!