The Nifty ended mildly higher in a volatile session on December 11 to close at yet another all-time high levels. At close, the Nifty was up 27.7 points at 20,997.

With the Nifty surging to new life highs, the trend remains positive on all time frames - short term, intermediate and long term. Technical indicators, too, are supporting the uptrend as the Nifty continues to trade above all the key moving averages like the 20-day, 50-day, 20-week and 50-week SMAs (simple moving average).

In the Option segment, we have seen Put writing at 20,500-20,600 levels. This level coincides with the 11-day EMA (exponential moving average) which is placed at 20,580 levels. Therefore, we believe that 20,500-20,600 levels to act as a strong support. Traders are advised to hold longs with trailing stop-loss of 20,500 in the Nifty on the closing basis.

Our immediate upside target is at 21,430, which is the 76.4 percent Fibonacci extension target arrived at using the March 2023 lows, September 2023 highs and October 2023 lows.

Broad market indices like Nifty Midcap and Smallcap indices outperformed the Nifty on Monday with gains of 0.74 percent and 0.84 percent. Both these indices remained in a short term and intermediate uptrend and have not shown any sign of a reversal.

In terms of strategy, we recommend a selective buying approach by looking for stocks that are making sustainable breakouts and are from outperforming sectors.

Here are three buy calls for the next 3-4 weeks:

Karur Vysya Bank: Buy | LTP: Rs 163.85 | Stop-Loss: Rs 150 | Target: Rs 172-185 | Return: 13 percent

The stock price has broken out on the daily chart to close at all-time high levels with higher volumes. The stock price has been forming bullish higher top higher bottom formation on the weekly chart.

Momentum indicators and oscillators are showing strength in the stock.

CARE Ratings: Buy | LTP: Rs 945 | Stop-Loss: Rs 890 | Target: Rs 1,010-1,050 | Return: 11 percent

The stock price has broken out from the ascending triangle on the weekly chart. Primary trend of the stock is positive as stock price is trading above important short and long term moving averages. Stock price has been forming bullish higher top higher bottom formation on the weekly charts.

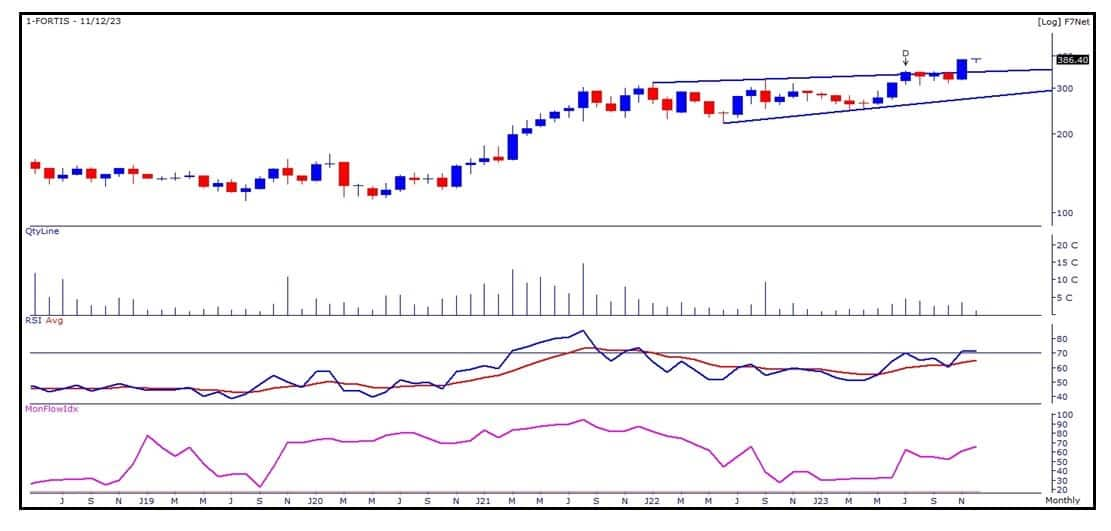

Fortis Healthcare: Buy | LTP: Rs 386 | Stop-Loss: Rs 360 | Target: Rs 420-440 | Return: 14 percent

The stock price has broken out from the downward sloping trendline on the daily chart, adjoining the high of July 31 and September 28, 2023. It has broken out on the weekly and monthly chart with higher volumes. Hospital as a sector is looking strong on the short to medium term charts.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.