Jefferies analysts are bullish on the defence sector in India, according to a latest report. This comes on the back of a government push for indigenisation, reduced dependency on import and geopolitical conflicts.

The brokerage has a buy call on HAL, BEL and Data Patterns. Stocks of most large defence players have seen rapid gains over last five years. For example, HAL has gained over 9x, BEL has gained around 6x and Data Patterns has gained nearly 3x (since listing).

In charts, here are four reasons why Jefferies continues to be bullish on this segment:

India among top 10 spenders in defence

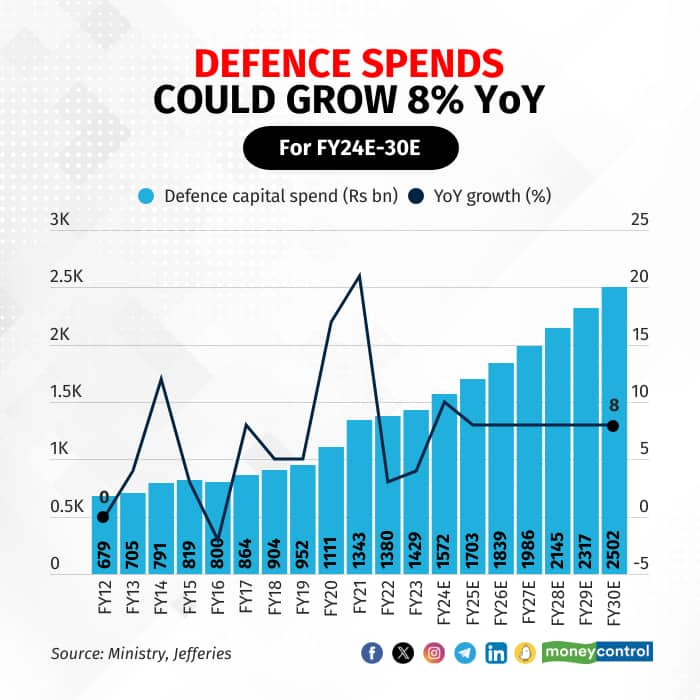

India is currently the second largest defence spender in Asia (ex-Japan) and third largest in defence spends globally. According to the report, India has a $100-120 billion in domestic defence opportunity over 5-6 years. In CY2022, the overall defence spend was just 10 percent of US’ spend and 27 percent of China’s.

India is currently the second largest defence spender in Asia (ex-Japan) and third largest in defence spends globally. According to the report, India has a $100-120 billion in domestic defence opportunity over 5-6 years. In CY2022, the overall defence spend was just 10 percent of US’ spend and 27 percent of China’s.

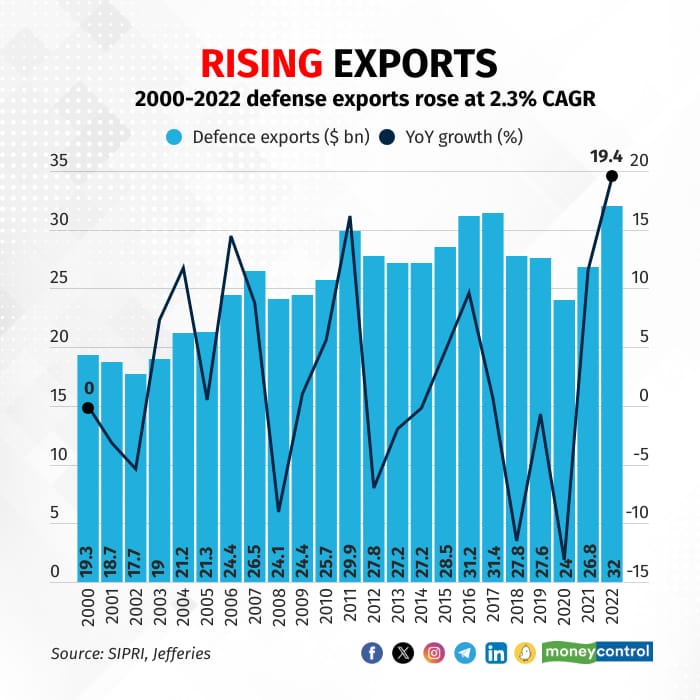

Exports growth over the years

Over FY2019-FY2024, Indian defence exports have grown 2x.

Jefferies estimates factor in a 2.5x rise over FY24E-30E against the government target of 3x. "PSU companies and their vendors should lead the way on this as suggested by recent government to government defence interactions. Given this, we believe sector is poised for double-digit growth till FY30E, and are positive on Data Patterns, HAL and BEL," the report added.

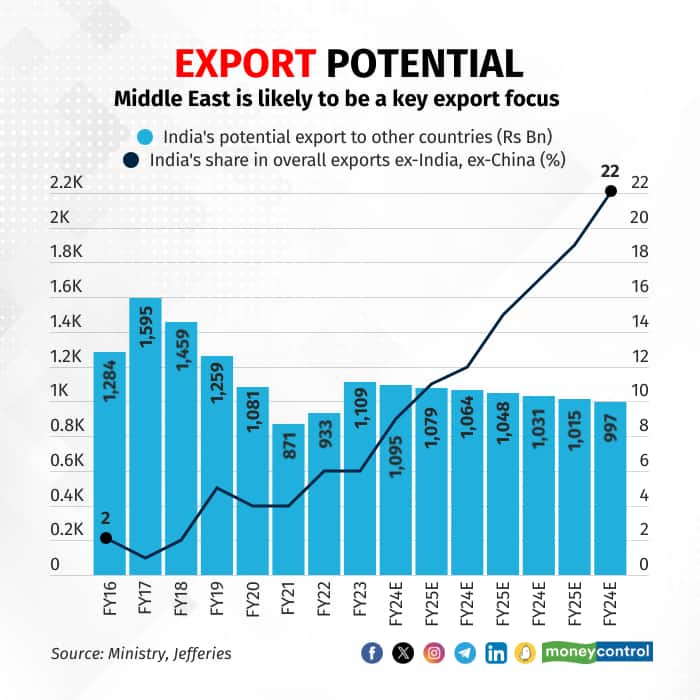

New export markets

While some of the major export destinations have been countries like Italy, Egypt, UAE, Bhutan, Ethiopia, Saudi Arabia, Jefferies sees huge potential in Indian exports to the Middle East. Currently, the Middle East accounts for

33 percent of global arm imports at $11 billion and offers opportunity for India, the report notes.

Also read: Moneycontrol Pro Panorama | Defence: Making in India for the world

Geopolitical tensions, India's focus on indigenisation to increase spends

.

.

While global defense spends declined from 1990-2000, they have been growing since. From 2016-2022, defence spends saw three percent CAGR led by Ukraine. According to the report, China (five percent CAGR) and India (four percent CAGR) were the other drivers, during this period. According to the brokerage, India is the number-two importer of defense equipment, accounting for nine percent of arms imports. "We believe India’s capital defence spend should continue at the 7-8 percent CAGR seen in the last decade. Indigenisation focus will drive double-digit growth in domestic defence spends," the report noted.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.