The Nifty 50 index faced stiff resistance at an all time high level on June 19 and thus it slid to trade flat in early trade Weak global cues also dented the sentiments back home. As of 10.30 am, the Nifty traded down 0.17 percent or 32 points at 18,794.15. The Bank Nifty was down 0.49 percent to 43,721.40.

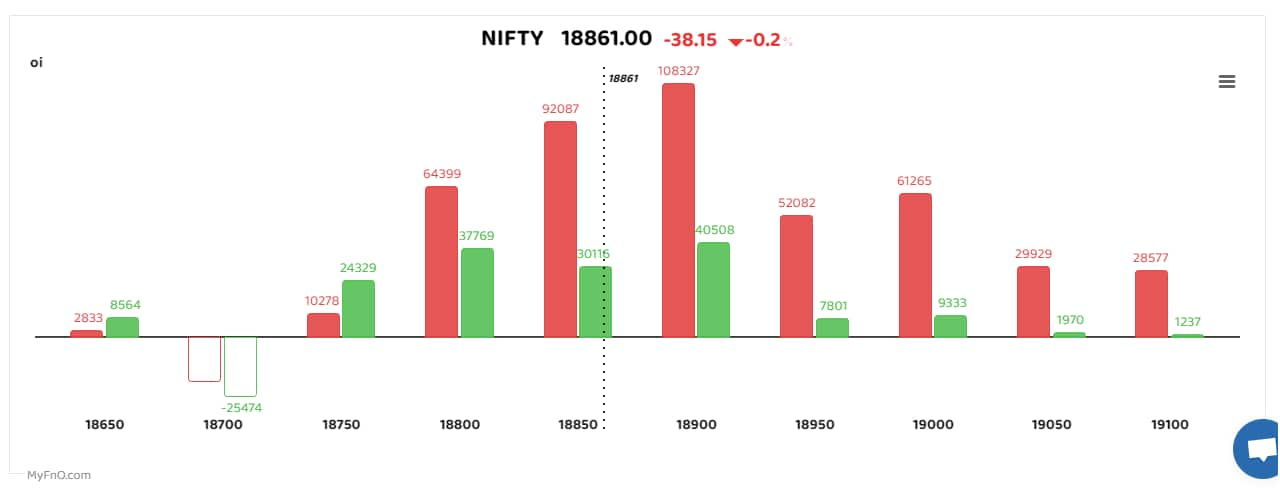

Nifty weekly contract has highest open interest at 18,800 for Calls and 18,700 for Puts while monthly contracts have highest open interest at 19,000 for Calls and 18,000 for Puts. On JUne 19, call writers were more active with heavy writing seen at 18,900 and 18850 which is keeping bulls in check.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Though, some traders expect a recovery from hereon.

“I expect buying to happen at the current level which will lift the index, though if we will cross all time high is a question,” said Santosh Pasi, a derivatives trader and Sebi-registered investment advisor. He said he is a buyer for Nifty in the range of 18750-18775 with the first target at 18825.

Pasi believes the index has strength to clinch 18,900 level.

FIIs have continued to infuse funds in local equities and India's improving economic situation – these are two positive catalysts that have been keeping bulls afloat in the India market.

Among individual stocks, traders were seen taking long trades in Jindal Steel, Shriram Finance, Dr Lal Pathlabs, and Metropolis Healthcare among others. On the other hand, Adani Group stocks were among those that were on bears’ radar. Vodafone Idea, Bandhan Bank, and Kotak Bank were also those that saw short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.