Indian indices opened on a positive note on August 8 with the Nifty hovering on 19,600 points. Except bank and pharma, all sectoral indices traded in the red by 12 noon on day of range-bound movement. The BSE midcap index was down 0.3 percent and the smallcap index traded flat.

Around noon, the Sensex was down 106.00 points or 0.16 percent at 65,847.48, and the Nifty was down 30.60 points or 0.16 percent at 19,566.70.

Technically, key indices lacked assertive moves and stayed in a mere range throughout the day, which portrays a lack of conviction among the market participants on either side.

As per analysts, the extension of the ongoing consolidation from 19,900 to 19,200 amid stock-specific actions signifies a healthy retracement. In a secular bull market, secondary correction makes the market healthy by cooling off overbought conditions. They believe that accumulating quality stocks on dips would be a prudent strategy to adopt amid progression of the ongoing earnings season.

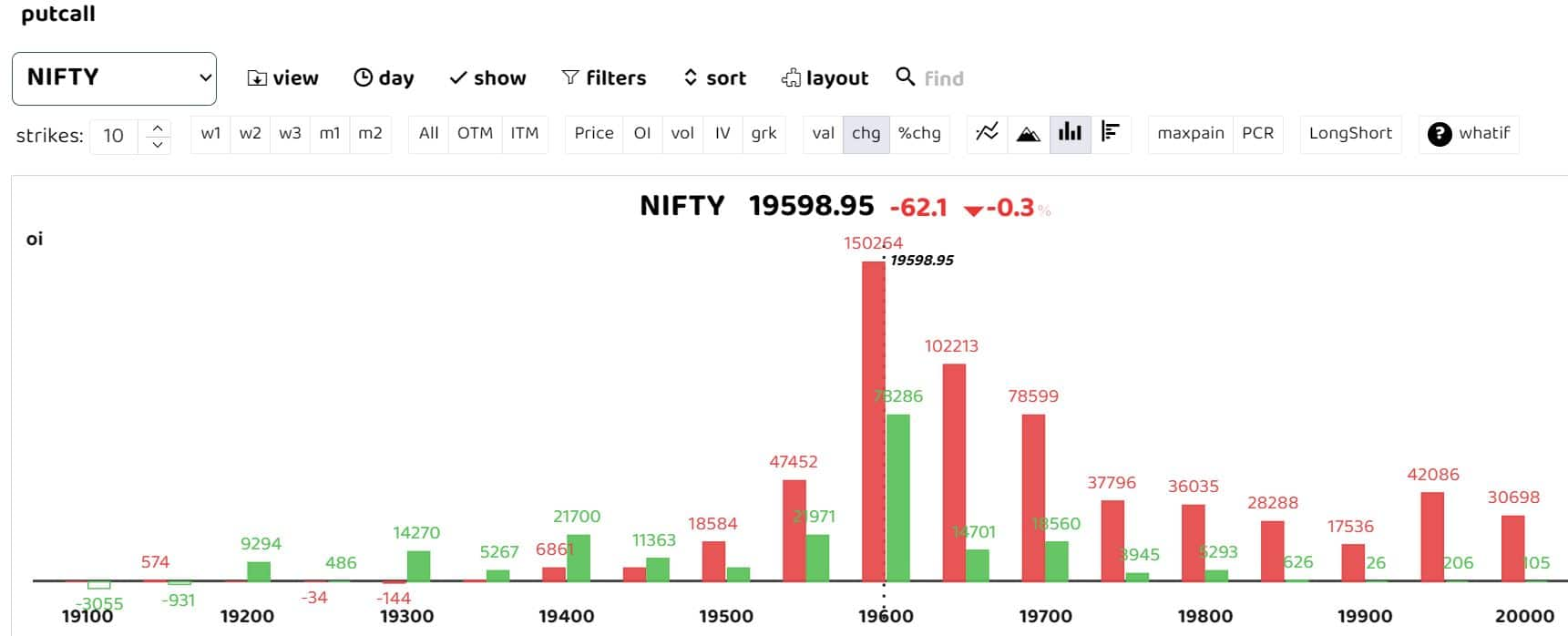

The Nifty has an immediate hurdle at the 19,650-19,700 zone and a decisive breakout could lead towards a short-covering move in the Call writers’ positions, as per ICICI Securities.

"The bearish gap of 19,678-19,705 is the crucial hurdle and it requires an authoritative breach to turn the sentiment to ultra bullish once again. On the flip side, the pivotal support at 19,300 is supposed to cushion any intra-day blip," Sameet Chavan, Head of Research in Technical and Derivatives at Angel One, said.

Among individual stocks, Hero MotoCorp, Cipla, Biocon and Dixon displayed a bullish set-up. On the other hand, Tatachem, Seimens and AdaniPort saw a short build-up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!