The Nifty fell for the second straight session amid Israel-Iran crisis to close at 22,273 on April 15. After gap-down opening of 180-odd points, the benchmark index attempted the recovery during the day but failed to sustain at higher levels. The Nifty closed near day’s low with more than 1 percent loss. Its cash market volumes dipped a bit from Friday's level.

Declining shares outnumbered the advancing shares as advance decline ratio stood at 0.31 on the BSE, lowest since March 13, 2024.

Short-term trend in the Nifty turned bearish as it is placed below its 5, 11 and 20 DMAs (day moving average). Moreover, negative divergence of RSI-14 (relative strength index) is observed on daily and weekly timeframe.

In the derivatives, the Nifty Open Interest Put Call ratio fell sharply to 0.81-odd level on the back of aggressive Call writing at 22,400-22,500 levels. Moreover 5 and 11-day EMA (exponential moving average) are placed at 22,484 and 22,455, suggesting on the upside, the 22,400-22,500 level would act as a very strong resistance. Therefore, traders are advised to exit in long positions and wait for the Nifty to close above the 22,500 levels for creating fresh longs.

On the downside, support for the Nifty is seen in the range of 22,100-22,150, where the 50-day EMA and super trend indicator levels are placed. Far support for the Nifty is placed at 21,880 and 21,700 levels.

Here are three buy calls for the next 3-4 weeks:

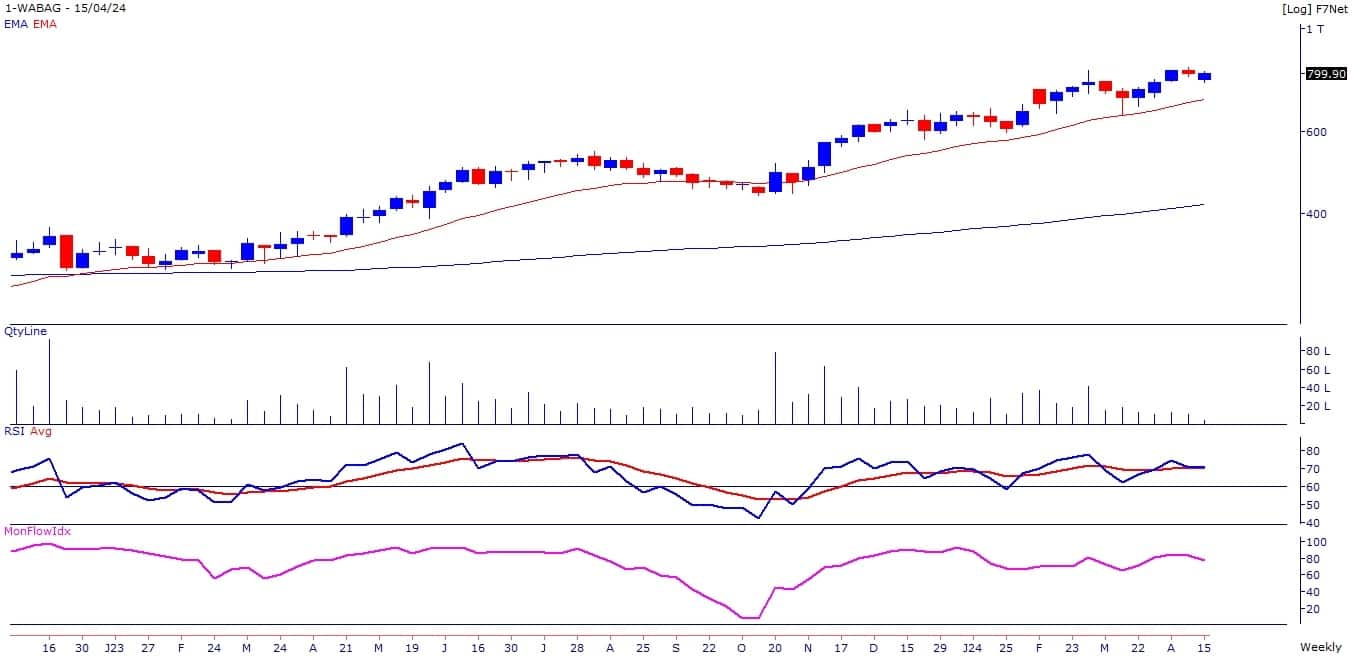

Va Tech Wabag: Buy | LTP: Rs 800 | Stop-Loss: Rs 735 | Target: Rs 870/910 | Return: 14 percent

Primary trend of the stock has been bullish with higher tops and higher bottoms on the weekly chart. During the recent correction in the midcap space, the stock has shown resilience where stock price is trading above its 11 and 20-day EMA.

Momentum indicators and oscillators like RSI (relative strength index) and MFI (money flow index) are in rising mode and placed above 60 on the weekly and monthly chart, indicating strength in the stock.

Techno Electric & Engineering Company: Buy | LTP: Rs 824 | Stop-Loss: Rs 760 | Target: Rs 890/915 | Return: 11 percent

Primary trend of the stock has been bullish with higher tops and higher bottoms on the weekly and monthly chart. During the correction in the month of March, stock price took support at 200-day and reversed northwards.

In Monday’s correction, the stock has shown resilience where stock price has closed above its 5-day EMA on the back of higher volumes. This augurs well for the uptrend to continue.

Suryoday Small Finance Bank: Buy | LTP: Rs 193 | Stop-Loss: Rs 180 | Target: Rs 208/215 | Return: 11 percent

Suryoday Small Finance Bank: Buy | LTP: Rs 193 | Stop-Loss: Rs 180 | Target: Rs 208/215 | Return: 11 percent

The stock price has broken out on the daily chart where it closed at highest level since February 23. Primary trend of the stock is bullish as stock price is placed above its 100 and 200-day EMA.

Momentum indicators and oscillators like MFI and RSI are sloping upwards and placed above 60 on the daily chart, suggesting strength in the current bullish trend.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.