China-based artificial intelligence startup DeepSeek's V3 and R1 large language models have sent information technology stocks spiraling across the globe. The market sentiment on AI and big tech has turned negative following the initial success DeepSeek, which are reportedly trained at significantly lower training costs with deep discounts on inference.

With the recent initial success of DeepSeek’s large language AI models, investors are grappling with concerns about potential AI price wars, Big 4’s AI capex intensity, and how to navigate investments. International brokerage UBS said, "With few details about DeepSeek and its business model available currently, we recommend investors to focus on the upcoming tech company results for more guidance, instead of panicking."

Further, the broking house suggested that even if DeepSeek's methodology is the better path forward, it still sees a bright outlook for AI as potentially lower costs would accelerate

AI adoption with artificial general intelligence coming sooner than expected.

Also Read | DeepSeek shockwaves hit energy stocks; here’s the connection

"While that means investors need to tilt their AI portfolios in favor of AI application (our current

allocation is 25-30 percent in the AI portfolio) and the intelligence layer (15-20 percent) over the enabling layer (50-60 percent). But we believe it is too early to make any conclusions at this

stage as more clarity should emerge in the next few weeks," said UBS.

According to the brokerage, while the introduction of cheaper Chinese smartphones has led to a wider adoption of smartphones globally, the industry leader Apple still maintains dominance in premium smartphones.

"Still, we recommend investors to closely monitor the upcoming results and take advantage of any extreme volatility through structured strategies and buy the dip in quality stocks," added UBS.

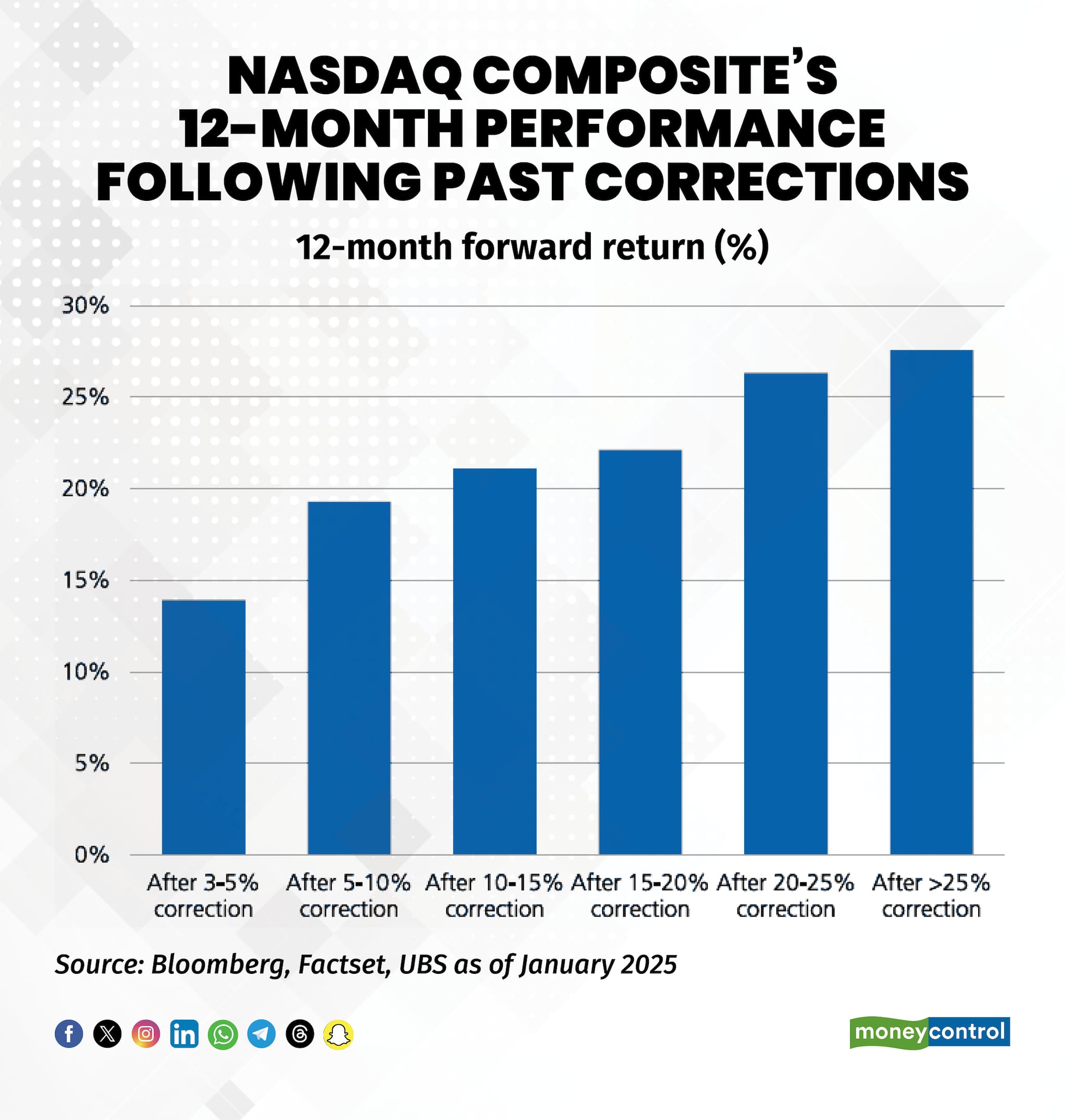

Over the past ten years, there has been at least one 10 percent valuation reset in global tech every year (except in 2017, which experienced a strong bull market). Barring the 30 percent or so reset in 2022 which was driven by macroeconomic events (rising rates and Russia-Ukraine escalations), over the past decade tech indices have rebounded strongly over the next twelve months after a 10 percent valuation reset as investors reward the sector for its strong growth.

Therefore, investors should stay calm and take advantage of extreme volatility and buy the dip in quality stocks. Any undue correction in quality stocks/tech benchmarks barring a major macroeconomic event has historically proved to be a good buying opportunity.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.