The artificial intelligence (AI) boom kicked off in America, as investors across the world aimed to cash in early on the wave of the future. However, after two years of an unrelenting bull rally in the Magnificent Seven technology stocks leading to sky-high valuations, the entry of China's new low-cost, energy-efficient AI model DeepSeek has thrown the global markets into a freefall.

IT behemoths such as Nvidia saw their stocks in a tailspin, cracking up to 17 percent to wipe hundreds of billions of dollars out in value. However, it wasn't just the technology and semiconductor plays that sulked in trade. A second-order impact from the release of DeepSeek was felt on the power and energy sector.

Why is DeepSeek causing a rout in the power segment?

AI needs power. Lots of it. A commonly quoted statistic suggests that one search request on ChatGPT might take 10x the energy of a simple Google search.

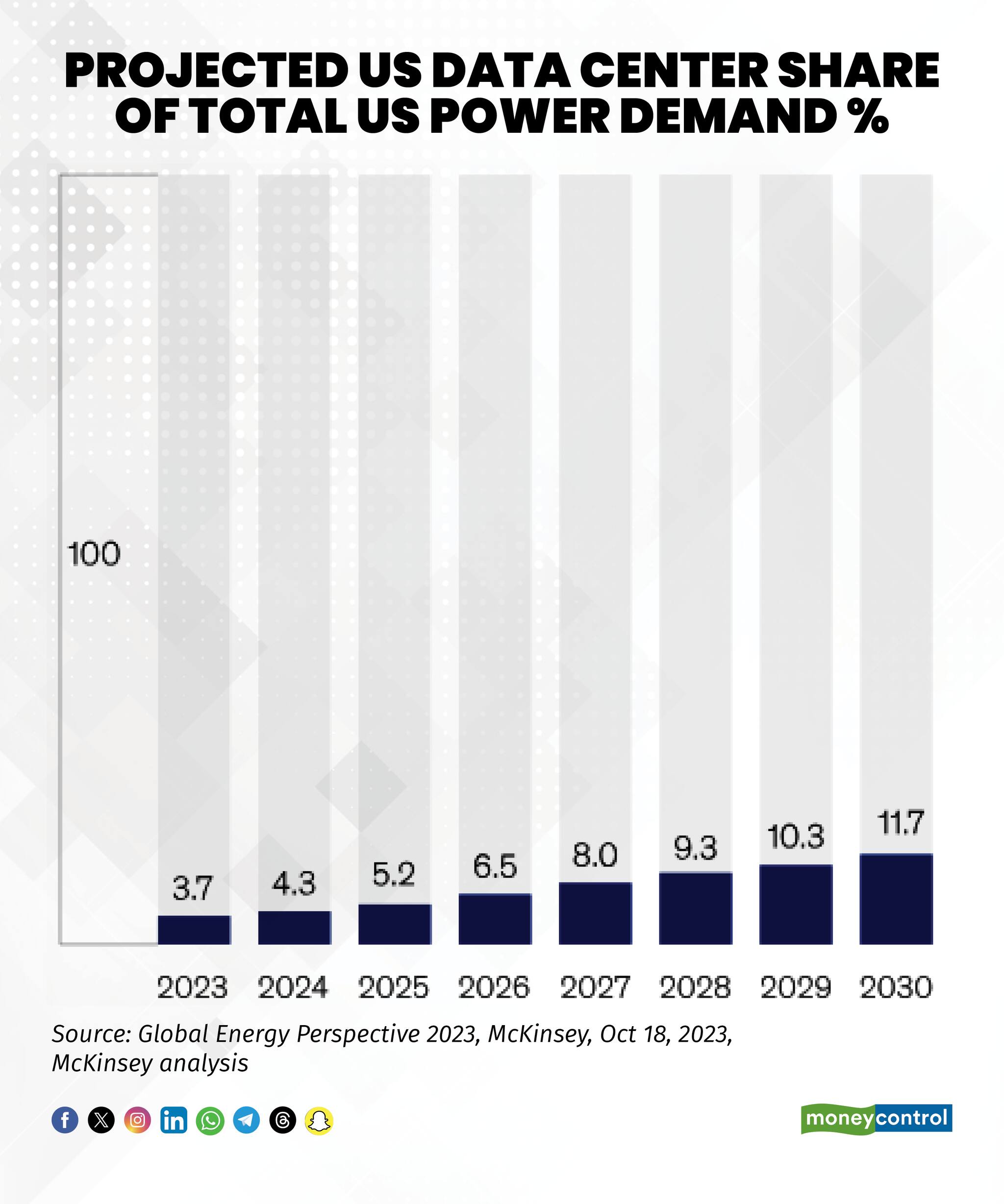

Data centers are a major consumer of power, with the need to be available 24/7/365. As the AI engine continues to chug along, analysts expect the need for energy to jump multifold to keep the train running. According to a Barclays note, data centres account for 3.5 percent of US electricity consumption today, and data centre electricity use could be above nine percent by 2030.

Globally, Goldman Sachs Research suggested that data centers worldwide consume 1-2 percent of overall power, but this percentage will likely rise to 3-4 percent by the end of the decade. Meeting this kind of demand for power would require more electricity than is currently produced, therefore requiring rapid grid expansion and increased capacities.

Apart from thermal energy plays, investors were also betting on the increased scope of renewable energy and emerging nuclear generation capabilities to fuel rising demand. The increased adoption of AI and AI-led research caused technology majors such as Google to shift away from their 'carbon-neutral' stance.

Also Read | DeepSeek hit by outages as users flock to Chinese AI startup

However, with the entry of DeepSeek into the AI race, energy stocks crumbled on the bourses. As an open-source model, it is outperforms its peers, is more cost-effective, and energy efficient. It requires less power than most LLMs and other AI models do.

If increased data usage needs less energy than previously estimated, it could have serious ramifications on power stocks and firms. The S&P Energy index has cracked three percent over the last three sessions. Even in India, over the past week, the Nifty Energy index has tumbled seven percent, with CG Power, Hitachi Energy, and Power Grid recording sharp losses.

Way Forward?

"We still believe data center growth will result in more electricity demand, but not as much as market valuations suggested," stated one Morningstar note. The electrification theme will remain a tailwind, but market expectations went too far, added the note.

Further, a Barclays Research report said that while new processing chips may drive more efficient energy consumption, efficiency gains alone cannot offset the energy demand created by the computing power required to run AI’s increasingly complex large language models and training data sets. "In addition, as efficiency increases, it is expected that use of AI will grow, in turn resulting in higher electricity demand," said Barclays analysts.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.