Benchmark indices Nifty 50 and Sensex traded with cuts for a fifth straight session on April 19 as heightened geopolitical tension in the Middle East after Israel's fresh missile launch on Iran spooked investors.

The geopolitical concerns also tipped off a spike in oil prices amid fears of a supply shortage which further weighed on investor sentiment.

Even though analysts expect volatility to remain high in the coming sessions on account of these prolonging concerns, they believe the trend reversal for the Nifty 50 may actually happen when the index decisively breaks below the 21,500 mark.

At noon, the Sensex was down 234.83 points or 0.32 percent to 72,254.16, and the Nifty was down 76.80 points or 0.35 percent to 21,919.00.

Most sectors also saw a buildup of short positions, triggering losses in the cash market as the sentiment worsened.

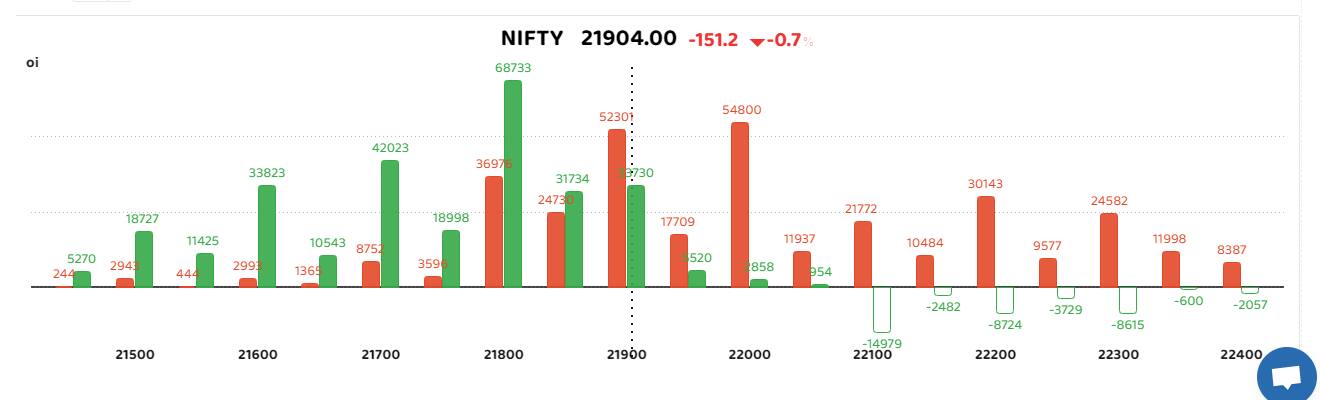

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

According to Avdhut Bagkar, derivatives and technical analyst at StoxBox, the persisting geopolitical worries have pushed the Nifty 50 into a phase where prior crucial levels will be tested. "While the Nifty 50 breached immediate support of the 50-day moving average (DMA) set at the 22,170 level, the index needs to violate 21,500- 21,700 range to enter the bearish phase," he said.

Until that happens, Bagkar still sees a chance for the Nifty 50 to recoup its losses or trade sideways. He feels that only a decisive breach of 21,500 – 21,700 might derail the positive bias, leading the index to breach the 21,000 mark.

"Moving forward, 22,500 becomes a major barrier for the current trend," he said. Sameet Chavan, head-technical and derivatives at Angel One believes that the undertone in the market certainly favors the bears now and any rise should be seen as an opportunity to either exit longs or to look for bearish bets in the index.

"Any relief from the global markets could only provide some aid to the ongoing carnage, hence, a strong watch is required over any developments. Meanwhile, it is advisable to refrain from aggressive bets until the uncertainty subsides," Chavan added.

Bank Nifty

The Bank Nifty index plunged drastically in the previous session to end below its 50-day EMA of 47,150. This, according to Vaishali Parekh, vice-president of technical research at Prabhudas Lilladher, has turned the sectoral index weak and is precariously placing it in the zone where 46,000 will act as the next major support level.

As for today, Parekh anticipates Bank Nifty to trade within a range of 46,000–48,000 levels.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.