Vidnyan Sawant, AVP - Technical Research, at GEPL Capital

The Nifty had last week formed a big bearish candle pattern and closed below its 20-week SMA (17,272) on the weekly chart which shows a bearish undertone of the market for the short to medium term. In the current week, the Nifty is forming a bullish candle pattern and once again sustaining above its 20-week SMA.

On the daily chart, the Nifty is consistently sustaining above 16,900 mark on closing basis, which is a 38.2 percent retracement level of previous advance from 14,151–18,604, indicating that the market may give some bounce in the short term to medium term.

Momentum indicator like RSI (relative strength index), however, is sustaining below 50 mark on the daily chart which indicates that the market has lack of positive momentum for the short to medium term.

We believe the Nifty will face strong resistance at the 17,600 and 18,200 levels. On the flip side, the support levels would be placed at 16,900, 16,720 and 16,450.

Here are three buy calls for next 2-3 days:

TCS: Buy | LTP: Rs 3,642.90 | Stop Loss: Rs 3,490 | Target: Rs 3,757-3,989 | Return: 3.1-9.5 percent

The TCS has made a life-time high at Rs 3,989 levels on October 2021 and after that it corrected till the Rs 3,385 level, which is around 50 percent retracement of the previous advance from Rs 2,880–Rs 3,989 mark. The stock has formed a CIP formation, or Change In Polarity, near Rs 3,400 levels.

Also on the daily charts the stock has formed a Double Bottom pattern at Rs 3,400 levels which confirmed limited downside of the stock. Momentum indicator RSI has sustained above the 55 levels on all the time frames which confirm strong positive momentum of the stock for the medium to long term.

Looking at the price action and the momentum indicators and other technical parameters, we believe this stock has a lot of upside potential left.

Going ahead, we expect that the prices will move towards Rs 3,757 levels (Gap Resistance) followed by Rs 3,989 mark (Life Time High). The stop loss for this trade set-up would be Rs 3,490 levels of closing basis.

Bajaj Holdings: Buy | LTP: Rs 5,347 | Stop Loss: Rs 5,150 | Target: Rs 5,629-5,860 | Return: 5.3-9.6 percent

Bajaj Holdings has been moving in a strong uptrend with a Higher Top Higher Bottom formation since November 2020 on the monthly charts. The stock has given a consolidation breakout which has been forming since past two months and made a fresh life-time high at Rs 5,394 levels which shows strong positive undertone of the stock for the medium to long term. The breakout is backed by the strong volume confirmation, indicating the strength of the upward move.

The momentum indicators and the technical indicators all point towards the possibility of prices moving higher towards the Rs 5,629 mark immediately (50 percent extension level of Rs 3,141 – Rs 5,100 projected from Rs 4,650). If this level is breached, we might see the prices move towards Rs 5,860 (61.8 percent extension level of Rs 3,141 – Rs 5,100 projected from Rs 4,650).

The stop loss for this trade set up would be Rs 5,150 levels of closing basis.

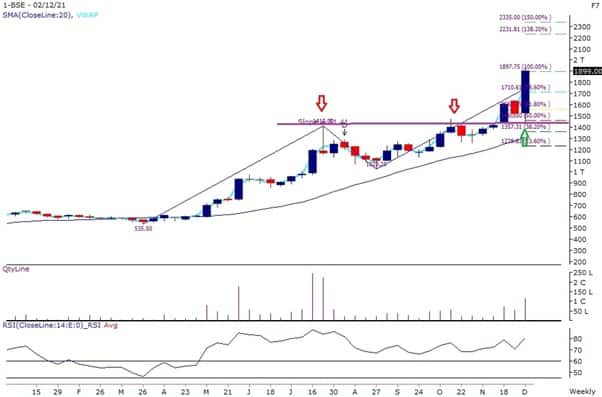

BSE: Buy | LTP: Rs 1,899 | Stop Loss: Rs 1,620 | Target: Rs 2,231-2,335 | Return: 17.5-23 percent

The stock has been making fresh life-time highs consistently since October 2021 which shows strong positive undertone of the stock. The stock has formed a CIP formation (Change In Polarity) at Rs 1,450 levels and moved up which shows bullish undertone of the stock.

In the current week as well, the stock has made a fresh life-time high at Rs 1,939 mark with a big bullish candle. This up move is backed by a huge volume confirmation. On the daily charts, the stock has been consistently sustaining above its 20-day SMA (simple moving average) since September 2021, indicating positive strength of trend.

The momentum indicator like RSI is sustaining above 60, indicating strong positive momentum of the stock. As per price pattern, we feel that the stock prices gain momentum and move higher towards the Rs 2,231 (138.2 percent extension level of Rs 535 – Rs 1,410 projected from Rs 1,023) levels and eventually towards Rs 2,335 (150 percent extension level of Rs 535 – Rs 1,410 projected from Rs 1,023).

Investors can accumulate BSE at this point and hold for a target of Rs 2,231 and Rs 2,335 with a stop loss of Rs 1,620 on closing basis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.