Indian equity markets witnessed contrasting moves by institutional investors on Thursday, with Foreign Institutional Investors (FIIs/FPIs) turning net sellers, while Domestic Institutional Investors (DIIs) stepped in as net buyers.

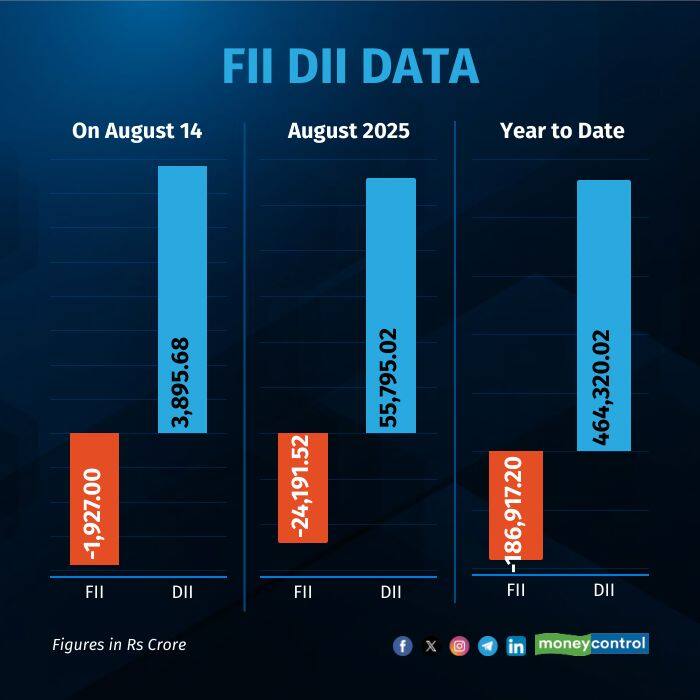

As per provisional data on the exchange, FIIs net sold equity shares worth Rs 1,926 crore, having bought stocks valued at Rs 13,646 crore but offloaded shares worth Rs 15,572 crore. In contrast, DIIs net purchased equities worth Rs 3,895 crore, with gross purchases of Rs 13,144 crore and sales of Rs 9,248 crore.

For the year so far, FIIs have been net sellers of Indian equities amounting to Rs 1.86 lakh crore, while DIIs have remained strong net buyers with purchases totaling Rs 4.64 lakh crore.

Market Performance

Indian equities ended largely unchanged on August 14, with the Sensex adding 57.75 points to 80,597.66 and the Nifty inching up 11.95 points to 24,631.30 after a day of subdued, range-bound trade. “A decisive move above 24,750 could open the way for an upside toward 24,850, while immediate support lies at 24,500 and 24,330 — both attractive for fresh long positions,” said Amruta Shinde, Technical & Derivative Analyst.

On the Bank Nifty, she added, “A breakout above the 55,670–56,000 zone may trigger a rally towards the psychological 56,200 mark, with supports at 55,000 and 54,900.” Sectorally, metals and oil & gas dropped 1% each, while consumer durables and IT rose 0.5% apiece. The India VIX rose 1.77% to 12.35, signalling a mild uptick in volatility, with derivatives positioning showing resistance near 24,700.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.