The continued rally in defence stocks has taken the market capitalization of listed defence names to an all-time peak, captured in the continued momentum of the Nifty India Defence index.

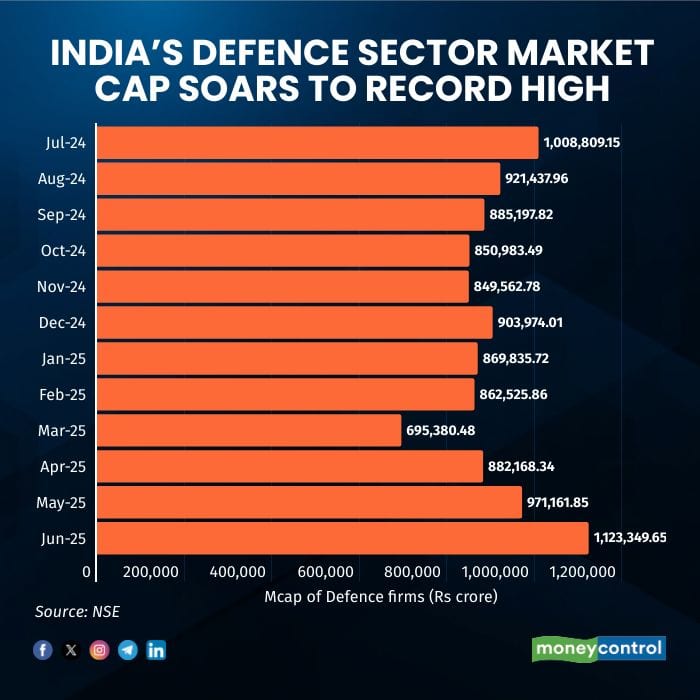

The combined market capitalisation of 18 listed defence companies now stands at Rs 11.23 lakh crore, reflecting strong investor confidence and growing interest in the sector. This is a significant rise from the previous record of Rs 10.09 lakh crore seen in July 2024 and represents a sharp 50 percent increase from the February low of Rs 6.95 lakh crore.

The Nifty India Defence Index has exhibited strong upward momentum, climbing 9 percent so far in May to a new high after robust gains of 11.5 percent in April and 24.6 percent in March. This rally comes close to the heels of a steep 33 percent correction seen between July 2024 and February 2025.

Since bottoming out in February, the index has recorded an impressive cumulative recovery of over 50 percent. However, despite this broad surge, only six stocks within the index have managed to surpass their previous record highs, while the rest continue to trade below peak levels.

The rally has been particularly pronounced in select counters. Ten companies that had touched their 52-week lows during March and April have since rebounded sharply, with gains ranging between 55 and 112 percent. Notable performers include DCX Systems, MTAR Technologies, Dynamatic Technologies, Cyient DLM, Unimech Aerospace and Manufacturing, Data Patterns, Mishra Dhatu Nigam, Astra Microwave Products, Hindustan Aeronautics, and BEML.

Additionally, eight other stocks, which had previously hit their 52-week lows earlier in 2024, have also witnessed strong recoveries, posting returns between 58 and 200 percent. These include Cochin Shipyard, Bharat Dynamics, Mazagon Dock Shipbuilders, Zen Technologies, Bharat Electronics, Solar Industries India, Paras Defence and Space Technologies, and Garden Reach Shipbuilders.

This uptrend was triggered by escalating geopolitical tensions between India and Pakistan, followed by a sharp rebound from March to April after an earlier market correction.

Investor sentiment received an additional boost when Prime Minister Narendra Modi reaffirmed the government’s commitment to indigenous defence manufacturing under the Make in India initiative. His emphasis on modern warfare capabilities and the strategic importance of ‘Made in India’ defence systems has reinforced expectations of continued policy support.

The sentiment has been further buoyed by reports of more than a dozen countries expressing interest to acquire the BrahMos missile system, after Operation Sindoor showcased the weapon’s strategic capabilities, underscoring India’s growing strength in defence and technology.

Mutual funds have also increased their exposure to the sector. In April, fund managers raised holdings in 11 of the 18 listed defence firms. Hindustan Aeronautics led the inflows with Rs 505 crore added, taking total holdings to Rs 13,480 crore. Solar Industries India saw an addition of Rs 119 crore, raising its total to Rs 15,510 crore, while Mazagon Dock Shipbuilders attracted Rs 78 crore in new investments, bringing its total to Rs 1,727 crore.

Other firms that saw increased mutual fund interest include Zen Technologies, BEML, Data Patterns, Garden Reach Shipbuilders, Mishra Dhatu Nigam, and Dynamatic Technologies, with inflows ranging from Rs 2 crore to Rs 60 crore. In contrast, Bharat Electronics witnessed the largest outflow, with mutual funds reducing their stake by Rs 893 crore to Rs 33,619 crore. Smaller outflows were recorded in Cochin Shipyard, Astra Microwave Products, Unimech Aerospace, and MTAR Technologies.

Sandeep Bagla of Trust Mutual Fund said in a recent interview with Moneycontrol that the rising geopolitical tensions are likely to drive sustained increases in defence spending. He views the sector as a compelling multi-year investment theme with strong return potential.

Anil Rego of Right Horizons PMS has described defence as both a tactical and structural investment opportunity. In the near term, factors such as regional instability, higher defence budgets, and procurement momentum are driving performance. Over the long term, the sector stands to benefit from consistent government investment in modernisation, a growing export pipeline, and policy reforms under the Atmanirbhar Bharat programme aimed at fostering innovation and self-reliance.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.