HomeNewsBusinessMarketsDefensive FMCG stocks likely to be winning ideas as consumption takes centre stage

Defensive FMCG stocks likely to be winning ideas as consumption takes centre stage

These companies are better placed to navigate near-term challenges successfully.

August 14, 2025 / 19:24 IST

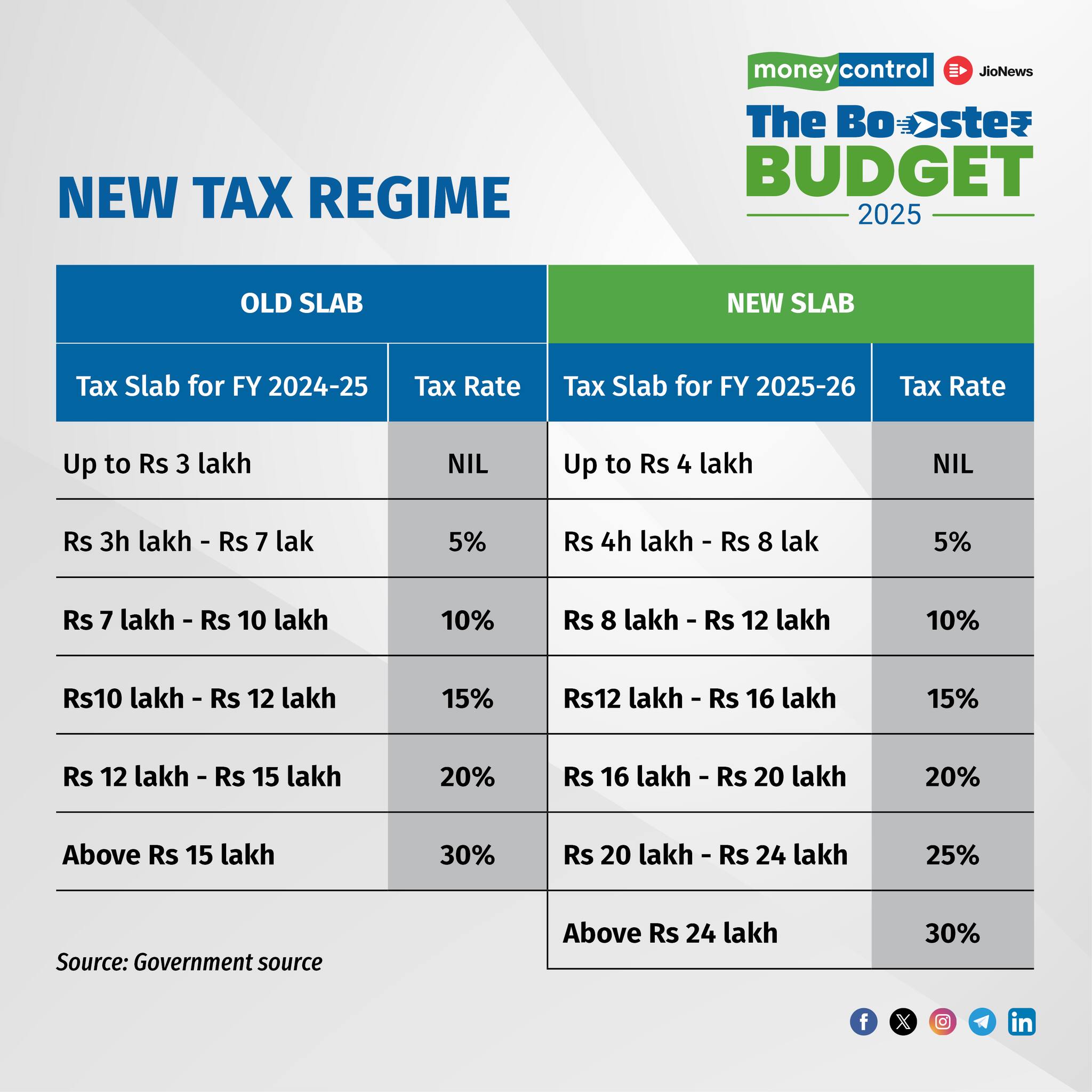

The increased tax exemption limit announced in Budget 2025-26 would lead to a lower tax outgo. This would increase disposable income in the hands of consumers, supporting consumption growth.

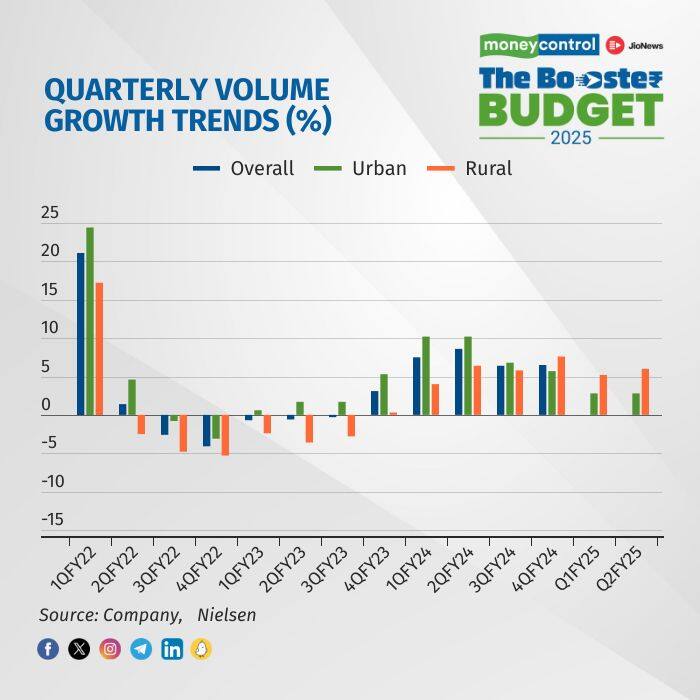

While subdued income growth constrained household savings, persistently elevated inflation led to urban consumption slowdown. Lower tax liability and policy support will drive consumption and rural income, which are vital for sustained volume growth recovery for the FMCG (fast-moving consumer goods) sector.

Agri and oil commodities continued to face inflationary pressure. However, there are prospects of price stability as retail inflation cools off, driven by a sharp sequential dip in food inflation.

Rural consumption will continue to shine, backed by healthy agriculture growth, easing food inflation, and government schemes and regulatory actions.

FMCG sector is on the cusp of a recovery

FMCG companies, with greater rural exposure, are expected to witness healthy growth, though urban-centric players could continue to witness muted performance.

Companies wit large rural presence -- Emami (50 percent salience), HUL and Dabur (more than 45 percent), and Colgate (40 percent) – will outperform peers. Our top picks among consumer staples are HUL and Dabur, followed by Emami and Britannia.

We feel that these defensive stocks could be winning ideas in the volatile environment. Given the strong fundamentals, these companies will be able to navigate the near-term challenges successfully.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Subscribe to Tech Newsletters

- On Saturdays

Find the best of Al News in one place, specially curated for you every weekend.

- Daily-Weekdays

Stay on top of the latest tech trends and biggest startup news.