Foreign Institutional Investors (FIIs) bought heavily in the cash and options segments on Monday, even as benchmark indices closed flat in a subdued trading session.

A day before the Budget, FIIs' bet long-short ratio for index futures now stands at a little over 77 percent, after having sold 20,096 index futures contracts worth Rs 1,274.1 crore on Monday

This contrasts with the day ahead of election day results, when FIIs had their highest-ever net index short positions. So far in July, FIIs have net bought close to Rs 33,000 crore worth of shares, after net purchases of over Rs 26,000 crore in June.

They turned bullish on India in a big way after the election results, and the latest stance in both the equity and derivatives segments shows they are sticking to their view.

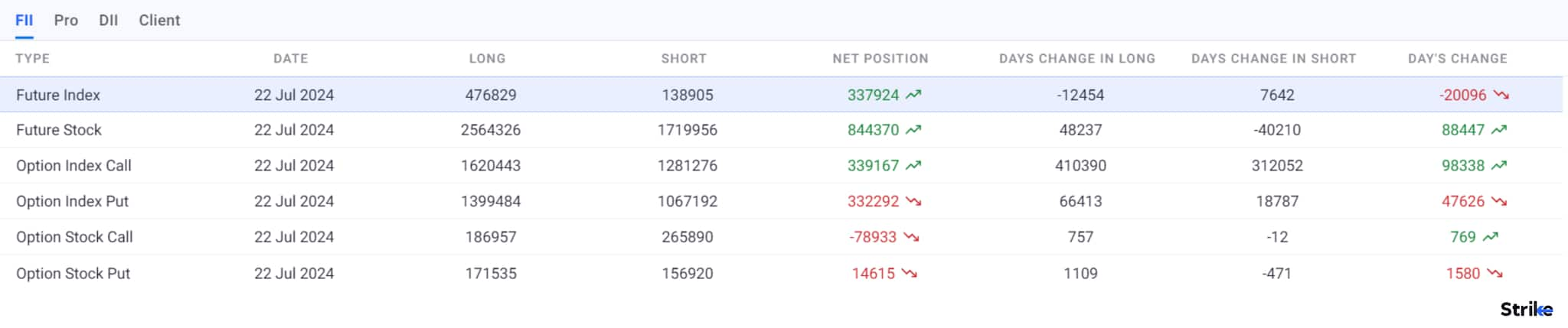

The table below show FIIs' positioning on July 22, a day before the Budget announcement, and FIIs' index futures and stock futures net positions over the past month:

Source: web.strike.money

Source: web.strike.money

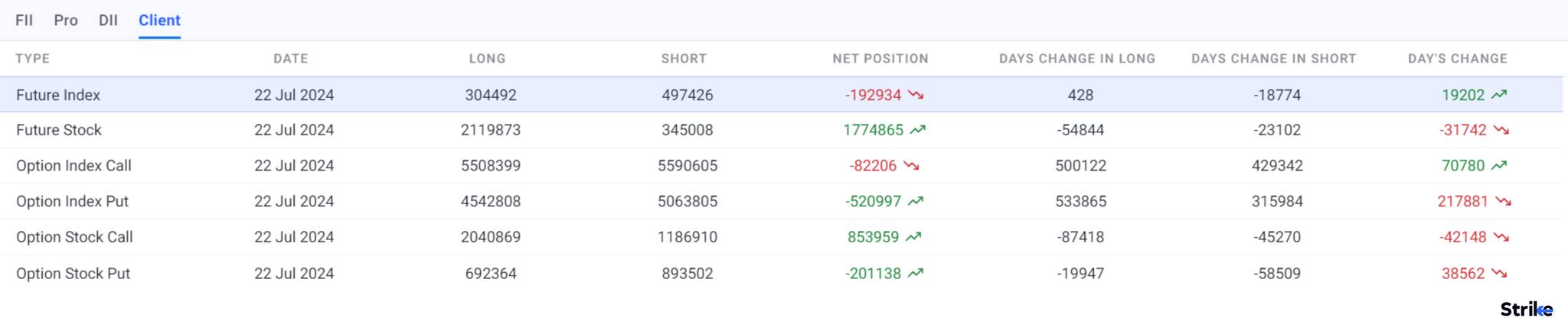

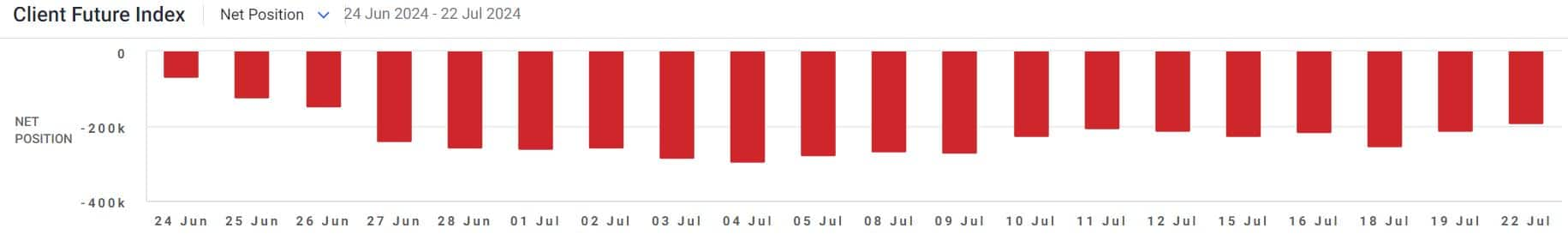

In comparison, client net index positioning has been significantly falling in the past month. The tables below show client positioning on July 22, a day before the Budget announcement, and client index futures and stock futures net positions over the past month:

Source: web.strike.money

Source: web.strike.money

Clients had net index short positions of 192,934 contracts, while on the stock futures front, they had 1,774,865 net long positions on July 22.

"Market has priced in a positive budget outcome. Strong earnings growth justify current market levels. FIIs are 80 percent long in index futures; such positions, long or short, can signal market reversal. The budget needs to be on the positive side for markets to sustain," wrote Feroze Azeez, Deputy CEO of Anand Rathi Wealth Ltd, on X.

Also Read: Union Budget 2024 Live Updates

FII Cash positioning

In the cash market, FIIs bought positions worth Rs 3,444.1 crore. On month-to-date basis, FIIs have accumulated a net buying of Rs 25,108.7 crore, while Domestic Institutional Investors (DIIs) have net sold Rs 873.3 crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!