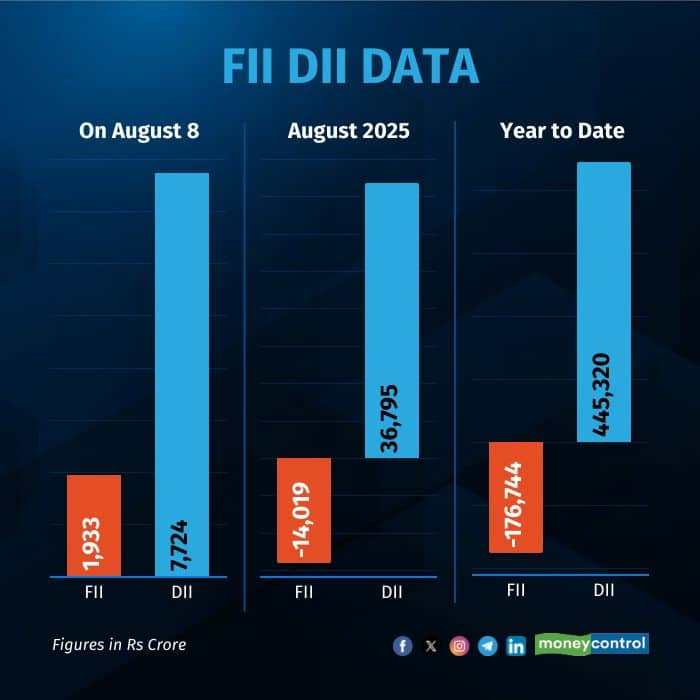

After three weeks of consecutive selling, Foreign Portfolio Investors (FPIs) turned net buyers of Rs 1,932 crore-worth of shares, as its highest single-session buy since June 26. Their shift to net buying signals a potential reversal or at least a pause in their risk aversion toward India.

At the same time, domestic institutional investors (DIIs) net bought Rs 7,723 crore of shares, according to provisional NSE data.

The US has imposed steep tariffs, including targeting India’s benefits from its bilateral trade agreement (BTA) with Russia on oil. This geopolitical friction has weighed on investor confidence, especially on sectors like pharma with US exposure, leading to FII selling. The new buying interest suggests FIIs may be starting to see value or resilience despite these challenges.

DIIs purchased equities worth Rs 16,682 crore and offloaded shares amounting to Rs 8,958 crore. FPIs, on the other hand, bought stocks worth Rs 17,682 crore while selling Rs 15,749 crore.

For the year so far, FIIs have been net sellers of equities worth Rs 1,76 lakh crore and DIIs were net buyers worth Rs 4.45 lakh crore.

Market Performance

Market edged lower, failing to build on the previous session’s rebound, and ended with a loss of around one percent. Therefore, closing at a three-month low amid growing concerns over the impact of US tariffs on Indian exports. Reflecting on today's market performance, Ajit Mishra – SVP, Research, Religare Broking Ltd said, "After a flat start, the Nifty gradually drifted downward and remained range-bound for most of the session, before sharp selling in the final hour dragged it close to the day’s low at 24,363 level. Sensex closed 65.47 points or 0.95 percent lower, at 79,857.79."

Today's session saw all key sectors ending in red, with realty, metal, and auto emerging as the top losers. The broader indices mirrored this trend, shedding nearly one and a half percent each.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.