The market was off to a cheerful start on January 10 despite mixed global cues. Barring a small dip around mid day, the Nifty traded in the green throughout the session to gradual march towards the 18,000-mark. Some tail-end buying helped the Nifty push past the psychological mark to end the session over a percent higher.

The move got extended in the next couple of days as the benchmark index breezed through the key resistance zone of 18,100–18,200. Lack of participation from heavyweight spaces like banking and IT in the later half, however, saw the index consolidate in a small range to conclude end the week a tad above 18,250.

In the week gone by, the Nifty gained 2 percent to rally more than 1,800 points in a span of four weeks, which is remarkable. The market is now exhibiting behaviour that generally happens after a decent rally and if any major event is close by.

Since we are inching closer to the budget, key indices seem to be in a consolidation mode.

For the coming week, 18,350 is the level to watch. Once it is surpassed, there is no major level visible before 18,600. As of now, we do not expect a runaway move in the forthcoming week, hence, traders are advised to focus on individual stocks because almost each sector has started chipping in.

Apart from this, the broader market has started buzzing, which generally indicates a healthy rally. One needs to on potential movers to make decent gains. As far as supports go, 18,200 followed by 18,100 should be considered key levels and the sacrosanct base remains at 18,000.

Here are two buy calls for next 2-3 weeks:

Jubilant Ingrevia: Buy | LTP: Rs 635.90 | Stop-Loss: Rs 591 | Target: Rs 704 | Return: 10.7 percent

This new entrant has had a fabulous run after it listed in 2021 and clocked a record high of Rs 838.75 mid-October. Thereafter, the stock underwent a strong correction for nearly two months. Now, after forming a strong base a tad above the Rs 500-mark, the stock has started moving northwards.

On January 14, it witnessed a decisive price and volume breakout on the daily chart after traversing the key moving average of '89-exponential moving average (EMA) with some authority.

We recommend buying this counter at current levels and any minor dip would make it an attractive risk-to-reward candidate for a trading target of Rs 704. The stop-loss can be placed at Rs 591.

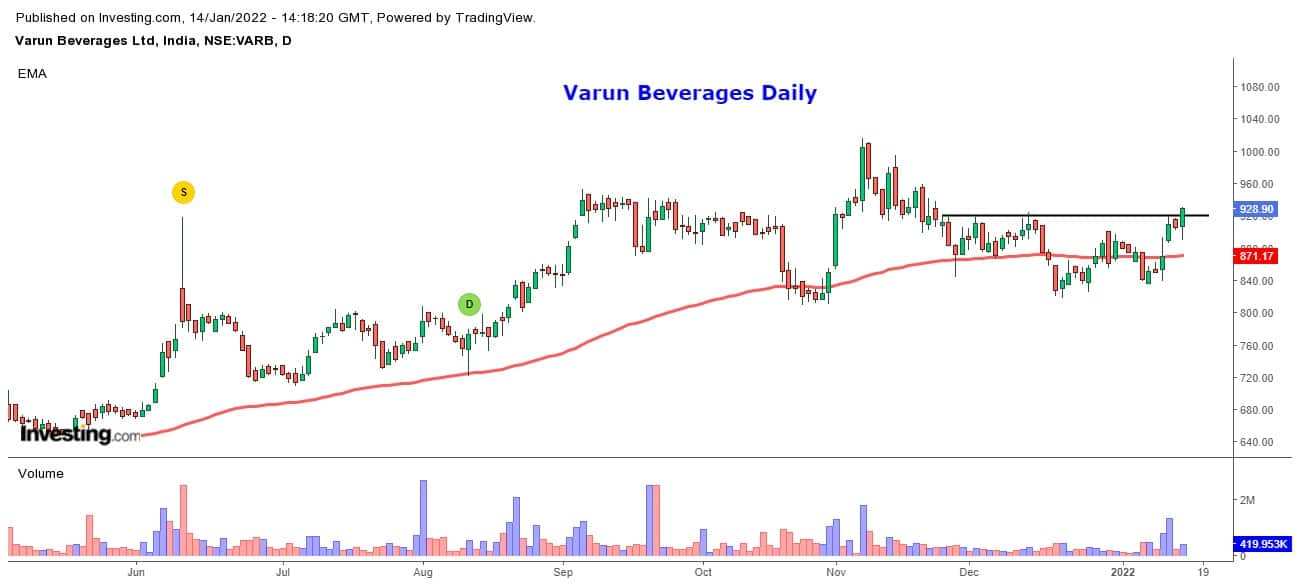

Varun Beverages: Buy | LTP: Rs 928.65 | Stop-Loss: Rs 890 | Target: Rs 980 | Return: 5.5 percent

If we take a glance at the daily time frame chart, we can see the price resting around its key moving average of 89-EMA for the last one and a half months.

Last week, some buying emerged around its lower range of Rs 840 and in four days, the stock surged more than 10 percent. With this, we can see a breakout happening on the daily chart with a substantial rise in volumes.

Traders are advised to buy for a near-term target of Rs 980. The stop-loss can be placed at Rs 890.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.