Foreign institutional investors (FIIs) raised stakes in India's smallcap companies to their highest level in at least five years even as their holdings in largecap and midcap showed declined, according to Prime Database data.

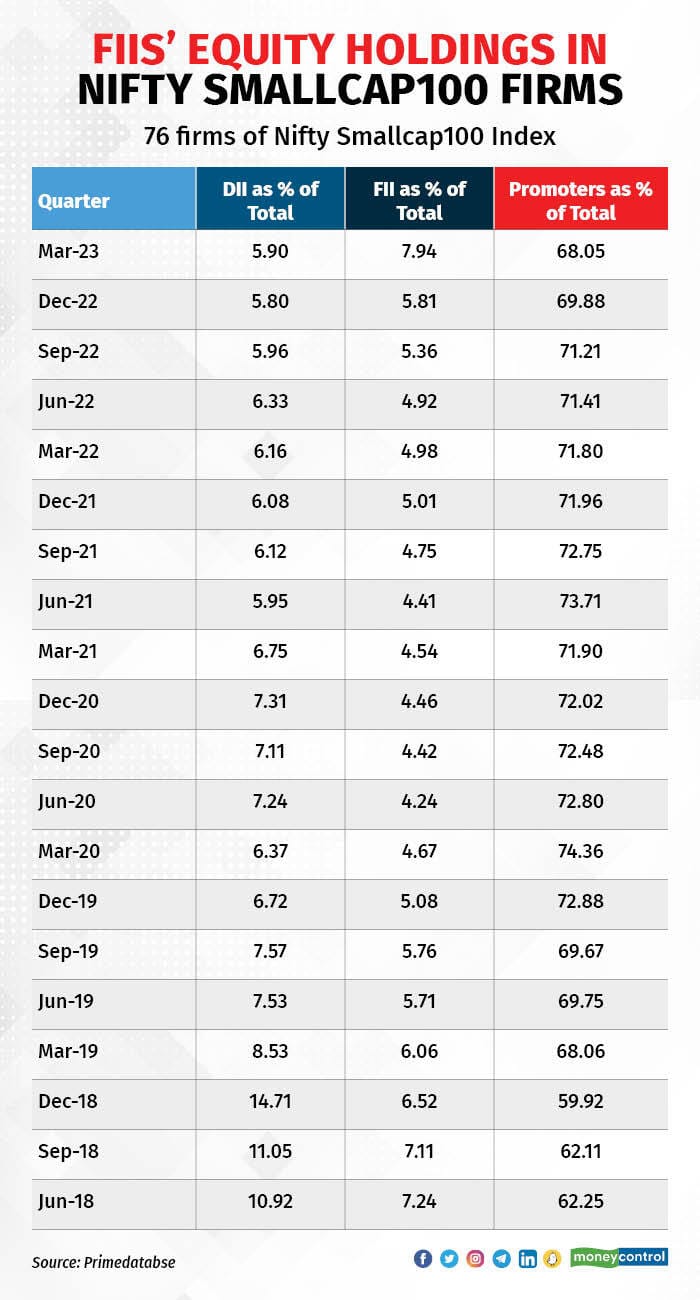

A Moneycontrol analysis of 76 stocks of the Nifty SmallCap100 Index showed the stake of foreign institutional investors, on an aggregate basis, rose to 7.93 percent in the March quarter, the highest since the quarter ended June 2018. FIIs held 5.8 percent and 5.36 percent in December 2022 and September 2022 quarters, respectively.

"FPIs seem to be looking to earn alpha going by the way they have increased their holdings in select smallcap companies in the March quarter. This also reflects their comfort with the Indian micro story whereby some companies in their areas could outperform irrespective of the direction of the overall market," said Deepak Jasani, Head of Retail Research, HDFC Securities.

"This may also be reflective of some new FPIs which may have become active in the quarter and have the mandate to invest across the capitalisation spectrum," he added.

A total 41, or 54 percent, of these 76 companies saw FII stakes rising in the March quarter. FIIs increased their stake the most by 9.6 percentage points in Jindal Stainless Ltd to 22.82 percent.

Other companies where they raised their stake by more than 1 percentage points were Indian Energy Exchange, Aegis Logistics Ltd, Cyient, Exide Industries, Birla Corp Ltd, Mahanagar Gas and City Union Bank.

On the other hand, FIIs cut their stake the most by 11.47 percentage points in PVR to 32.29 percent. The other companies in which they cut their stake by at least 1 percentage point were RBL Bank, Quess Corp, Amber Enterprises India, JK Lakshmi Cement, Central Depository Services India, Suzlon Energy and IDFC Ltd.

FIIs' Equity Holdings in Nifty Smallcap100 Firms

FIIs' Equity Holdings in Nifty Smallcap100 Firms

DII holdings

Meanwhile, domestic institutional investors (DIIs) increased their stakes marginally in these companies to 5.9 percent from 5.8 percent while promoters kept reducing their stakes.

For the purpose of this study, stocks of only those companies which have announced their March quarter shareholding pattern and for which comparable data is available for 20 quarters were considered.

Analysts suggest that the recent uptick in buying in smallcap firms can be attributed to the remarkable resilience shown by the benchmarks Sensex and Nifty over the past 18 months. While these indices have remained relatively stable, hovering at around 10-20 percent below their all-time highs (excluding IT services companies), the midcap and smallcap segments have experienced more significant declines. As a result, these segments are now appearing more attractive from a value perspective, according to analysts.

For Nifty 500 stocks, the FII stake as a percentage of the total shareholding declined to 14.26 percent from 14.45 percent a quarter ago while for Nifty MidCap 100 index stocks their stake for the March quarter stood at 10.66 percent from 11.72 percent last quarter.

DIIs stake in Nifty 500 companies rose to 18.18 percent from 15.77 percent while in Nifty midcap 100 companies it went up to 23.74 percent from 16.86 percent in Q3 2023.

Meanwhile promoters' stakes in Nifty 500, midcap and smallcap reduced to 52.9 percent, 49.17 percent and 68.05 percent, from 54.66 percent, 53.48 percent 69.88 percent a quarter ago, respectively.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.