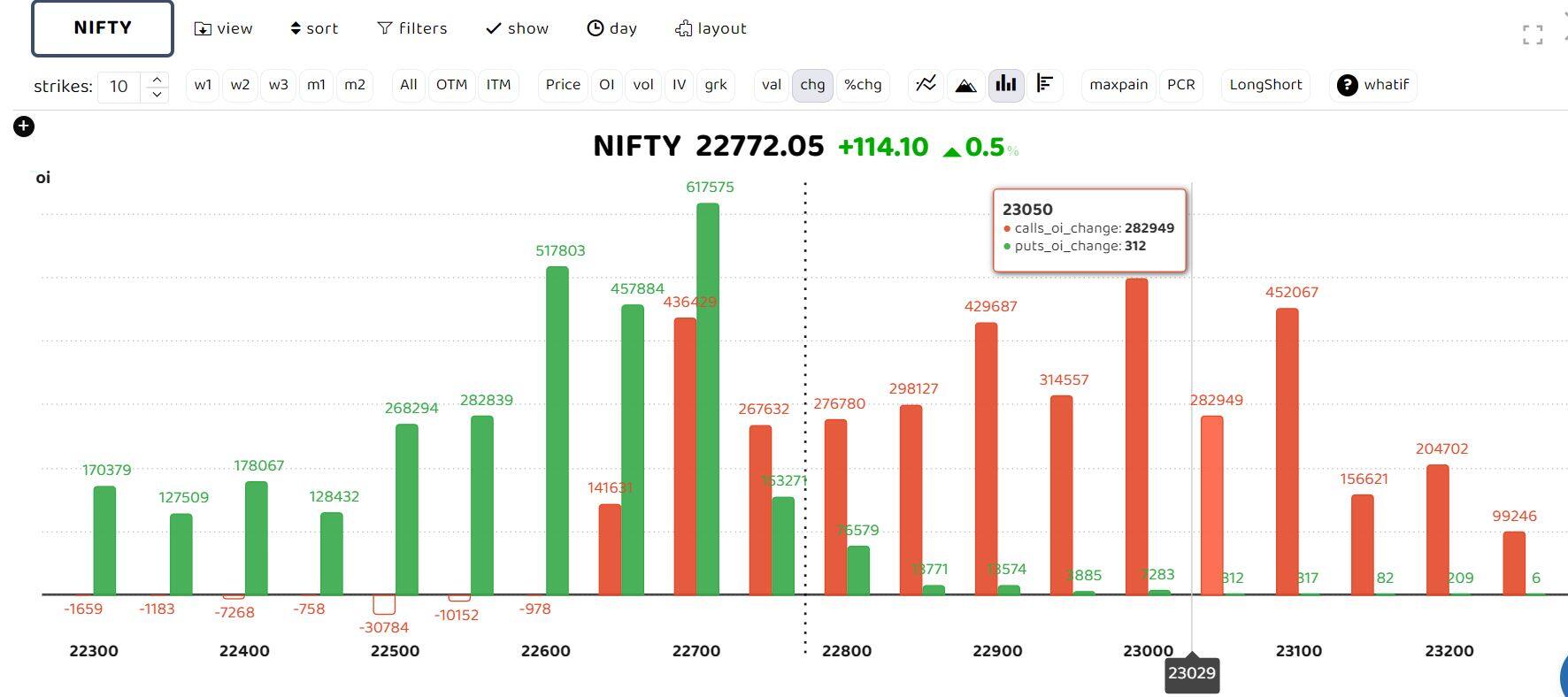

Benchmark indices were trading firmly in green on May 23, with NSE Nifty 50 reclaiming 22,700 intraday ahead of the weekly options expiry. Options data suggests heavy call writing at 23,000.

Analysts say the near term support for the Nifty is in the 22520-22500 zone. They see resistance for the index at 22,810 on the upside.

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

“The weekly series, OI PCR (open interest put call ratio), is at 1.16, and the max pain is at 22,550 strike. For the May monthly series, OI PCR is at 1.11, which implies a buy on dips strategy in Nifty,” said Sudeep Shah, DVP and Head of technical and derivative research at SBI Securities.

SBI Securities: The 22,520-22,500 zone will act as immediate support for the Nifty. As long as the index trades above 22,500, it has a shot at rising to 22,730, and then to 22,810 in the short term, said Sudeep Shah.

“Any sustainable move below 22,490 will lead to profit booking in the index. In that case, the 20-day EMA will act as immediate support for the index, which is currently placed at 22,378 level,” he added.

Angel One: “Although there are no signs of weakness, it is advisable not to make aggressive long bets and to consider booking some profit as the Lok Sabha election results approach. For the next momentum move, Nifty needs to close above 22,800, which could push it towards 23,000-23,100. However, this seems unlikely for the current trading week. On the downside, 22,400 is a key support level, and dips towards it can be seen as buying opportunities. Traders should monitor these levels and plan their trades accordingly.”

Bank Nifty technical view

Prabhudas Lilladher: The index needs to decisively rise above 48,300 to establish conviction for further rise to 49,600 and 49,900. BankNifty has a daily range of 47,500-48,300 for today.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.