The market was trading higher on June 12 afternoon but the gains were capped as investors feared the US Federal Reserve, which meets a day later, could remain hawkish following a surprise rate hike by the Bank of Canada

The Nifty’s struggle to hit its all-time high of 18,888 continues. At 12.20 pm, the benchmark index was up 0.18 percent, or 32.85 points, at 18,596.25. Nifty Bank was flat at 43,981.30.

On June 9, the monthly expiry contract of the 18,600 put option did not lose any open interest, which indicates that for now, traders are seeing the level as the battle zone.

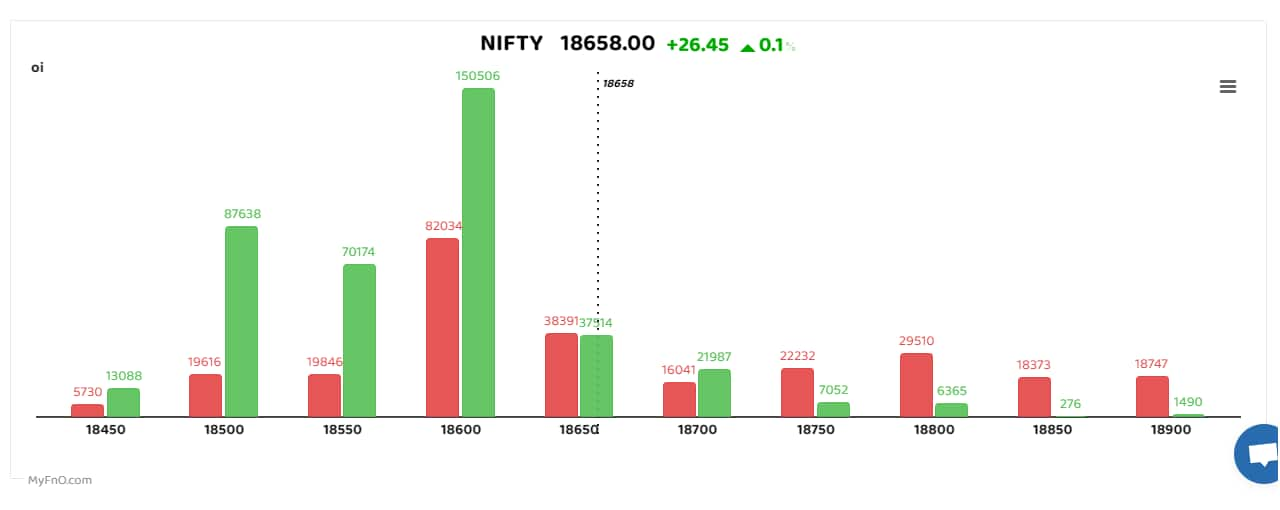

Weekly option data shows 18,700 has a heavy call open interest, emerging as the greatest hurdle for the index for the week. The level of 18,600 has seen Straddle trades, which is a neutral strategy as traders expect the index to be rangebound for the day. The overall outlook though is positive, say traders.

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI.

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI.

“The floor for the Nifty index is at 18,400 and the floor for Bank Nifty is at 43,350, till either are taken out, the trend is up and intact,” said Rahul Ghose, a Mumbai-based derivatives trader.

Prashanth Tapse, Senior VP (Research), Mehta Equities, said downside risk for the Nifty is at 18,463, while risk appetite remains intact for Nifty's Bank, which is aiming to go past its record high of 44,499.

Among individual stocks. Traders took long positions in PI Industries and REC. IT midcaps Intellect Design, LTI Mindtree and Birlasoft also saw long buildups, which is a bullish sign.

Balrampur Chini Mills, SRF and McDowell's, on the other hand, saw short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.