Britannia Industries stock derivatives data shoes a build-up of long position, with addition of over 7 percent in open interest in the early morning sessions on Tuesday, May 7. The stock jumped as much as 2.7 percent to Rs 5,200 in the late morning trade.

Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox recommends taking a long position with a Bull call spread option strategy, to capture this bullish set up.

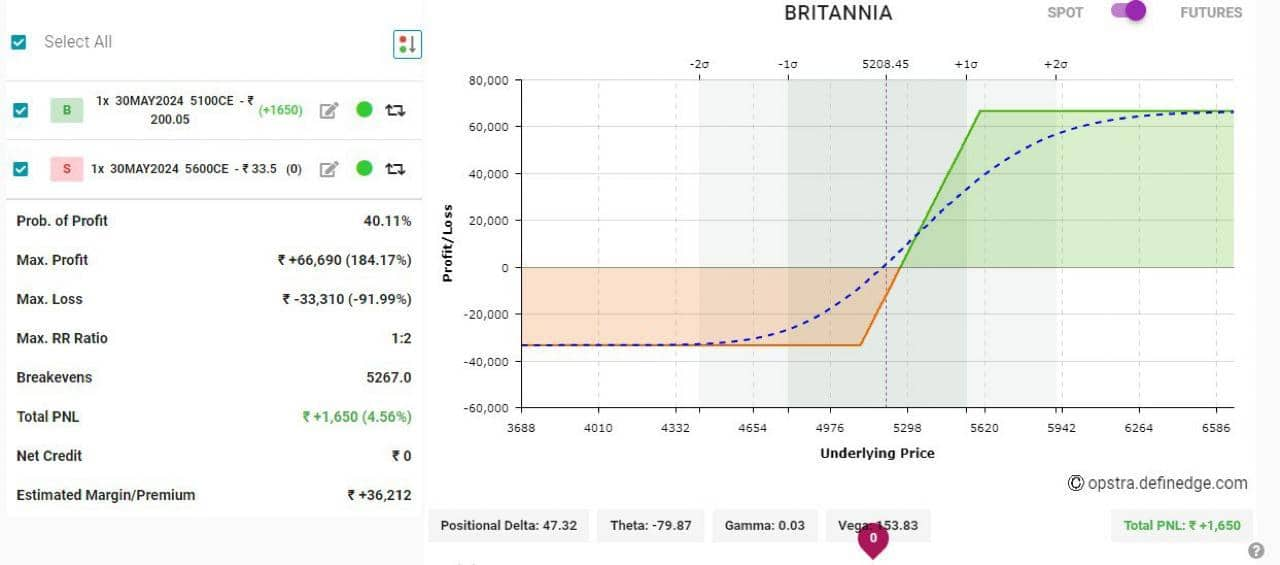

Buy 1 lot Britannia May 5100 CE (call option) at around Rs 200;

Sell 1 lot Britannia May 5600 CE (call option) at around Rs 35;

Total cost of this strategy would be Rs 33,000 per lot

Potential profit would be Rs 67,000.

The breakeven point is at Rs 5267.

Bagkar observed a long build-up in Britannia Industries. The highest open interest was recorded in the 5000 PE, which was utilized for writing purposes. A long build-up was also noticed in the 5200 CE, followed by the 5300 CE and 5400 CE.

"The overall option chain suggests support around the Rs 5500 level, with a tendency to rally towards 5400. The total volume stands at 6 lakhs, with open interest exceeding 25 lakhs. The PCR for the at-the-money option locates at 0.94, indicating a positive bias. The IV has remained stable at 8 percent," stated Bagkar.

Technical viewTechnically, the trend remains bullish, as the price action resulted in a breakout of the trend line on the daily chart. "Sustainability above the key level of the 100-daily moving average, set at 4973, further reinforces a bullish bias. While the stock has entered the overbought territory of the Relative Strength Index (RSI), the price action is able to withstand selling pressure on the higher ground," said Bagkar.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.