Harshvardhan Dole of IIFL Institutional Equities expects Reliance Industries to induct a strategic investor in the oil-to-chemicals O2C business in the next 12-18 months.

In an interview with Moneycontrol, the Vice President of IIFL Institutional Equities talks about the expectations from RIL's upcoming AGM, moats for the company, growing contribution of Jio and Retail and much more. Edited Excerpts:

Q: Reliance Industries' Annual General Meeting is scheduled to be held on June 24. What are your expectations from the event?

In the past 12 months, RIL has not only mobilised funds aggregating Rs 2,16,400 crore to de-leverage its balance sheet but also inducted strategic investors in its high growth businesses such as organised retail (Reliance Retail) and technology (Jio). In this context, RIL is expected to share the value added by each of these stakeholders to the individual businesses, how the individual businesses are shaping up, and what should be the growth/investment outlook.

Some comments are expected towards value unlocking in its O2C business, where outlook on margins is improving, given the pick up in global consumption. Media articles also suggest that RIL may induct Aramco's CEO on its board which would be seen as a step towards a much larger partnership between the two conglomerates.

Also read - RIL AGM on June 24 | Goldman Sachs expects the retail business to be the next growth engine

Investors are also expecting some comments on 1) progress and possible launch dates for the smartphone being developed by Jio and Google jointly; 2) roadmap for the listing of Reliance Retail and 3) progress to induct a strategic investor in O2C business.

RIL Chairman in the last AGM outlined ambitions to become a net carbon zero company by 2035. Investors would keenly await the strategy adopted by RIL to achieve this target, as it would significantly improve its positioning on the ESG (Environmental Social & Governance) framework.

Q: What is the reason behind your bullish view on Reliance Industries; any price targets?

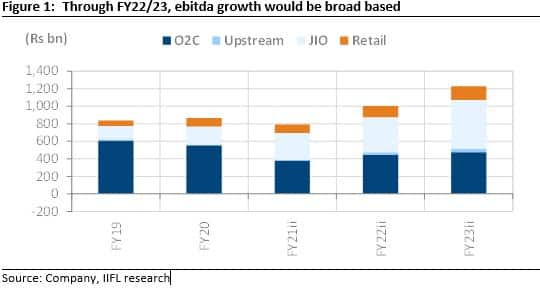

RIL's consolidated earnings are set to register a 17 percent per annum growth through FY21-23ii – on the back of - 1) recovery in the O2C business: cyclical recovery in gross refining margin (GRMs) aided by pick up in consumption across the globe clubbed with strength in petchem deltas; 2) 34 percent growth in Jio's EBITDA (earnings before interest, tax, depreciation and amortisation) (10 percent per annum growth in ARPU assumed); 3) 26 percent per annum growth in EBITDA of Reliance Retail, as we build in 14 percent per annum growth in the area under operations and improving revenue and profit margins. The earnings growth has an upside, provided the GRM (gross refining margin) improvement is ahead of estimate and recovery in retail sales growth is sharper. For a $1 per barrel change in GRMs, the earnings swing by 6 percent, while a 10 percent change in sales growth for Retail causes a consolidated PAT change of 2 percent.

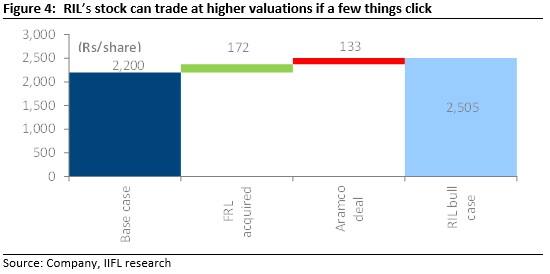

In the base case, we value RIL at Rs 2,200 per share, near the CMP (current market price), but the stock can offer significant upsides with the following events: 1) value unlocking in the O2C segment (induction of strategic investor); 2) successful consummation of Future Retail's business which as of now is under litigation.

Q: What is your outlook on the telecom business? How much do you see it contributing by 2025?

The business outlook on Jio's operations is improving. The recently launched Jio Phone with attractive plans, the upcoming launch of the Google phone, and the capacity boost from a 45 percent increase in spectrum holdings post-March auctions are likely to result in higher subscriber adds in the next few months (notwithstanding some weakness in April and May due to the second wave of Covid).

With Vodafone Idea facing large cash outflows from December 2021, we see either industry-wide price hikes or accelerated market share loss for Vodafone Idea. Jio stands to benefit in either case. The progress on the FTTH (Fiber to the home) business remains steady. The key trigger to watch out for in the near term would be the pricing of the smartphone to be launched in collaboration with Google and the plans. IIFL expects Jio to contribute 13 percent to RIL’s consolidated revenues by FY23.

Q: Do you think Reliance Industries will raise more funds for its retail and Jio businesses in the coming years?

RIL, through FY21, raised Rs 1.52 lakh crore and Rs 37,700 crore through induction of strategic investors in Jio and retail, respectively. The management commentary on capex intensity in each of these businesses is lowering at a time when the visibility on cash flows is set to improve. As such, the balance sheet of RIL and individual businesses is strong enough to pursue organic growth initiatives and bolster their competitive positioning in their respective addressable markets. We, however, expect RIL to induct a strategic investor in the O2C business sometime in the next 12-18 months and unlock value.

Q: Do you think Reliance will complete its stake sale in O2C business by 2022?

RIL has one of the most complex and integrated O2C business operations. Its deep integration helps to offset the impact of volatility in the feedstock prices and the product cracks on its O2C profits. While it is pursuing partnerships with global firms which can add value to its operations and enhance shareholders value, it would be inappropriate to comment on the timelines. This is because of two key reasons: first, the strategic partnerships are usually not forged by keeping specific timelines in mind, and secondly, it is a function of growth strategy outlined, ability to add value in the relationship, and valuation benchmarks. RIL Chairman, in the last AGM, said that active negotiations with Aramco were underway.

Q: What is your view on Reliance Retail and will it contribute more than the telecom segment, to total revenue in coming years?

RIL's retail business has ramped up faster than our estimates, particularly the store additions, in a challenging macro environment. While the near term outlook is tricky, given the 2nd wave of COVID and resultant impact on footfalls, we like RIL's approach of focusing on omni-channel offerings, and strengthening the supply chain, while ramping up the JioMart / digital sales channel. Our FY22ii EBITDA assumes normal operations for 3 quarters; FY23ii EBITDA growth of 25 percent YoY has upside, given the pace of current ramp up in operations. Our forecasts assume 23 percent-32 percent sales growth in FY22/23ii and EBITDA margins of 6.1/6.3 percent versus 5.5 percent seen in FY21ii.

RIL's proposed takeover of the retailing and logistics business assets of the Future group is facing legal issues, and awaits SC judgment. Future Retail's asset takeover will help RIL fast track its ambitions to grow the footprint in the organized retail segment. As such, the 26 percent per annum EBITDA growth forecast in the retail business is without integrating the assets of Future Retail. Takeover, if completed in the next 6-8 months, can add Rs 1,00,000-1,20,000 crore enterprise value to RIL's retailing business.

By FY23, we forecast Reliance Retail to register Rs 2,27,000 crore sales, and contribute 26 percent to the consolidated sales. These revenues would be almost 106 percent higher than estimated revenues of the telecom segment.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.