Krishna KarwaMoneycontrol Research

With GST rollout around the corner, the Indian garment industry will likely become more organised, handing branded marquee names a clear advantage over the fragmented players, who currently make up over 60 percent of the industry. Indian Terrain Fashions (ITFL), which has been in apparel business for over six years now, looks to be on solid turf, given its brand recall, and focus on men’s wear.

The Company

Indian Terrain, with a market cap of Rs 775 crore, grew out of a split from Celebrity Fashions (CF) in 2010. The Chennai-based company has been quietly expanding its footprint over the years to leverage the strengths it had gained in menswear. Its recent product offerings include men’s footwear and boys wear.

Leveraging On The Expertise Of Celebrity Fashions: Indian Terrain benefits from one of its key suppliers Celebrity Fashions’ (CF) experience in understanding fashion trends. About 25 percent of ITFL’s woven outsourcing requirement is met by CF alone.

GST, A Shot In The Arm: Post GST, scores of small unbranded garment players, who hogged the market share of organised entities such as ITFL in the past, will come under a uniform tax regime. However, after July 1 this year, a marginally higher tax rate of 12 percent on apparel items (where price exceeds Rs 1,000) as against the current effective rate of 8 to 10 percent, is likely to be a short-term dampener.

Asset-Light Business Model: Since ITFL’s focus is solely on retail and distribution activities pan-India, manufacturing of garments and apparel is completely outsourced to external suppliers. Though this model assures a better return on capital, on the flip side, it also exposes the company to major external uncertainties. However, quality control checks and long-term contractual agreements ensure that such risks are mitigated to quite an extent.

Product Variety with Superior Realizations: ITFL’s product pricing strategy is targeted at the upper middle class, with an average realization in the range of Rs 1500-Rs 3000 per unit. Though this may seem marginally higher than most other competitors, superior product quality, backed by a strong brand recognition, plays a vital role not only in terms of product differentiation, but also by way of higher contribution towards operating margins. The ability to meet a diverse range of consumer requirements spanning t-shirts, knitwear, shorts, shirts, trousers, and jackets also gives the brand ample visibility.

Wide Distribution Network: To ensure adequate brand presence and awareness, ITFL’s products are marketed through over 1200 multi-brand outlets (MBOs), 269 large format stores (LFS), 141 exclusive brand outlets (EBOs), and 7 e-commerce platforms. To expand its reach further and capitalize on the uptrend in the non-metros as well, ITFL’s strategy entails adding new stores (mainly in Northern India because of the immense untapped potential), entering into agreements with new franchisees, and setting up of more effective distribution channels throughout the country.

Retailing in a Sweet Spot: India’s branded apparel market is anticipated to grow at a CAGR of 10-12 percent every year, largely led by a spurt in GDP, thereby boosting discretionary consumption. A change in consumer preferences towards premium garments underscores the subtle shift in favour of aesthetics and quality over price for the new generation of Indian men.

The growing popularity of online shopping has revolutionised the retail industry and will continue to drive the sector’s growth in the coming years, owing to the convenience and flexibility it offers. However, the growth of e-commerce channels with deep pockets, apart from their steep discount strategies, may pose significant challenges for the company’s brand.

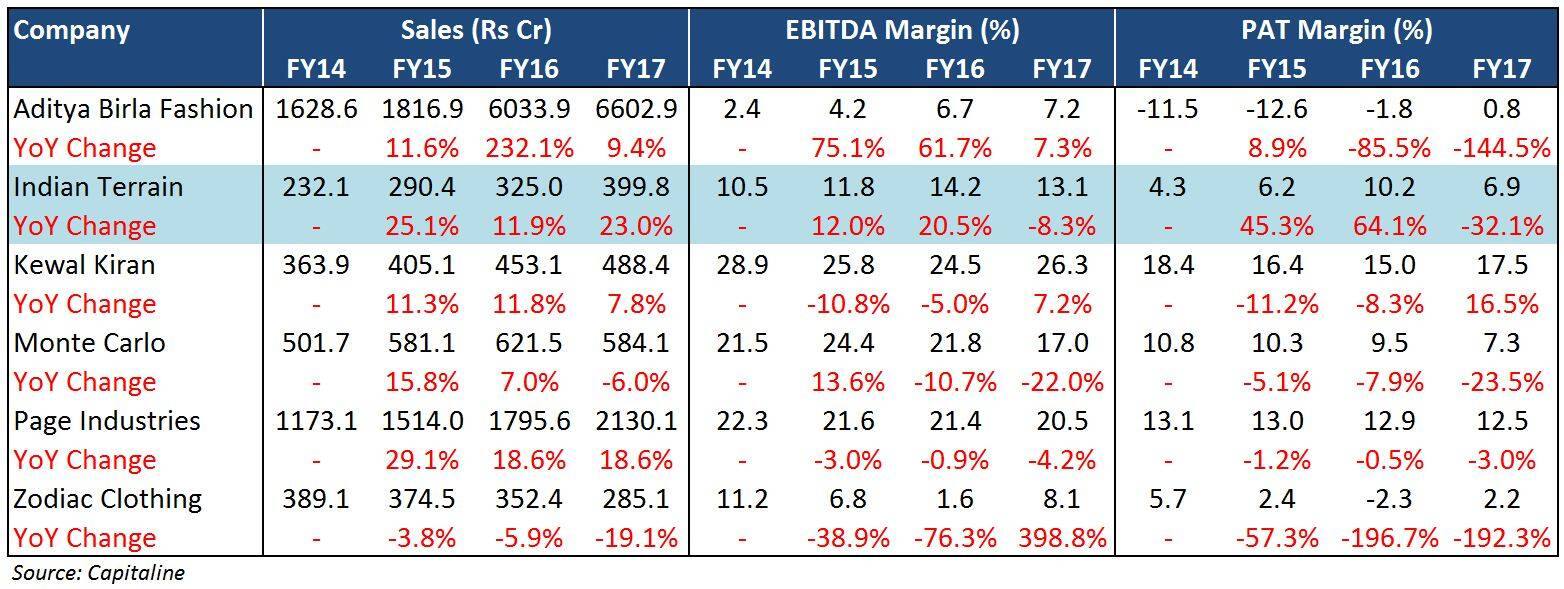

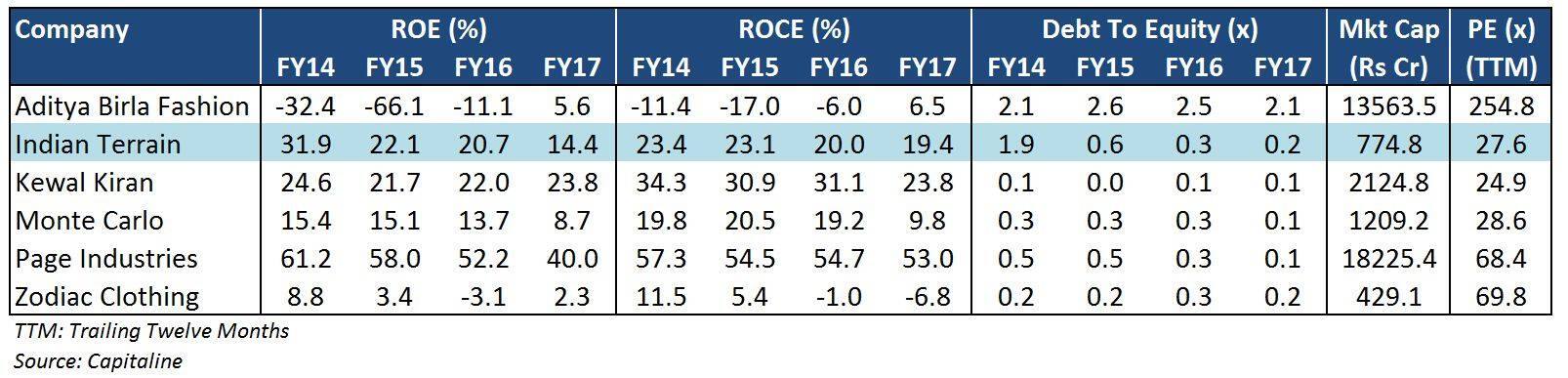

Peer Comparison

Valuation

Despite a strong top-line growth, ITFL’s performance on the operational and bottom-line fronts was affected in FY17 (in comparison to FY16) on account of high procurement costs, higher interest and depreciation expenses (attributable to store additions), and an increase in the tax rate. Barring this blip, the company has been performing steadily year-on-year.

Since the wholesale distribution channel accounts for more than 30 percent of ITFL’s annual turnover, there could be GST-induced disruptions impacting the company’s earnings for a couple of quarters. With the long-term tailwinds firmly in place, any weakness could be an accumulation opportunity, as the stock looks reasonably valued at 18.5x FY19 estimated earnings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!