Budget 2024 Highlights: Haven't left out any state in this Budget, says FM Sitharaman

Union Budget 2024Highlights: Finance Minister Nirmala Sitharaman 's maiden Budget for Modi 3.0 government is now announced. The Budget, at a glance is tough for investors, good for jobs, high on political priorities.

-330

July 23, 2024· 22:33 IST

The live blog session has concluded

The live blog session has concluded. For more news, views and updates, stay tuned with Moneycontrol.com.

-330

July 23, 2024· 22:27 IST

Budget 2024 live updates: Duty waiver on critical minerals to add investments, boost mining sector growth, says mines minister

Mines minister G Kishan Reddy on Tuesday said waiving off of import duty on 25 critical minerals and reducing the levy on two others will bring down input costs for domestic players dependent on these minerals, attract investments in processing and refining, and support the growth of downstream industries.

Finance Minister Nirmala Sitharaman, while presenting the FY25 budget, proposed to fully exempt 25 critical minerals from custom duties and reduce basic custom duties (BCD) on two of them.

"This move is significant for shielding India from elevated levels of import reliance and supply risks owing to the global trends of geopolitical turbulence," the minister.

-330

July 23, 2024· 22:10 IST

Budget 2024 live updates: Budget betrayed Delhi again, not even a penny as share in central taxes, says Atishi

The Union Budget has once again "betrayed" the people of the national capital, Delhi Finance Minister Atishi said on Tuesday, asserting that despite paying over Rs 2 lakh crore in taxes to the BJP-led Centre, the city government did not get even a single penny as its share in central taxes.

Addressing a press conference, Atishi said Delhi had demanded a budgetary allocation for both the city government and the Municipal Corporation of Delhi (MCD) but it did not get even a single rupee from the Centre in lieu of its tax contribution.

"Today's budget presented by the BJP's Central government in Parliament proved to be a betrayal for the people of Delhi. This is a budget that dashes the hopes and aspirations of the people of Delhi," Atishi said.

-330

July 23, 2024· 21:36 IST

Budget 2024 live updates: Budget demonstrates govt commitment to lowering deficit, policy continuity, says Fitch Ratings

Fitch Ratings on Tuesday said the FY25 Budget demonstrated the government's ongoing commitment to reducing fiscal deficit and ensured policy continuity during the NDA government's new term.

"Today's FY25 Budget demonstrated the government's ongoing firm commitment to deficit reduction, while keeping an eye towards growth by maintaining its capex push. In all, the budget highlighted clear policy continuity during the NDA government's new term," said Jeremy Zook, Director and Primary Sovereign analyst for India, Fitch Ratings.Zook said sustained fiscal consolidation, which supports a downward trajectory in the government debt ratio over the medium-term would be supportive of India's credit profile, particularly when combined with the current positive momentum on macroeconomic performance and external finances.

"We will continue to assess the impact the gradual improvement in the fiscal outlook will have on the medium-term debt trajectory as a key factor in our ongoing monitoring of India's rating," Zook added.

-330

July 23, 2024· 21:24 IST

Budget 2024 live updates: Budget initiatives will increase disposable income, boost spending, expects retail industry

Budget proposals such as duty cuts, higher exemption limits in personal income tax and increased standard deductions will leave more money in the hands of people, leading to increased spending, said retail industry players.

This will stimulate consumption growth, thereby boosting the overall economy, they added.

IKEA India Country CFO Murali Iyer said the budget demonstrated commitment to supporting MSMEs and women via access to finance, infrastructure and skilling support.

-330

July 23, 2024· 20:55 IST

Budget 2024 live updates: Budget remains well-grounded in domestic and international realties, says Dinesh Khara, Chairman, SBI

“The Union Budget 2024-25 while pursuing fiscal consolidation is largely focused on private demand revival with a slew of fiscal measure targeting the middle class, MSMEs and employment generation. The thrust to agriculture productivity, infrastructure, climate transition and rationalization of capital gains taxation regime are the deeper facets of the transformation that Budget seeks to achieve. From banking perspective budget is pro-growth and offers scope for balance sheet expansion. In all, Budget remains well grounded in domestic and international realties and has chalked the best strategy for future,” said Dinesh Khara, Chairman, SBI

-330

July 23, 2024· 20:42 IST

Budget 2024 live updates: Cut in gold import duty to help contain smuggling, boost jewellery exports, says Piyush Goyal

The announcement in the Budget to cut import duty on gold will help boost domestic manufacturing and promote jewellery exports, Commerce and Industry Minister Piyush Goyal said on Tuesday. He also said that the decision for the removal of angel tax will further strengthen the startup ecosystem in the country.

"The gold import duty cut to 6 per cent (from 15 per cent) will promote the manufacturing of gold and silver jewellery. It will also contain smuggling," Goyal told PTI.

-330

July 23, 2024· 20:15 IST

Budget 2024 live updates: We now have a uniform, simpler capital gains tax regime, says Fin Secy

Simplification of capital gains tax is just not about reducing rates

Attempt is to clean up the complex regime of capital gains regime

Capital gains by no means is a preserve of the middle class, it is actually the opposite

Capital gains tax at 12.5 percent is still low vs globally

Earners of capital gains are not poor and we keep taxing it at a decent rate

-330

July 23, 2024· 20:06 IST

Budget 2024 live updates: Have split RBI dividend equally between fiscal consolidation and higher spending, says Finance Secy

Have split RBI dividend equally between fiscal consolidation and higher spending, says Finance Secy

Have shelved approach of just looking at divestment as selling of assets, says DIPAM Secy

RBI vetting on IDBI sale in advanced stage, says DIPAM Secy

-330

July 23, 2024· 20:00 IST

Budget 2024 live updates: Budget emphasizes innovation, research, and development, says Gautam Bali

"The Finance Minister has defined the main focus points for the Union Budget 2024-25 as 'Garib' (Underprivileged), 'Yuva' (Youth), 'Annadata' (Farmer) and 'Mahilayen' (Women), reaffirming the government's commitment to empowering the youth and women. As India continues to invest in skill development, it not only unlocks the potential of its youth but also propels the nation towards inclusive growth and prosperity.

The direct selling industry is aligned with the government’s initiatives and is optimistic that the introduction of pro-people programs such as the PM’s Package - 3 employment linked initiatives, PM’s Package - 4th scheme of 20 lakh youth to be skilled over a 5-year period and Mudra Yojana will contribute towards creating an inclusive workforce with greater opportunities for employment and entrepreneurship for youth and women.

Furthermore, the Union Budget 2024-25 emphasizes innovation, research, and development with a heightened focus on resilience in agriculture and related activities. Increased allocation towards the agricultural sector, shift towards natural farming, and development of climate-resilient crop varieties, are poised to create opportunities for related sectors and companies. These efforts will undoubtedly play a significant role in India’s overall sustainable growth,” said Gautam Bali, MD and Founder, Vestige Marketing Pvt. Ltd.

-330

July 23, 2024· 19:47 IST

Budget 2024 live updates: Budgetary allocations for Andhra not politics but something much required to rebuild state, says TDP

The TDP, a key NDA partner, on Tuesday hailed the Union Budget as one of the best and thanked Prime Minister Narendra Modi for the budgetary announcements for Andhra Pradesh, saying it was not politics but something that was very much required for rebuilding the state.

Union minister and Telugu Desam Party (TDP) MP Kinjarapu Rammohan Naidu described the budget as "very futuristic" and said the proposals made in it is the central government's effort to strengthen the four key segments -- poor and weaker sections of society, agriculture and farmers, women and youth of the country.

-330

July 23, 2024· 19:36 IST

Budget 2024 live updates: Budget emphasis on technological innovation and digitization, says Puneet Chandok

“The Union Budget and Economic Survey’s emphasis on technological innovation and digitization sets India on the fast track to becoming an ‘AI-first nation,’ opening new opportunities for collective and inclusive progress from commerce to communities. Leveraging a digitized economy and an AI-ready workforce aligns well with the budget’s priorities towards employment & skilling, innovation, research & development, and productivity & resilience in agriculture. With a diffusion rate surpassing that of any previous technology, India leads the world in AI skill penetration and talent concentration rates. This progress is remarkable, with human capital, businesses, and public sector organizations rapidly adopting new technologies, said Puneet Chandok, President, Microsoft India & South Asia

-330

July 23, 2024· 19:24 IST

Budget 2024 live updates: Himachal ignored in Budget, special financial package needed, says CM Sukhu

Himachal Pradesh has been completely ignored and got nothing in the Union budget presented by Finance Minister Nirmala Sitharaman, Chief Minister Sukhvinder Singh Sukhu said on Tuesday. The discrimination is clearly visible in the budget as the NDA allies in Bihar and Andhra Pradesh have been rewarded, but Himachal's legitimate claim for a special package for last year's monsoon disaster finds no mention in the budget, he said while talking to the media persons here, Sukhu said in a statement.

"The cessation of GST compensation has put Himachal Pradesh in a precarious financial position, resulting in an annual loss the state can't afford. A special financial package was urgently needed in the analogy of Bihar and Andhra Pradesh to mitigate this loss and support our state's fiscal stability," the chief minister said.Terming the budget as anti-poor, inequitable and not futuristic, Sukhu said it is a total opportunistic budget and fails to address the critical issues of unemployment, rising prices, and growing inequality.

Sukhu highlighted several key areas of concern and called for immediate revisions to address the needs of the wider population and said that the Centre had again disappointed Himachal Pradesh by ignoring its long pending demands and the aspirations of the people. He said the Himachal government had requested the Centre to release Rs. 9,042 crore as financial assistance following a post-disaster assessment carried out by a central team. It was expected that Himachal too, would be given direct assistance on the pattern of Assam, Sikkim and Uttarakhand.

-330

July 23, 2024· 19:15 IST

Budget 2024 live updates: Budget 2024 has tried to provide some relief to the salaried taxpayers, especially those in the lower tax slabs, says Naveen Kukreja

"Budget 2024 has tried to provide some relief to the salaried taxpayers, especially those in the lower tax slabs, in the form of increased standard deduction and some favourable tweaks in the tax slabs under the new tax regime. The proposal to increase deduction for family pension under the new tax regime should also provide some relief to those in the golden years.

We welcome the Government’s move to include MSMEs in the 9 priorities of the Budget. The proposed credit guarantee scheme for the purchasing equipments and machineries by MSMEs, without the need of furnishing collaterals or third-party guarantee, should help in improving the credit flow to the manufacturing MSMEs. We also welcome the announcement of a new credit assessment model for MSMEs based on their digital footprints. Alternative credit scoring models like these would not only help increase access to credit for MSMEs, but would also incentivise adoption of digital payment.

However, the most positive announcement is the proposal to set up a new mechanism for ensuring credit access for MSME during financial stress caused by factors beyond their control. The current SMA guidelines restrict the MSMEs from using their existing credit lines when they require it the most. It is good that the government has recognised this problem and we hope that the regulator takes a more nuanced approach towards the unique payment cycle related problems faced by the MSMEs.

Another major positive proposal for the MSME segment is the reduction in mandatory turnover threshold from Rs 500 crore to Rs 250 crore. The proposal will further deepen the market of invoice discounting and increase the price discovery mechanism for more MSMEs.

I feel the proposal to increase LTCG tax on equities was a dampener. Instead of increasing LTCG tax on equities, the government could have increased the holding period for LTCG tax from 1 year to 3 years to incentivise long term investments. However, we welcome the increase in STT on F&O trades as even the regulators have flagged the macro-economic dangers of household savings being diverted to speculative activities. The proposal to increase employer’s contribution to NPS should also be welcomed for the same reason that it promotes long-term investing for retirement security," said Naveen Kukreja, Co-Founder and CEO, Paisabazaar.

-330

July 23, 2024· 19:10 IST

Budget 2024 live updates: Budget will usher in new era of employment, opportunities, says Amit Shah

Union Home Minister Amit Shah on Tuesday said Budget 2024-25 will fuel the country's pace on the path of emerging as a developed nation by ushering in a new era of employment and opportunities. He also said the budget reflects Prime Minister Narendra Modi's "unwavering commitment" to driving economic growth by bolstering India's entrepreneurial power and ease of doing business.

Shah said the budget provides relief to taxpayers by simplifying the tax assessment rules. The budget not only exemplifies the country's newfound sense of purpose, hope and optimism under the NDA government but also fortifies them, he said.

-330

July 23, 2024· 19:05 IST

Budget 2024 live updates: Budget is built on commitment to clear and stable policies and conservatism in estimates, says Rajiv Memani

The 2024 Indian budget is built on commitment to clear and stable policies and conservatism in estimates. Its impetus on creating jobs, skilling at scale and making the taxpayers’ life easy will have far-reaching impact in the medium to long-term," said Rajiv Memani Chairman EY India

-330

July 23, 2024· 18:54 IST

Budget 2024 live updates: Growth-spurring measures like increasing of MUDRA loan limit will ensure inclusive growth of Bharat, says, Rakesh Kaul, CEO, Clix Capital

“Budget 2024 succeeds in building on the growth momentum generated in the past decade with the announcements aimed at bolstering growth in mass-employment creating sectors. MSMEs are the lifeblood of our economy, and the Honourable Union Finance Minister Nirmala Sitharaman should be commended for ensuring the sector is poised to embark on the next phase of growth. Growth-spurring measures like increasing of MUDRA loan limit from Rs 10 lakh to Rs 20 lakh, creation of e-commerce export hubs to boost MSME hubs, loans for MSMEs for the purchase of machinery and equipment without collateral will go a long way in ensuring the inclusive growth of Bharat,” says, Rakesh Kaul, CEO, Clix Capital.

-330

July 23, 2024· 18:36 IST

Budget 2024 live updates: The organised SMEs should benefit from the larger Mudra loan limits, says Sanjay Sharma, MD and CEO, Aye Finance

The organised SMEs should benefit from the larger Mudra loan limits under the Tarun category, the increased corpus of Credit guarantee scheme and the enablement of Treds for those with turnover of 250crores .

However, the micro-scale enterprises that generate the bulk of the non-agri jobs have no specific program except some trickle-down from the 100cr Credit Guarantee fund. Here the simplification of Credit Guarantee Schemes for the micro loans would have helped, but that will need some more wait.

There is clear intent to tackle the issues of unemployment. The intent to skill 20 lakh youth in 5 years and the promise to allocate Rs 2 lakh crore for job creation over 5 years are urgently needed steps. The internship scheme for 2 crore youth in large companies, the monthly reimbursement of upto Rs3000 of EPFO contribution for companies that create new jobs , increasing the working women hostels – will start the momentum towards tackling the huge problem of unemployment that looms on the horizon, says Sanjay Sharma, MD and CEO, Aye Finance

-330

July 23, 2024· 18:31 IST

Budget 2024 live updates: Higher F&O taxes will curb speculation, promoting informed investment, says Jyoti Bhandari

"Budget 2024 aims to boost economic growth with tax reliefs like raising the personal income tax exemption limit to ₹5 lakhs and increasing the standard deduction to ₹75,000. The Government’s increase in capital gains taxes reflects market maturity, encouraging long-term investments and stability. Higher F&O taxes will curb speculation, promoting informed investment. Combined with infrastructure investments and support for green initiatives and small businesses, this budget is a step towards a prosperous and sustainable future for all citizens," says Jyoti Bhandari, Founder and CEO, Lovak Capital

-330

July 23, 2024· 18:25 IST

Budget 2024 live updates: The Union Budget 2024 balances well between fiscal responsibility and growth, says Manish Jain

The Union Budget 2024 balances well between fiscal responsibility and growth. Fiscal deficit at 4.9% is in line with market expectations, and points the government is on the path of fiscal discipline.

For the capital markets , the increase in capital gains tax does hurt investors. Short-term gains on financial assets will now be taxed at 20%, compared with 15% earlier while long-term gains on all assets face a 12.5% tax, from 10% earlier. This change, coupled with an increased exemption limit of ₹1.25 lakh per year for capital gains on financial assets, could reshape investor behaviour.

From a corporate perspective , the reduction of tax for foreign companies from 40% to 35% is likely to attract more overseas investment. This move, along with the abolition of angel tax for all investor classes, signals a pro-business stance that could boost both foreign and domestic investor sentiment in Indian markets.

The government's focus on infrastructure with a substantial allocation of ₹11.11 lakh crore (3.4% of GDP) continues to build on infra-led growth in related sectors. It will create interesting opportunities for investors in infrastructure and allied industries.

For the MSME sector, enhanced credit guarantees, and a new credit assessment model could improve liquidity and growth prospects. The increase in Mudra loan limits to ₹20 lakh under the 'Tarun' category further supports this economic segment.

The budget's emphasis on manufacturing and services including twelve new industrial parks and a Critical Minerals Mission, could open up new avenues for investment.

These initiatives, combined with skill development programs and employment generation schemes, aim to boost overall economic productivity.In the energy sector, initiatives like private sector involvement in nuclear energy and the Pumped Storage Policy could create new investment opportunities in the power and renewable energy sectors.

Overall, the budget measures encourage long-term growth while potentially dampening short-term speculation. The overall push for economic growth will further enhance market depth and stability in the long run, said Manish Jain, Managing Director, Bajaj Broking.

-330

July 23, 2024· 18:18 IST

Budget 2024 live updates: Budget will significantly enhance India's ship building and cruise industry capacity, says Sarbananda Sonowal

Union ports, shipping and Waterways Minister Sarbananda Sonowal on Tuesday said that the Budget 2024-25 will significantly enhance India's ship building and cruise industry capacity and create new job opportunities.

In a social media post, Sonowal said the budget places a huge emphasis on employment, skill development, MSMEs, agriculture and investment-led economic growth.

"The Budget will significantly enhance India's shipping, cruise, shipbuilding, and ship repair industry, creating new job opportunities and boosting exports," he said. Sonowal also extended his gratitude to Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman for presenting this visionary document.

-330

July 23, 2024· 18:13 IST

Budget 2024 live updates: The enhancement of Mudra loans to ₹ 20 lakh will fuel the growth of mid-level companies, says Akshay Mehrotra

Akshay Mehrotra, Cofounder & CEO, Fibe,said, "This year’s Budget has taken a forward-looking approach, aimed at building a self-reliant economy with MSMEs and startups as key drivers of Bharat's next phase of growth. It is encouraging to see the Government’s focus on creating more jobs for the youth with enhanced focus on skill upgradation. This clubbed with the reduction in taxes for the salaried class signifies the strategy to support individuals in middle-income group and younger professionals, leading to their professional development. Furthermore, the efforts to promote sustainable energy solutions will give a boost to more ‘Make-in-India’ businesses and boost innovation in the clean energy space, creating more job opportunities for the youth. Besides, the focus on MSMEs is another step forward in driving nation’s progress. The enhancement of Mudra loans to ₹ 20 lakh will fuel the growth of mid-level companies (INR 50 lakh to 2 crore revenue) and ensure they get enhanced opportunities. Lastly, the increase in capital gains tax will pose challenges for venture capitalists and investors, especially when exiting. On the other hand, the abolishment of angel tax will provide the much-needed boost to the startup ecosystem and help them thrive in India.”

-330

July 23, 2024· 17:58 IST

Budget 2024 live updates: Government has accelerated the fiscal consolidation path, says Mahesh Patil

The government has accelerated the fiscal consolidation path targeting 4.9% fiscal deficit in FY25 ensuring macro stability continues. It is mildly positive for small ticket consumption due to marginal reduction in personal tax, welfare schemes and focus on job creation through multiple schemes. The increase in capital gains tax is marginally negative and it's a move towards a uniform tax structure across asset class. However, the overall economic growth is robust and given no adverse impact on corporate earnings, the markets should stabilize, said Mahesh Patil, CIO, Aditya Birla Sun Life AMC Ltd

-330

July 23, 2024· 17:52 IST

Budget 2024 live updates: New tax regime for long-term capital gains could impact investor returns, says Veer Mishra

The Union Budget has delivered a mixed bag for the market. While the reduction in customs duty on precious metals is expected to boost investor sentiment, the changes in the taxation of financial instruments could dampen enthusiasm. The abolition of angel tax is a major positive for startups and the overall investment climate. However, the new tax regime for long-term capital gains could impact investor returns. The market is likely to remain volatile in the near term as investors digest these announcements, said Veer Mishra, Founder of PLUS-

-330

July 23, 2024· 17:42 IST

Budget 2024 live updates: 4,275 kms of optical fibres have been laid down under Kavach systems in India, says Vaishnaw

Operating Ratio target of India Railways for 2024-25 has been set as 98.22 percent from 98.65 percent in 2023-24

4,275 kms of optical fibres have been laid down under Kavach systems in India

-330

July 23, 2024· 17:37 IST

Budget 2024 live updates: We expect an increase in investment due to the abolition of angel tax, says Vaishnaw

DPDP Rules formulation in very advanced stages. It will be released for consultation soon, says Vaishnaw

-330

July 23, 2024· 17:28 IST

Budget 2024 live updates: Budget has announced rationalisation of customs duty which will hugely benefit industry, says Vaishnaw

We are working on developing mobile component ecosystem. The budget has announced rationalisation of customs duty which will hugely benefit the industry

Server and laptop manufacturing has started in India. The success we have witnessed in mobile manufacturing, we will witness the same in this sector

For deep tech startups angel tax was a major issue, specifically in regards to determining valuation. With angel tax now being removed, this has now been resolved.

-330

July 23, 2024· 17:24 IST

Budget 2024 live updates: Focus on setting up new projects under Indian Railways will continue, says Ashwini Vaishnaw

5 lakh jobs have been awarded in the 10 years of NDA governance, 20% higher than the 4.11 lakh jobs awarded under the 10 years of UPA government, says Ashwini Vaishnaw

-330

July 23, 2024· 17:21 IST

Budget 2024 live updates: Kavach installation will be fast-tracked in coming years, says Ashwini Vaishnaw

Kavach '4.0' safety system was approved last week

Kavach will get a major part of the funds earmarked for safety-related measures

-330

July 23, 2024· 17:19 IST

Budget 2024 live updates: Indian Railways has been allocated Rs 2.62 lakh crore under Budget for 2024-25, says Ashwini Vaishnaw

Rs 1.08 lakh crore of budget allocation to Indian Railways will be used to boost railway safety in 2024-25.

Demand for 'General' travel is on the rise in Indian Railways.

10,000 extra general coaches over and above the 2,500 general coaches announced earlier will be manufactured in India

-330

July 23, 2024· 17:09 IST

Budget 2024 live updates: Substantial allocation for Maharashtra in Budget, don't create negative narrative, says Fadnavis to Oppn

Maharashtra Deputy Chief Minister Devendra Fadnavis on Tuesday accused the opposition of trying to build a "negative narrative" even though "substantial allocations" are earmarked in the Union Budget for the western state.

Speaking to reporters in Mumbai, Fadnavis claimed the Opposition parties had prepared their reaction against the Budget in advance to build a negative narrative against the Central government.

"The Budget includes substantial allocations for Maharashtra. It is advisable for the opposition to thoroughly examine the Budget before reacting," he said.

-330

July 23, 2024· 17:00 IST

Budget 2024 live updates: Most-forward looking budget presented by finance minister, says Pralhad Joshi

This is the most-forward looking budget presented by finance minister, says New & Renewable Energy Minister Pralhad Joshi.

The poor and underprivileged would be benefited the most by PM solar scheme.

It would not be an exaggeration to say that PM solar scheme is one of the best schemes in the world.

-330

July 23, 2024· 16:55 IST

Budget 2024 live updates: Nothing in Budget speech gives us confidence that govt will seriously tackle issue of inflation, says Chidambaram

Govt seems to be blissfully ignorant of its own statistics that wages have stagnated in last six years, says Congress leader P Chidambaram

Unemployment biggest challenge facing country; response of govt 'too little', will have little impact on grave situation, says P Chidambaram

-330

July 23, 2024· 16:50 IST

Budget 2024 live updates: The increased Mudra loan limit is a game-changer for entrepreneurs, says Shikhar Aggarwal

"This budget is a blueprint for a prosperous and inclusive India. By prioritizing land reforms with initiatives like Bhu-Aadhaar and digitizing land records, the government is laying a solid foundation for equitable growth. The increased Mudra loan limit is a game-changer for entrepreneurs, especially women, who will be empowered further through schemes allocated over ₹3 lakh crore and foster greater Financial Inclusion. The focus on agriculture, employment and human development demonstrates a comprehensive approach to addressing India's challenges. This budget is not just about numbers; it's about transforming lives and building a stronger nation through inclusive development," says Shikhar Aggarwal, Chairman of BLS E-Services.

-330

July 23, 2024· 16:40 IST

Budget 2024 live updates: Privatisation a cabinet decision, has to be honoured, says FM

FM: Disinvestment, strategic sales of PSUs is a cabinet decision that will be honored, timing though will be decided

-330

July 23, 2024· 16:39 IST

Budget 2024 live updates: Previous cases emanating from angel tax will continue, says Revenue Secy

Revenue Secy on angel tax cases currently ongoing: Only where there is actual laundering will penalty be imposed

-330

July 23, 2024· 16:38 IST

Budget 2024 live updates: Haven't left out any state in this Budget, say FM

FM: Bengal didn't want to be part of some central government schemes

FM: Want to reassure every state has been covered under announcements and projects

-330

July 23, 2024· 16:24 IST

Budget 2024 live updates: Fin Secy on lowering fiscal deficit target

Here after intention is not to focus on fiscal deficit number but to focus on reduction in debt to GDP ratio: Finance Secy

India is fastest growing economy, the deficit that we can support is more than 3%

Fiscal deficit that we can support in a given year without increasing debt to GDP ratio is much higher than the original 3 percent FRBM mandate, it is possibly below 4.5 percent

-330

July 23, 2024· 16:22 IST

Budget 2024 live updates

Vishal Sharma, Cofounder & CEO, AdvaRisk, “The Govt went all out to continue its reforms in agri and allied sectors. The Finance Minister proposed to provide coverage to farmers and their land under digital public infrastructure under which 6 crore farmers and their land will be brought into the farmer and land registry. Furthermore, the push to boost digital agriculture infrastructure is a step in right direction. This mapping of agricultural land using unique identifier (ULPIN) will help increase credit penetration among farmers. This will also help lenders to better gauge the credit profile of farmers. I believe, the proposal will not just bring efficiency in onboarding farmers as borrowers but also reduce instances of defaults. Besides, the abolishing of angel tax on startups will leave entrepreneurs with more capital to develop their businesses and will encourage the startup ecosystem. We can see more investments in businesses with this step.”

-330

July 23, 2024· 16:17 IST

Budget 2024 live updates: Have kept Rs 62,000 cr with DEA for any ministry that may require more funds than allocated

-330

July 23, 2024· 16:15 IST

Budget 2024 live updates: Have intentionally aimed at reducing short term T-bills, says Finance secy

Expenditure is going up substantially, and so is the revenue

-330

July 23, 2024· 16:15 IST

Budget 2024 live updates: Will actually aid middle class, says Finance Secy on removal of indexation on real estate

Fin Secy on lower rate without indexation on real estate and gold: This will actually aid middle class

Small savings mop up target brought down and one reason could be that stock market is becoming a more attractive investment option for households: Finance Secy

-330

July 23, 2024· 16:10 IST

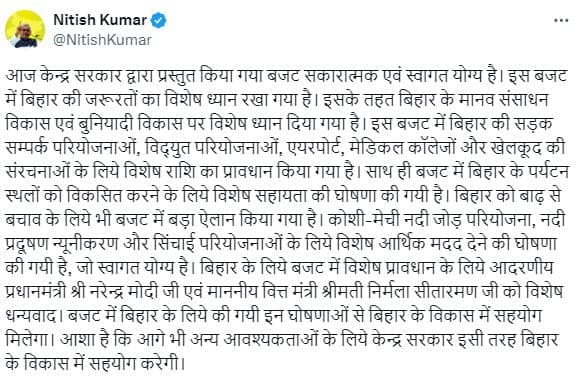

Budget 2024 live updates: Special attention has been paid to the needs of Bihar, tweets Nitish Kumar

-330

July 23, 2024· 16:06 IST

Budget 2024 live updates: Chandrababu Naidu hails Budget, says it will rebuild Andhra Pradesh

Andhra Pradesh Chief Minister N Chandrababu Naidu has lauded the Budget 2024 for its substantial allocation to the southern state, saying the support from the Centre would go a long way towards rebuilding Andhra.

In the tweet, Naidu extended his thanks to Prime Minister Narendra Modi and Union Finance Minister Nirmala Sitharaman for addressing Andhra Pradesh’s critical needs in the budget.

-330

July 23, 2024· 16:04 IST

Budget 2024 live updates: FM Sitharaman stands firm on fiscal discipline; RBI dividends help in juggling post-poll necessities

Gaurav Choudhury, consulting editor, Network18 writes:

Finance Minister Nirmala Sitharaman on July 23 presented a carefully crafted plan, raising expenses by Rs 3.7 lakh crore from last year’s estimates, but walked the talk on fiscal discipline despite additional welfare spending—likely a nod to post-election political dynamics.

In the new government’s first budget, the fiscal deficit target—shorthand for what the government plans to borrow to fund its expenses—has been set at 4.9 percent of GDP, lowered from the 5.1 percent projected in the Interim Budget.

-330

July 23, 2024· 15:55 IST

Budget 2024 live updates: Investments do go through press note route 3 from China even now, says FM

Investments do go through press note route 3 from China even now. Not disowning Economic Survey's suggestion on Chinese FDI: FM SItharaman

-330

July 23, 2024· 15:52 IST

Budget 2024 live updates: At advanced stage of arriving at options on NPS, says Finance Secy

Aim to balance Core priorities of the staff with fiscal prudence on NPS review: Finance Secy

Have had 4 meetings with staff committee on NPS review: Finance Secy

-330

July 23, 2024· 15:49 IST

Budget 2024 live updates

Employment linked incentive scheme outlay roughly at Rs 5000 crore for FY25, internship scheme allocation seen at Rs 2000 crore: Fin Secy

-330

July 23, 2024· 15:42 IST

Budget 2024 live updates: Continuing effort to relax FDI rules, says FM

FM: Willing to do further simplification on FDI rules if needed.

-330

July 23, 2024· 15:40 IST

Budget 2024 live updates: Rail budget at highest ever at Rs 2.56 lakh cr, says Finance secy

-330

July 23, 2024· 15:38 IST

Budget 2024 live updates: Nominal GDP of 10.5% is slightly conservative, but likely, says Revenue Secy

Finance secy: Endeavor is to reduce the debt to GDP every year

-330

July 23, 2024· 15:31 IST

Budget 2024 live updates: Hiked STT on F&O trading prospective not retrospective, says Revenue Secy

Alert: Increased STT with effect from October 1, 2024

-330

July 23, 2024· 15:30 IST

Budget 2024 live updates: FM Sitharaman on angel tax removal

Money laundering issue was being tackled via a tax measure. But there are other measures and laws that can help tackle any laundered money

FM: Angel tax was introduced in 2012 under UPA government, we continued it, but tried to make it simpler

Finance Secy on angel tax removal: Certain laws of companies act also helps tackle any laundering

-330

July 23, 2024· 15:25 IST

Budget 2024 live updates: Idea is to utilise asset monetisation better rather than selling assets, FM on divestment

PSU dividends have gone up: FM

Non-tax revenue mobilisation is happening: FM

-330

July 23, 2024· 15:23 IST

Budget 2024 live updates: Attempt to widen tax net has been made, says FM Sitharaman

Attempt to widen tax net has been made. It has to be widened for both direct and indirect tax: FM

-330

July 23, 2024· 15:21 IST

Budget 2024 live updates: Wanted to simplify approach to taxation of capital gains, says FM

FM on capital gains: Average taxation has come down for asset classes. This encourages investment in the market

Fin secy: The effective rate is actually lower or same on real estate, gold. Short term has gone up, long term has been rationalised -- it has not necessarily gone up

-330

July 23, 2024· 15:17 IST

Budget 2024 live updates: FM Nirmala Sitharaman holds press briefing post Budget speech

Employment captures everything to do with this Budget: FM in press conference

-330

July 23, 2024· 15:12 IST

Budget 2024 live updates: Budget signals first major political shift by Modi govt after the elections

Nalin Mehta, Managing Editor, Moneycontrol writes:

A month after the Bharatiya Janata Party lost its single-party majority in Parliament, PM Narendra Modi has responded to the political message of the elections by directly attempting to address discontent in key voting groups - like farmers - where the BJP saw an erosion in support, a clear focus on creating jobs, new outlays for key NDA allies in Bihar and Andhra Pradesh and some tough love for the stock markets. For several weeks now, the political messaging from the BJP had been one of business-as-usual, that nothing much had changed, despite the change in Lok Sabha numbers. The framing of Finance Minister Nirmala Sitharaman’s budget is the first major public indication of a political shift. Read more

-330

July 23, 2024· 15:09 IST

Budget 2024 live updates: Raamdeo on real estate indexation benefit removal

There has been tax hike for all assets that have got capital appreciation, Govt is not making any distinction.

-330

July 23, 2024· 15:07 IST

Budget 2024 live updates: Raamdeo Agrawal on capital market taxation:

People come to markets for capital gains, not for what tax rate is in place. If the macro story of earnings is intact, the negative sentiment in market may not last. Meaning whatever you sold till today was under the older tax, even in this financial year.

-330

July 23, 2024· 15:06 IST

Budget 2024 live updates: Railways mentioned only once, allocation maintained

While speaking about Andhra Pradesh Reorganization Act Sitharaman said that "Under the Act, for promoting industrial development, funds will be provided for essential infrastructure such as water, power, railways and roads in Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor and Orvakal node on Hyderabad-Bengaluru Industrial Corridor."

That was the Finance Minister's only mention of Railways in the Budget Speech for 2024-25.

-330

July 23, 2024· 14:52 IST

Budget 2024 live updates: This Budget will improve infra as well as the economy of Bihar, says Chirag Paswan

Union Minister Chirag Paswan said, "We demanded that we should be given a special package and I want to thank PM Modi and FM Nirmala Sitharaman for providing special packages to the state. As Bihari, I am extremely happy and in this Budget, announcements have been made to build bridges, medical colleges, airports...This Budget will improve the infrastructure as well as the economy of the state..."

-330

July 23, 2024· 14:35 IST

Budget 2024 live updates: “Kursi Bachao” Budget, says Rahul Gandhi

Opposition leader Rahul Gandhi tweeted: Appease Allies: Hollow promises to them at the cost of other states.

- Appease Cronies: Benefits to AA with no relief for the common Indian.

- Copy and Paste: Congress manifesto and previous budgets.

-330

July 23, 2024· 14:34 IST

Budget 2024 live updates: This support from the Centre will go a long way towards rebuilding Andhra Pradesh, says CM Naidu

Andhra Pradesh CM N Chandrababu Naidu tweets "On behalf of the people of Andhra Pradesh, I thank the PM Modi and Union Finance Minister Nirmala Sitharaman, for recognising the needs of our State and focusing on a Capital, Polavaram, industrial nodes and development of backward areas in AP in the union budget of FY 24-25. This support from the Centre will go a long way towards rebuilding Andhra Pradesh. I congratulate you on the presentation of this progressive and confidence-boosting budget..."

-330

July 23, 2024· 14:25 IST

Budget 2024 live updates: PM Modi on employment scheme

Prime Minister Modi said, "In this Budget, the government has announced ‘Employment Linked Incentive scheme. This will help generate many employment opportunities. Under this scheme, the government will give the first salary to those who are newly entering the workforce. Youth from villages will be able to work in the country's top companies under the apprenticeship program."

-330

July 23, 2024· 14:13 IST

Budget 2024 Live updates: This budget is for empowerment of new middle class, says PM

Prime Minister Narendra Modi says "In the last 10 years, 25 crore people have come out of poverty. This budget is for the empowerment of the new middle class. The youth will get unlimited opportunities from this budget. Education and skill will get a new scale from this budget. This budget will give power to the new middle class...This budget will help women, small businessmen, MSMEs..."

-330

July 23, 2024· 14:08 IST

Budget 2024 Highlights: PM says education and skill prioritized in 2024 Budget

On Union Budget 2024-25, PM Modi says, "This budget will give power to every section of the society..."

-330

July 23, 2024· 14:02 IST

Budget 2024 Highlights: What gets cheaper, what's dearer after FM's speech

Items Becoming Cheaper:

Mobile Phones: Basic customs duty on mobile phones and chargers will drop to 15%.

Gold and Silver: Customs duties on these metals will be reduced to 6%.

Platinum: Customs duties on platinum will decrease to 6.5%.

Cancer Drugs: Three additional cancer treatment drugs will be exempt from customs duties.

Seafood: Basic customs duty on certain brood stocks, shrimps, and fish feed will be cut to 5%.

Solar Energy Parts: Customs duties on parts related to solar energy will not be extended.

Ferronickel and Blister Copper: Basic customs duties on these materials will be removed.

Footwear: Customs duties on leather and footwear manufacturing will be reduced.

Items Becoming Costlier:

Ammonium Nitrate: Customs duty will rise to 10%.

Non-Biodegradable Plastics: Duty on these plastics will increase to 25%.

Telecom Equipment: Basic customs duty will go up to 15% from 10%.

Tax Collection at Source (TCS): A 1% TCS will be applied to notified goods exceeding Rs 10 lakh.

Solar Glass: Customs duty on solar glass will not be extended.

-330

July 23, 2024· 13:55 IST

Budget 2024 Highlights: Capital Mind's Deepak Shenoy on indexation removal from real estate

"No indexation at all has huge implications - absolutely massive - for property. People who have held for 15 years and seen their prices double or such, would otherwise have not paid any capital gains tax due to indexation Now, they will pay 12.5%."

-330

July 23, 2024· 13:52 IST

Budget 2024 Highlights: Capital gains changes in Modi 3.0 Budget

1) Only two holding periods: 12 and 24 months

2) Gold, debentures, bonds will be 24M (along with unlisted shares and RE)

3) All listed securities (incl bonds) will be 12M

4) STCG increased from 15% to 20%

5) All LTCG is 12.5%. No indexation anymore.

6) LTCG up to 1.25 lakh is tax free (from 1 lakh earlier)

Note: These changes come into effect from July 23, 2024.

-330

July 23, 2024· 13:36 IST

Budget 2024 Highlights: Apple to save upto $50 million per year due to BCD reduction, say experts

The government's proposal to reduce basic customs duty on mobile phones, mobile printed circuit boards (PCB), and chargers to 15 percent will help iPhone maker Apple save $30-$50 million per year, analysts and industry executives said

“This could be savings for OEMs who are importing CBU (Completely Built Units), especially like Apple or new entrants who don't have manufacturing set up yet or OEMs importing super-premium models such as Foldables though in few quantities,” Neil Shah, vice president at Counterpoint Research told Moneycontrol.

Shah added that this could translate to $35-$50 million per year in savings for Apple until it starts manufacturing Pro models immediately.

-330

July 23, 2024· 13:30 IST

Budget 2024 Highlights: Budget achieved the trinity of impossible, says Kotak AMC's Nilesh Shah

“This budget has achieved the trinity of impossible. Fiscal Prudence, Investment and Growth momentum.

Fiscal Prudence of 4.9 % for FY 24 will pave the way for Rating upgrade. Support to employment generation will boost growth. Infrastructure investment at 3.4 % of GDP is elevated yet not crowding out others.”

- Nilesh Shah, Managing Director, Kotak Mahindra AMC

-330

July 23, 2024· 13:15 IST

Budget 2024 Highlights: Rupee declines to record low after government raises tax on capital gains

The rupee declined to 83.69 to the dollar, inching past the previous lifetime low of 83.6775, and compared with 83.6275 before the budget announcement.

-330

July 23, 2024· 13:13 IST

Budget 2024 Highlights: Govt import tax on gold, silver to 6% to tackle smuggling

FM Sitharaman slashed import duties on gold and silver to 6% from 15%, a move that industry officials say could boost retail demand and help curtail smuggling in the world's second-biggest consumer of bullion.

Higher demand for gold from India could boost global prices, which hit a record high this year, although that could widen India's trade deficit and put pressure on the ailing rupee.

She also announced an import duty exemption for 25 critical minerals, including lithium. India has been exploring ways to secure supplies of lithium, a critical raw material used to make electric vehicle batteries.

-330

July 23, 2024· 13:05 IST

Budget 2024 Highlights: FM Sitharaman' s Budget wordcloud

-330

July 23, 2024· 12:58 IST

Budget 2024 Highlights: No significant customs duty hike announced on metal imports

The BSE Metal index is down by 3.3 percent, falling sharply towards the end of the budget speech as no significant customs duty increases were announced on metal imports. The govt appears to have preferred to let user industries and its infra thrust to benefit from lower commodity prices. This will leave metal companies exposed to cheaper competition from Chinese imports.

Ravi Ananthanarayanan

Executive Editor -MC Pro

-330

July 23, 2024· 12:56 IST

Budget 2024 Highlights: Markets plunge as FM hikes LTCG, STCG; taxes income from buyback of shares

--The equity benchmark indices went into a freefall mode as the finance minister Nirmala Sitharaman announced a hike in long term capital gains tax.

--The finance minister, while presenting the union budget, increased the LTCG on securities from the current 1o% to 12.5%. The short term capital gains was also hiked to 20% from 15% earlier.

--In addition, income from buyback of shares will be taxed at the hands of the recipient.

--The 30-share Sensex fell over 1000 points or 1.35% to trade at 79416, while the broader Nifty was down 1.38% or 337 points at 24,172.

-330

July 23, 2024· 12:50 IST

Budget 2024 Highlights: FM's income tax announcements

• Income-tax slab rates changed for the lower slabs, for the new simplified income tax regime

• Standard deduction, for taxpayers opting for the new tax regime, at Rs 75,000, up from Rs 50,000 earlier

• NPS Vaatsalya for minor children announced in Budget 2024. Where parents can invest on behalf of their kids. Upon attaining majority, this can be converted to regular NPS

• Deduction on employers’ contribution to private sector employees’ NPS has been hiked to 14%, up from 10% earlier. Only for the new income-tax regime.

• Changes in capital gains tax regime. Long-term capital gains rate hiked to 12.5%, up from 10%

• Long-term capital gains income up to Rs 1.25 lakh exempt from tax

• Holding period of capital gains tax streamlined: All listed financial assets held for more than a year: long-term. All unlisted financial and non-financial asserts held for more than 2 years: long-term.

-330

July 23, 2024· 12:36 IST

Budget 2024 Live: Limit of STCG tax hiked to 20%, LTCG raised from 10% to 12.5%

The unexpected - short term capital gains raised to 20% from 15% and long term to 12.5 %,from 10%, increase STT on futures and options, income from buy back to be taxed, short-term negative, will not fundamentally alter the market direction

Madhuchanda Dey, Head Research

-330

July 23, 2024· 12:35 IST

Budget 2024 Live: Sitharaman's Budget speech ends

FM Nirmala Sitharaman's Budget speech spans roughly for 80 minutes.

-330

July 23, 2024· 12:31 IST

Budget 2024 Live: Revised tax slabs under new regime

0-3 lakh - Nil

3-7 lakh - 5%

7-10 lakh - 10%

12-15 lakh - 20%

-330

July 23, 2024· 12:28 IST

Budget 2024 Live: FM revises tax structure under new tax regime

Under new tax regime, standard deduction hiked to Rs 75,000 from Rs 50,000

Salaried employee will save Rs 17,500 in income tax

-330

July 23, 2024· 12:25 IST

Budget 2024 Live: STT on F&O hiked to 0.02% and 0.1%, says FM Sitharaman

-330

July 23, 2024· 12:22 IST

Budget 2024 Live: Corporate tax rate on foreign companies reduced to 25%

-330

July 23, 2024· 12:22 IST

Budget 2024 Live: Relief for startups! Angel tax abolished, says FM Sitharaman

-330

July 23, 2024· 12:19 IST

Budget 2024 Live: Limit of LTCG hiked from 10% to 12.5%

Short term gains on certain financial assets will be 20 percent, rest is applicable tax rate

Long term capital gains will be 12.5 percent

Listed financial assets held for more than a year will be classified as long term

-330

July 23, 2024· 12:18 IST

Budget 2024 Live: TDS rate on e-commerce operators to be reduced to 0.1 percent from 1 percent

-330

July 23, 2024· 12:17 IST

Budget 2024 Live: Centre to borrow Rs 14.01 lakh crore in FY25, lower than interim Budget estimate

The Centre marginally cut the gross borrowing target from the markets in 2024-25 to Rs 14.01 lakh crore to finance its fiscal deficit of 4.9 percent of the GDP, Finance Minister Nirmala Sitharaman announced on July 23, in a speech presenting the full Budget for 2024-25.

This is Rs 1.4 lakh-crore lower compared to the estimate of Rs 15.43 lakh crore for FY24.

-330

July 23, 2024· 12:15 IST

Budget 2024 Live: Comprehensive review of Income Tax Act of 1961 to be completed in six months

-330

July 23, 2024· 12:14 IST

Union Budget 2024 Live: FM turned the lens on job creation and employability through a string of means

The finance minister Nirmala Sitharaman has turned the lens on job creation and employability through a string of measures as creating jobs by the millions for years on end for the armies of youth that are joining the queue of hopefuls every year remains a central long run policy challenge in India.

A new internship programme that will allow corporations to employ interns at Rs 5,000 per month for a year for which companies will be able to use corporate social responsibility (CSR) funds. Ten million youth is targeted to be skilled through this over five years.

She also announced the launch of an e-voucher scheme for loans of upto Rs 10 lakhs for higher education in domestic institutions given directly to 1 lakh students every year for annual interest subvention of 3 per cent of the loan amount.

For first timers, a direct benefit transfer of one-month salary in three installments of upto Rs 15,000 to first-time employees registered in EPFO.

For job creation in manufacturing, incentives will be given directly to the employees and the employers as per the EPFO contribution in the first four years of employment.

As a support to employers, reimbursement to employers up to Rs 3,000 per month for two years towards their EPFO contribution for each additional employee.

Gaurav Choudhury

Consulting Editor, Network 18

-330

July 23, 2024· 12:12 IST

Union Budget 2024 Live: Fiscal consolidation update

Receipts for FY25 seen at Rs 32.07 lakh crore

Expenditure for FY25 seen at Rs 48.21 lakh crore

-330

July 23, 2024· 12:10 IST

Union Budget 2024 Live: Customs duty on critical minerals

FM Exempts customs duties on 25 critical minerals, and lowers BCD for two of them

-330

July 23, 2024· 12:09 IST

Union Budget 2024 Live: Good news for phone buyers!

BCD (basic customs duty) of mobile phones, mobile chargers reduced to 15 percent: FM

-330

July 23, 2024· 12:05 IST

Union Budget 2024 Live: Fiscal deficit lowered to 4.9% of GDP, market borrowing unchanged at Rs 14.13 lakh crore

Fiscal deficit for FY25 further scaled down to 4.9 from 5.1% in interim Budget: FM Sitharaman

Aim to reach a fiscal deficit of below 4.5% by FY26: FM

-330

July 23, 2024· 12:02 IST

Union Budget 2024 Live: Priority 5 in Budget Urban Development

• Urban Housing: Urban 2.0. one crore houses for urban poor, allocation of ten lakh crore rupees.

• Enabling policies and regulations for transparent renting house markets

• Services for 100 large cities for urban development

• Street Markets: Svanidhi has transformed lives of street vendors. Support for urban haats

• Stamp Duty: Encourage states to charge high stamp duty to moderate the rates for all. Slashing of duties for women

-330

July 23, 2024· 12:01 IST

Union Budget 2024 Live: Govt's package for skilling and collaboration

The fourth scheme under the Prime Minister's package for skilling and collaboration with state governments and Industry

--20 lakh youth will be skilled over a 5 year period

--1000 ITIs will be upgraded in Hub and Spoke arrangements with outcome orientation

--The Model Skill Loan scheme will be revised to facilitate loans up to Rs 7.5 lakh with a guarantee from government promoted fund

--For helping our youth who have not been eligible for any benefit under govt schemes, I am happy to announce a financial support for loans up to Rs 10 lakh in higher education in domestic institutions

-330

July 23, 2024· 11:59 IST

Union Budget 2024 Live: Capex budget unchanged a relief

Capex budget at Rs 11.11 lac cr which is unchanged from Interim budget is a relief, but the announcements so far show overt accommodation of coalition partners, that will not go down positively for the markets

Madhuchanda Dey, Head Research

-330

July 23, 2024· 11:58 IST

Union Budget 2024 Live: Budget announcements to speed up the IBC process is commendable

FM Sitharaman’s Budget announcements to speed up the IBC process is commendable. Government to set up integrated technology system for IBC for better outcomes. Decision to initiate appropriate changes to IBC will augur well for faster asset resolution; creation of additional dedicated tribunals will be an enabler. However, the real change will depend on execution on the ground.

Dinesh Unnikrishnan, MC Pro

-330

July 23, 2024· 11:56 IST

Union Budget 2024 Live: Rs 1,000 crore boost for space economy!

--Space economy expanded 5 times in next 10 years.

--Boost of Rs 1,000 crore for space sector announced.

-330

July 23, 2024· 11:54 IST

Union Budget 2024 Live: Financial assistance for Sikkim, Assam, Uttarakhand, HP -- states impacted by floods

Will provide assistance to Assam and Himachal Pradesh for flood management, says FM