Indian benchmark indices fell sharply on 7 May amid strong selling pressure. Nifty began the trading session on a neutral note. But soon after, the intensified selling dragged the index below 22,300, widening its drawdown more than 2 percent from the recently-hit all-time high of 22,794.7.

Among the sectoral indices, Nifty FMCG was the best performing sector with gains of 2.19 percent, as investors moved money towards defensive allocation, bolstered by impressive Q4 results. Nifty Realty was the worst performing sector with a loss of 3.82 percent.

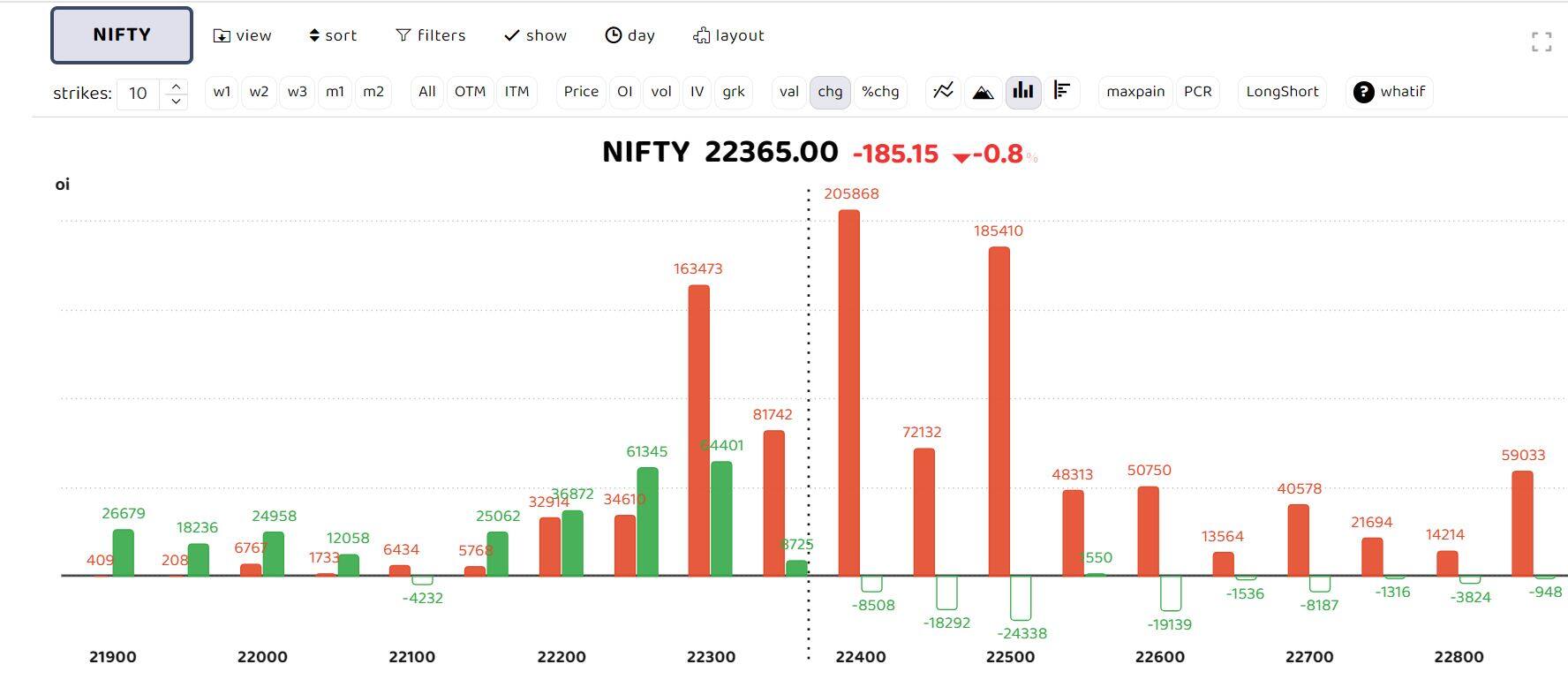

Significant Call Open Interest was seen at 22,300-22,400 strikes, and significant Put Open Interest buildup was seen at 22,200-22,100 strikes. Sudeep Shah, DVP and of Technical and derivative research at SBI securities, said, “This indicates resistance at higher levels around 22380-22430 & support on dips around 22150-22080 zone. The likely trading range for the day is 22370-22150.”

22,000 or below in sight for Nifty, if crucial supports breached

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“Positionally, until the 20 Day EMA of 22,430 is not crossed, it can test 22,130-22,080 level, which is a strong support zone, being the rising trendline support zone from 18,837, which was the low in Oct 2023. In case 22,080 is breached on the downside, the index can revisit 21,900-21,850 levels,” added Shah.

Nifty's Advance Decline Ratio was negative at 11:39, while India VIX gained 5.36 percent to 17.49, which is the highest level since March 2023.

Options data suggests that call writers are active for the day with heavy call writing at 22,400 forming stiff resistance. “Nifty is trading around its important support level of 22,300. It's important to watch this level on a closing basis. If the index closes below this, then it could see a dip towards 22,000-21,900 in the coming days,” said Ruchit Jain, Lead research at 5paisa.com.

“Rising India VIX and negative market breadth is leading to some nervousness on the street, but this just seems to be a short term corrective phase within an uptrend. If the index tops 22,400 again, then it would turn the sentiment positive,” Jain added.

Vaishali Parekh, Vice President, Technical Research at Prabhudas Lilladher, said, The nifty has a crucial support of the 50 DMA level of 22,300 and a decisive close below the 22,300 level the nifty can slide further to the 22,000 and 21,800 levels."

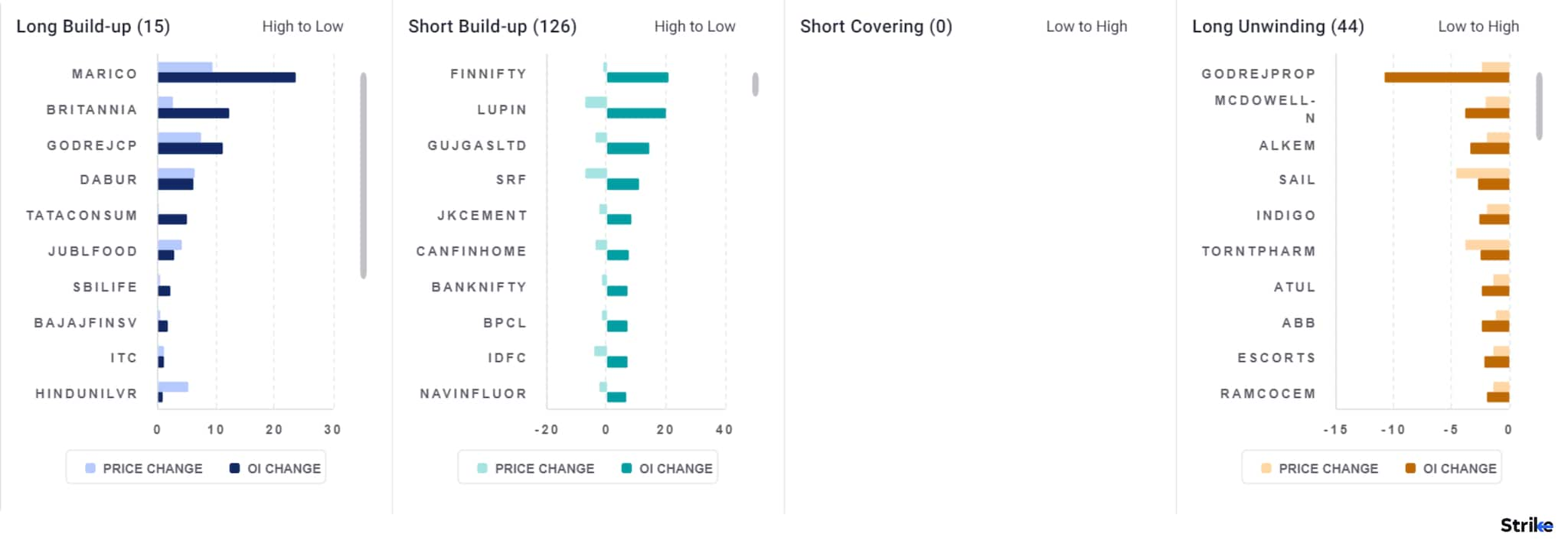

Among individual stocks long build up is seen in Marico, Britannia, Godrejcp, Dabur and ITC. While short build up is seen in Finnifty, Lupin, Gujgas and SRF.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.