Benchmark indices NSE Nifty 50 and BSE Sensex gained on June 11 amid volatility. However, the Nifty faces strong resistance around the 23,400 level on an immediate basis. Experts said that the technical indicators suggest sideways movement or even profit booking in the near term.

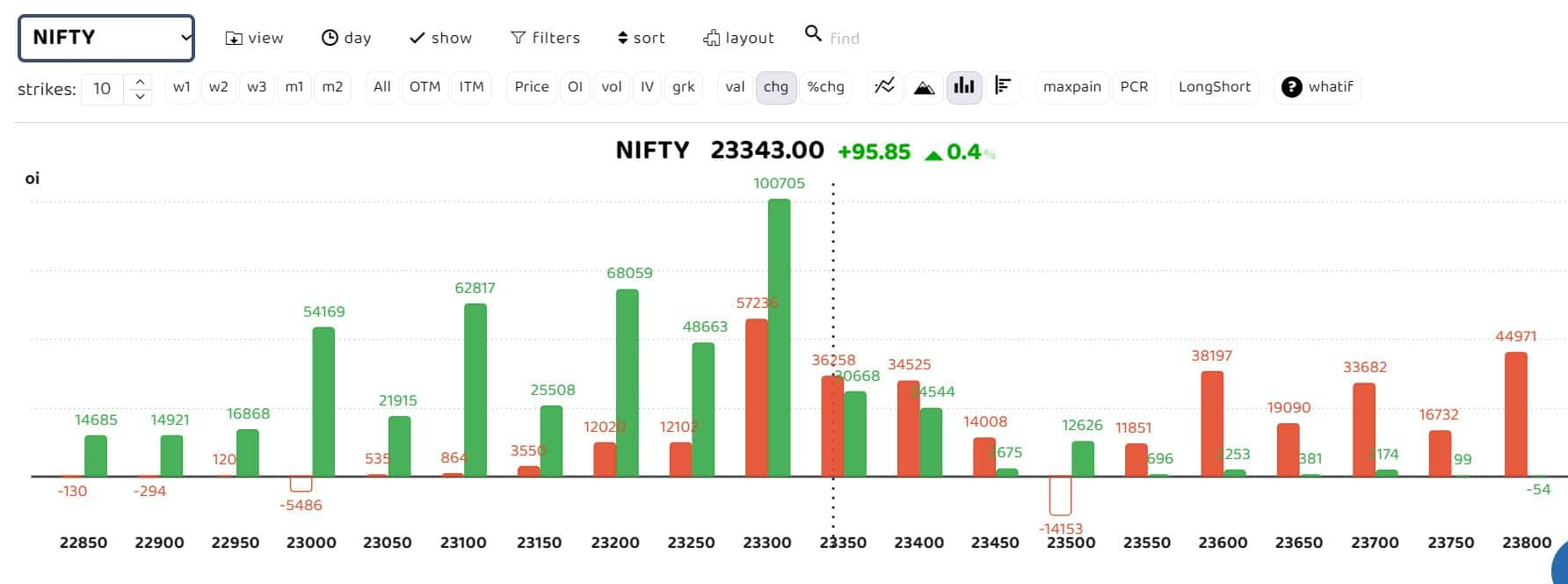

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing at the 23,550 and 23,600 levels, also acting as the next strong resistance.

Tejas Shah, Vice President of Technical Research at JM Financial, stated, “We believe that Nifty will further outperform only if it is able to decisively close above this resistance zone; otherwise, profit booking is likely from the current levels.”

“Some technical indicators, like RSI, are in the overbought territory on hourly charts with negative divergence, so there is a strong possibility of sideways consolidation or minor profit booking to continue from the current levels in the next few days,” said Tejas Shah.

The support for Nifty is now seen at 23,200 and the 22,950-23,000 zone. On the higher side, the immediate resistance for Nifty is at 23,350 levels, and the next resistance is at the 23,500 mark.

Sudeep Shah, DVP and Head of Derivative and Technical Research at SBI Securities, said that "The zone of 23,100-23,070 will act as immediate support for the index. Any sustainable move below the level of 23,070 will lead to further profit booking in the index up to the 22,950 level."

"On the upside, the zone of 23,350-23,370 will act as an immediate hurdle for the index. Any sustainable move above the level of 23,370 will lead to a sharp upside rally up to the level of 23,500, followed by the 23,650 level," he added.

Stock specific action

Stock specific action

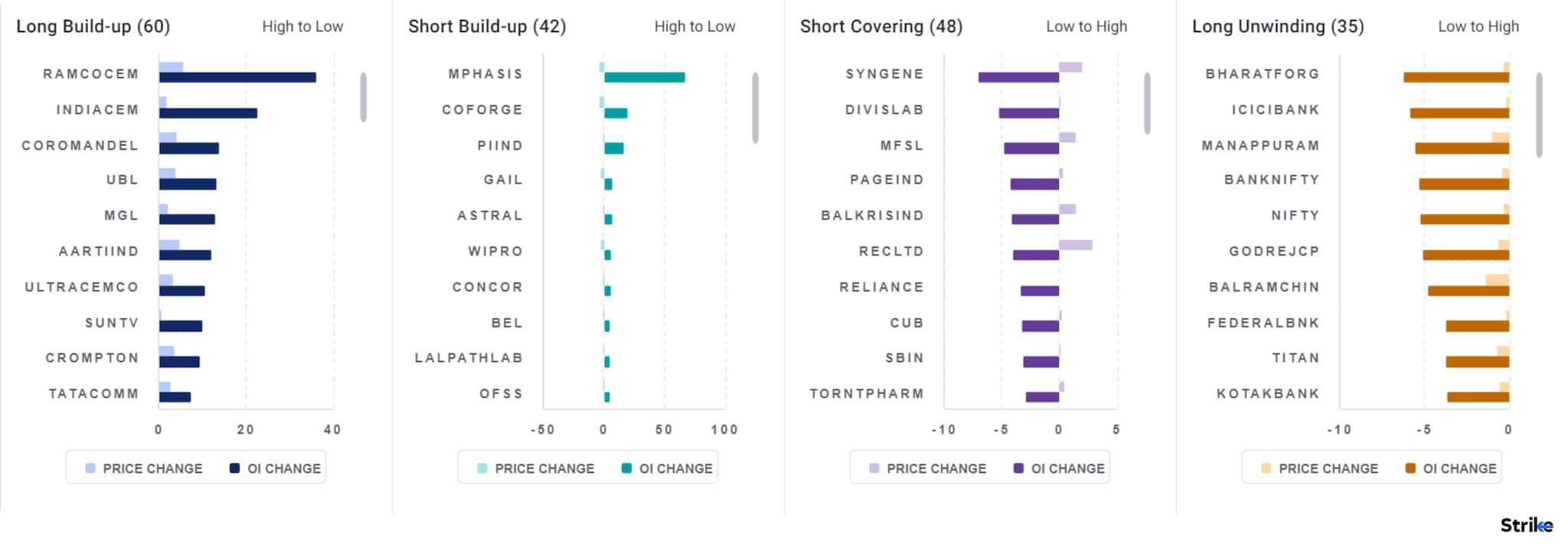

Among individual stocks, significant activity has been observed in cement stocks in the derivative market. The combined open interest (futures) added by six cement stocks amounts to approximately 9,500 lots, which is substantially higher than usual. The stocks showing notable activity are Ramcocement, Indiacement, Ambuja Cement, Ultratech cement, JK Cement and ShreeCement.

Also read: Option Strategy of the day| Long build up in HCL Tech, deploy bull call spread for upside

Amongst other stocks, long build up is observed in MGL, Coromadel and SunTV. While short build up is seen in CUB, SBIN, Syngene and Divislab.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!