Shabbir Kayyumi

The Money Flow Index (MFI) is an oscillator that usages both price and volume to measure buying and selling pressure on a financial instrument. It is created by Gene Quong and Avrum Soudack. This indicator is also known as volume-weighted RSI

What is a ‘Money Flow Index (MFI)?

The Money Flow Index is a rather unique indicator that combines momentum and volume with an RSI formula. MFI generally favors the bulls when the indicator is above 50 and the bears when below 50.

MFI above 80 is considered overbought condition and below 20 oversold condition. Pattern analysis can be combined with MFI to increase signal robustness.

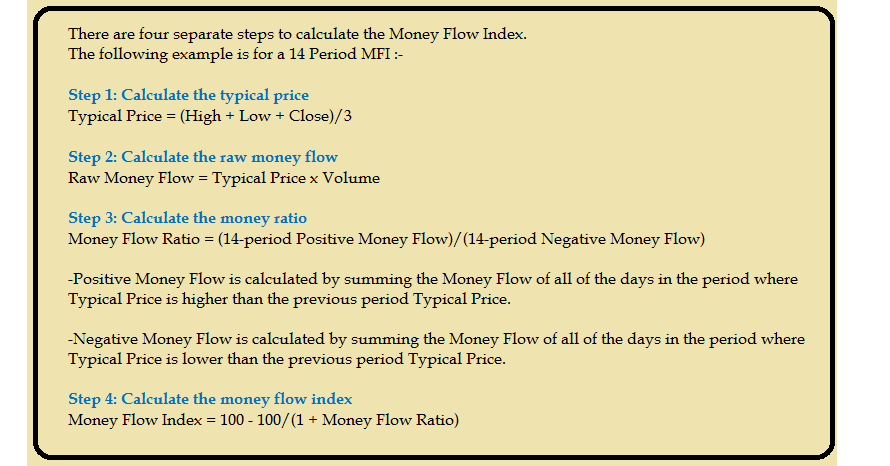

Construction of MFI Indicator

The MFI is calculated by accumulating positive and negative Money Flow values (see Money Flow), then creating a Money Ratio. The Money Ratio is then normalized into the MFI oscillator form.

Working of MFI Indicator

A divergence between the indicator and price is very important. There are two types of divergences positive divergence & negative divergence; both are very useful for trading purpose. While positive divergence indicates opportunity to Buy, negative divergence indicates opportunity to sell.

Money Flow Index (MFI) and the Relative Strength Index (RSI)

• The MFI and RSI are very closely related in construct.

• The main difference is that MFI incorporates volume, while the RSI does not.

• MFI provides lead signals, and warns of possible reversals, in a more timely fashion at times ahead of RSI.

• Just like the RSI, the value of the MFI ranges between 0 and 100, and uses a default setting of 14 periods for its calculation. The Money Flow Index has a high correlation with the RSI, but still differs to some extent as it takes into account the trading volume of the instrument.

Trading Technique:

Failure Swings Trading with MFI

Apart from regular oscillator trading technique, failure swings are another occurrence which can lead to a price reversal. Failure swings are completely independent of price and rely solely on MFI. Failure swings consist of four “steps” and are considered to be either Bullish (buying opportunity) or Bearish (selling opportunity).

Buying with MFI

1. MFI drops below 20 and enters inside oversold zone.

2. MFI bounces back above 20.

3. MFI pulls back but remains above 20.

4. A MFI break out above its previous high is a good buy signal.

Selling with MFI

1. MFI rises above 80 and enters inside overbought zone.

2. MFI drops back below 80.

3. MFI rises slightly but remains below 80.

4. MFI drops lower than its previous low is a signal to short sell or profit booking.

Using MFI in conjunction with other technical indicators helps in maximizing odds of success.

The author is Head - Technical & Derivative Research at Narnolia Financial Advisors.Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.