The Indian benchmarks were trading higher on January 29 morning and experts expect the Nifty, which ended the previous week lower, to continue to recover and rise up to 21,650 ahead of the budget, which will be presented on February 1.

The broader view for the February series, however, continues to be "sell on rise" until the Nifty goes past 21,700.

At 10 am, the Sensex was up 737.46 points, or 1.04 percent, at 71,438.13, and the Nifty was up 231.10 points, or 1.08 percent, at 21,583.70.

About 2,084 shares advanced, 1,059 declined and 104 remained unchanged.

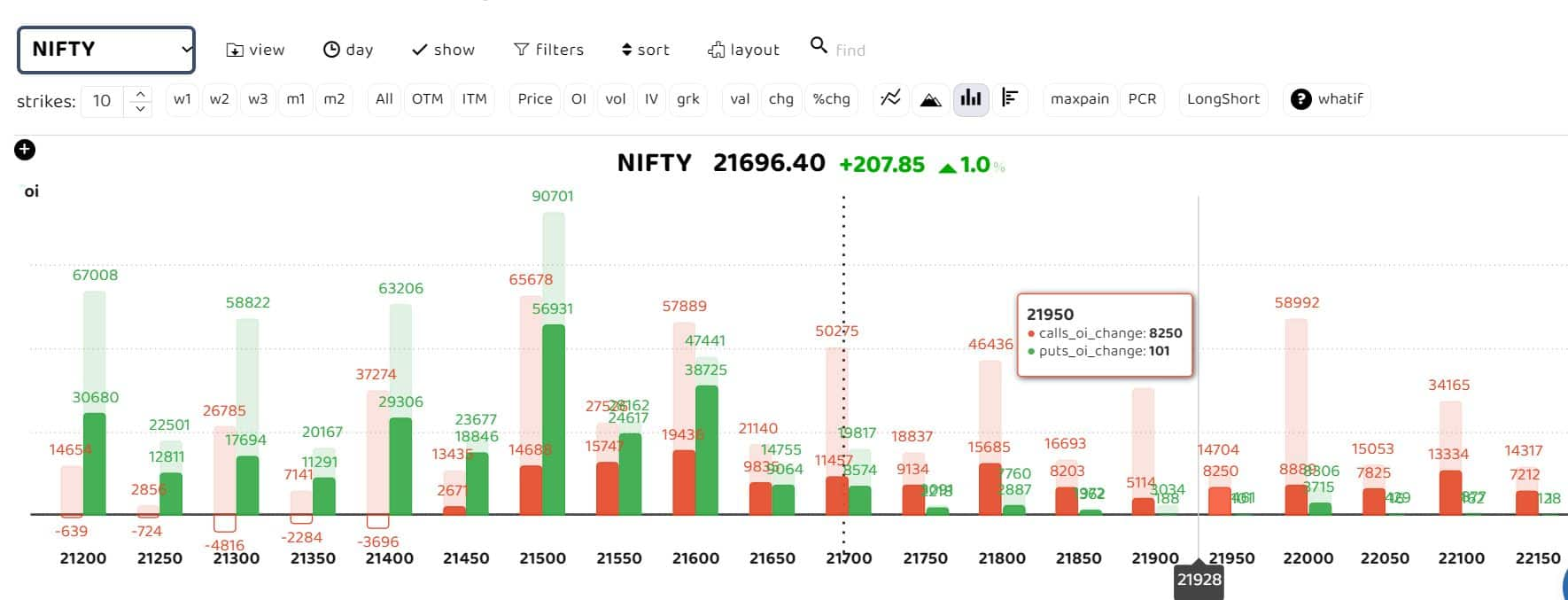

Bars in the red indicate the change in open interest (OI) of call writers, while the green show the change in OI of put writers

According to Akshay Bhagwat, Senior Vice President-Derivatives Research at JM Financial, "Nifty rollover is at 81 percent with a roll cost of 0.8 bps, starting the Feb series at a lower OI base compared to the last series (down 9 percent). The long-short ratio is 22:78, with heavy short bets positioned at the beginning of the Feb series."

It is the budget week and implied volatility is expected to spike. Put writing support is at 21,000, while call action is concentrated at the 21,500 and 22,000 strike. "PCR OI at 0.81 validates the action in calls to be significantly higher over puts. Also, call premiums are almost 1.5 times overpriced over puts. This suggests a relief recovery ahead of the budget. The ATM 21,350 straddle hints at a price band of 21,000-21,700 for the week. 21,150-21,200 is a key support area. Upside targets can be 21,500/21,650. Momentum gains in case 21,500 call writers are challenged," added Bhagwat.

Bhagwat said the view is still bearish, with a sell-on-rise market until the Nifty slips below 21,700. "This is a broader view for February. However, ahead of the budget, a relief recovery is possible until 21,650," he said.

According to Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, "The Nifty 50 index must surpass the critical hurdle of 21,850 before embarking on a new journey that could reach a new all-time high. While breaching the 21,550-21,450 mark in the last week has dented the positive bias, the following support at 21,000 could provide some respite. The trend remains fragile beneath the barrier of 21,850."

The strength oscillator, Relative Strength Index (RSI), has cooled from the overbought territory, which was noticed since mid-December to early January. It may help the index minimise the slide, Bagkar said.

"On the option side, a robust concentration can be evident in 22,000 and 21,000 strike prices, with the 21,800 strike witnessing resilient activity. The index must overcome the 21,800 - 21,850 barrier on a decisive note to scale uncharted territories in the February series," he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!