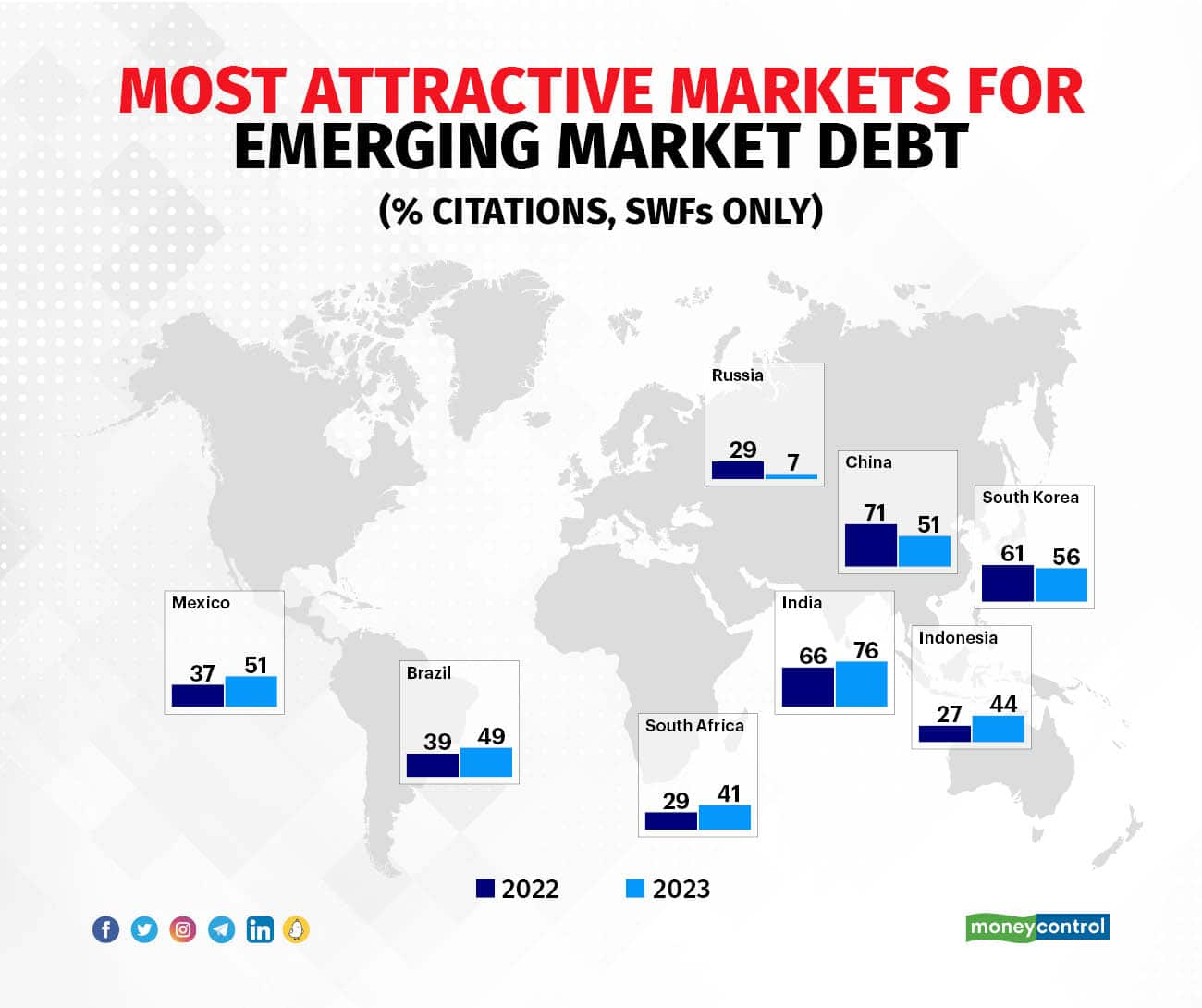

India has now overtaken China as the most preferred destination for Sovereign Wealth Funds (SWFs) looking to put money in emerging market debt, according to an Invesco Global Sovereign Asset Management Study.

The study is based on the views of 142 chief investment officers, heads of asset classes, and senior portfolio strategists from 85 sovereign wealth funds and 57 central banks, collectively managing approximately $21 trillion in assets.

As inflation remains stubbornly high and interest rates continue to inch up, sovereign wealth funds are now favouring favour fixed income and private debt, according to the Invesco study.

“Emerging Markets with solid demographics, political stability, and proactive regulation, particularly India, have emerged as prime investment destinations,” said the Invesco Study.

According to Invesco, India exemplifies the attributes sought by sovereign investors.

The country’s strong points are its improved business and political stability, favourable demographics, regulatory initiatives, and a friendly environment for sovereign investors, which has led to SWFs preferring India over China when it comes to emerging market debt.

The study quoted a development sovereign based in the Middle East as saying, “We don’t have enough exposure to India or China. However, India is a better story now in terms of business and political stability.

Demographics are growing fast, and they also have interesting companies, good regulation initiatives, and a very friendly environment for sovereign investors.”

The study noted India as being among the countries, including Mexico and Brazil, that are benefitting from increased foreign corporate investment aimed at both domestic and international demand through “friend-shoring” and “near-shoring”.

This was seen as helping fund current account deficits as well as support currencies and domestic assets including debt. Expectations for peaking inflation and completion of the Emerging Markets tightening cycle was also playing a role in this trend. Several EMs that saw an increase in their perceived fixed-income attractiveness were widely expected to be overcoming inflation and eventually stop tightening and start easing monetary policy.

Also Read: Sovereign investors embrace bonds and gold, Invesco survey shows

The RBI, in its bi-monthly monetary policy review, opted for a pause the second time in a row, maintaining the key benchmark policy rate at 6.5 per cent as inflation moderates. The rate increase cycle was paused in April after six consecutive rate hikes aggregating to 250 basis points since May 2022.

India's consumer price index (CPI) inflation, or retail inflation, fell to 4.25 per cent in May hitting a 25-month low. This was a significant drop in retail inflation as it was 4.7 per cent in April 2023 and 7.04 per cent in May 2022. The country's current account deficit (CAD) – which measures the difference between exports and imports of goods and services – narrowed to 0.2 per cent of gross domestic product (GDP) in the fourth quarter of fiscal 2022-2023, from 2 per cent in the preceding quarter.

India and South Korea continue to be the most attractive destinations for increasing exposure, according to the study. One central bank based in the West explained that they were looking at increasing their exposure to EM debt and focused on debt targeting real estate and infrastructure as well as other diversified industries, the study said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.