The market kept up the positive momentum for the fourth straight week ended March 7 and reached a new high with continuation of higher high formation amid decent volumes. Experts hope to see the Nifty 50 at 22,600 in an immediate term and 22,800 in the short term, with support at 22,400, and then at 22,200. But, in between, the 22,500 level is likely to be crucial in determining the subsequent direction in the market.

The Nifty 50 jumped half a percent last week to end at a new closing high of 22,493.50, whereas the broader markets underperformed with the Nifty Midcap 100 and Smallcap 100 indices declining 0.4 percent and 2.85 percent.

On the daily charts, the Nifty 50 maintained an upward sloping resistance trendline adjoining the previous record highs, which is a positive sign.

"From a technical perspective, there has been a bullish flag breakout observed on the daily scale of the Nifty index, indicating a potential target price of around 22,800. However, reaching the 22,500 level might introduce some softness in the market dynamics, as this represents the 100 percent extension of a previous move," Jigar S Patel, senior manager - equity research at Anand Rathi said.

Looking ahead, he feels 22,500 could act as an immediate resistance, with a close above this level possibly leading to further gains towards 22,800. On the downside, support is expected around the 22,200 to 22,000 range, with a major trend-changing support level identified at 21,500, he said.

From a technical standpoint, the index has managed to hold the higher ground and dips augured well for the bulls, but the range is narrowing down as the Nifty heads into an uncharted territory, which might be a sign of caution, said Osho Krishan, senior analyst in technical and derivative research at Angel One, who also sees similar support levels (of Jigar) for the benchmark index.

On the higher end, Osho feels finding resilience is challenging in an uncharted territory, though 22,600-22,650 could be seen as the following potent targets for the Nifty in the current week.

Moneycontrol collated a list of top 10 stock ideas from the experts with 3-4 weeks perspective. The closing price of March 7 is considered for stock return calculation.Expert: Vinay Rajani, CMT, senior technical & derivative analyst at HDFC SecuritiesColgate Palmolive: Buy | LTP: Rs 2578.7 | Stop-Loss: Rs 2,436 | Target: Rs 2,800 | Return: 9 percentThe stock price is on the verge of breaking out from the consolidation which has been there for last 10 weeks. Nifty FMCG index has recovered smartly from support levels and is likely to participate in the existing uptrend of the market.

The stock is placed above all important moving averages, indicating bullish trend on all time frames.

The stock price has broken out from the downward sloping trend line on the daily chart. Primary trend of the stock has been bullish with higher tops and higher bottoms on the weekly chart.

The stock is placed above all important moving averages, indicating bullish trend on all time frames. Price rise is accompanied by rise in volumes. Indicators and oscillators have been showing strength in the current uptrend.

The stock price has formed bullish double bottom formation near Rs 565 levels. Stock is placed above all important moving averages, indicating bullish trend on all time frames.

Indicators and oscillators have been showing strength in the current uptrend. Tata group stocks have turned bullish on the short to medium term charts.

After a promising uptrend rally, currently the stock is witnessing positive consolidation at higher levels. On daily charts it has formed higher bottom formation and on weekly charts it has formed breakout continuation formation.

For the positional traders now, as long as the stock is trading above 20-day SMA (simple moving average) or Rs 2,710 the positive momentum is likely to continue. Above the same, the stock could rally till Rs 2,950-3,000.

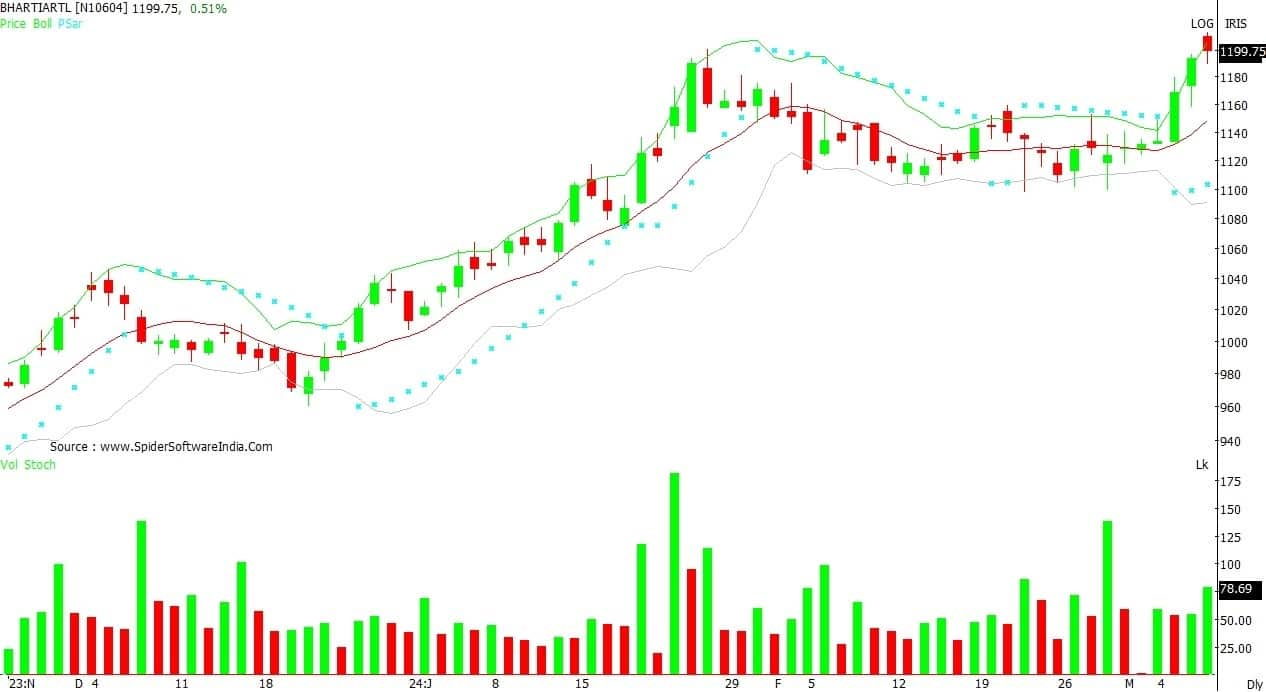

After a short term correction, the stock took support near Rs 1,060 and bounced back sharply. Post reversal the stock comfortably trading above 50 and 20-day SMA which is largely positive. In addition, on intraday charts the stock is holding higher bottom formation that also supports further uptrend from the current levels.

For the trend following traders now, Rs 1,090 would act as a key support zone. Above the same, the stock could move up till Rs 1,150-1,170. On the flip side, below Rs 1,090 uptrend would be vulnerable.

In last week so far, the stock rallied over 6 percent. On daily charts, it has formed bullish formation and on weekly charts, it has formed long bullish candle, which supports further uptrend from the current levels.

We are of the view that, the stock is in to the strong momentum and as long as it is trading above Rs 1,170, the positive texture is likely to continue.

Unless it is trading below Rs 1,170, positional traders retain an optimistic stance and look for a target Rs 1,260-1,280. Fresh buying can be considered now and on dips, if any between Rs 1,200 and Rs 1,180 levels with a stop-loss below Rs 1,170.

The stock is presently consolidating within a defined range, supported by a resilient ascending trendline. A bullish momentum is evident as the 9-day SMA has crossed above the 20 SMA and this crossover signifies a strengthening trend.

The relative strength index (RSI) recovered from lower levels and currently stands at 53 levels, indicating the healthy momentum.

Hence, based on the above technical structure, one can initiate a long position at CMP Rs 1,377 for a target price of Rs 1,480. The stop-loss can be kept at Rs 1,320.

The stock is forming higher highs and higher lows indicating a sustained uptrend. It is placed well above its short-term (20-day) and medium-term (50-day) moving averages suggesting bulls are in total control.

The RSI comfortably holding at 54 levels and is gradually inching higher, indicating strength in the stock. Double bottom pattern formation in the daily chart confirms a bullish setup as well.

Hence, based on the above technical structure, one can initiate a long position at CMP Rs 589 for a target price of Rs 650. The stop-loss can be kept at Rs 558.

The stock has given a good breakout from its triangle consolidation phase and successfully managed to close above its breakout mark of Rs 368. The daily RSI (14) is at 58.30, which shows good signs of momentum pick-up in the stock.

As per the anchor volume weighted average price (VWAP), minor resistance is placed at Rs 379 mark, above which the stock can move towards potential targets of Rs 390 and Rs 400. At the current market price, the risk-reward ratio looks favourable on the buying side with a set stop loss at Rs 364 mark.

On its weekly charts, RR Kabel has touched its major support mark of Rs 1,412.75, which is the anchor VWAP level for the stock from the listing day. The stock has corrected nearly 24 percent from its all-time high mark and is still trading nearly 38 percent up from its issue price. On the upside, minor resistance is placed at Rs 1,579 mark, so our conservative target would be around Rs 1,560 for the stock.

The stock gave a good breakout above its all-time high on February 28, 2024 and is now seen to be re-testing its breakout level. On the daily charts, ADX (average directional index 8) is placed at 49.26 and the RSI is at 66.53, showing strong momentum and strength on the counter.

Going forward, it is expected that the stock should head higher towards Rs 1,640, and a strict stop loss at Rs 1,500 should be kept to manage risk well on the stock.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.