On August 7, the Indian equity market retreated from its day's high but managed to hold on to modest gains during afternoon trade. Despite weak global cues, the domestic market opened higher. The rise in pharma stocks counterbalanced losses in FMCG names, contributing to the maintenance of the benchmark indices in positive territory.

At noon, the Sensex was up 96.53 points or 0.15 percent at 65,817.78, and the Nifty was up 29.20 points or 0.15 percent at 19,546.20. About 1,781 shares advanced, 1,378 shares declined, and 150 shares unchanged.

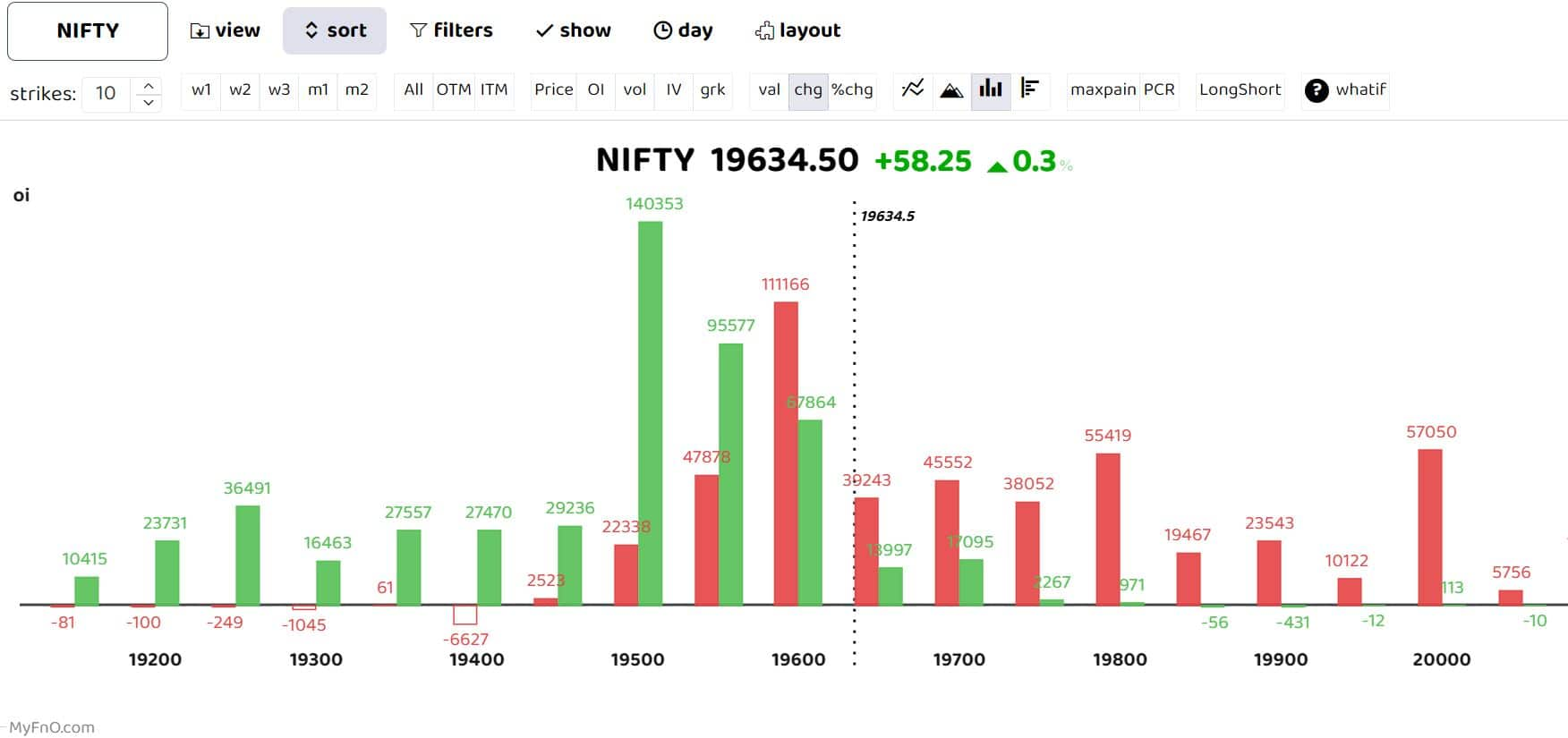

Options data highlighted an intriguing battle between call and put writers around the 19,600 levels. Key support area is observed at 19,500, followed by 19,400 levels. While immediate resistance is at around 19,700, 19,800 and 20,000 levels.

Analyst expect Nifty to prolong the ongoing consolidation in the broader range of 19,900-19,200 wherein stock specific action would prevail amid progression of ongoing earning season. ICICI Securities stated that, "in a secular bull market, secondary correction make market healthy by cooling off overbought conditions. Thus, accumulating quality stocks on dips would be the prudent strategy to adopt at current juncture."

Last week, Nifty succumbed to the global sell-off. Sameet Chavan Head Research, Technical and Derivatives, Angel One Ltd believes that in case of further global aberration, the Nifty may go back to challenge 19,400 – 19,300 levels and a move below this would reinforce the selling pressure to slide towards the next important cluster of 19,000 – 18,800. In an optimistic scenario, a move beyond 19,600 is crucial with globally situation needing to subside completely.

Among individual stocks, REC Ltd, PFC, Idea and Divislab displayed a bullish setup. On the other hand, Britannia, ABFRL and Dixon saw short buildup.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!