Bears maintained their control over Dalal Street for the fourth consecutive week ended July 25, with major pressure in broader markets, as weak June quarter earnings, cautious global sentiment, and significant FII outflow weighed on the market sentiment.

This week, starting July 28, the consolidation is expected to continue with focus on quarterly earnings, the FOMC meeting, US trade deals update (as the August 1 deadline approaches), auto sales, and several important economic data points from the United States, according to experts. The volatility also can't be ruled out, given the monthly F&O expiry scheduled this week.

The BSE Sensex declined 0.4 percent during the week to finish at 81,463, and the Nifty 50 dropped 0.5 percent to 24,837, while the Nifty Midcap 100 index plummeted 1.85 percent and the Smallcap 100 index tanked 3.5 percent.

Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services, expects the market to remain in consolidation mode amid continued uncertainty aroundthe India-US trade deal, a mixed Q1FY26 earnings season so far, and intensifying FII outflows.

According to Vinod Nair, Head of Research at Geojit Investments, subpar aggregate earnings performance is likely to challenge the sustainability of current premium valuations across benchmark indices.

Going forward, "the market will be keeping a close eye on key US data such as GDP and jobs data this week, which will influence the Fed's interest rate decision," he said.

Here are 10 key factors to watch for this week:

The quarterly earnings season will remain in full swing this week with more than 500 companies delivering June quarter earnings scorecard including Nifty 50 names like Larsen & Toubro, NTPC, Asian Paints, IndusInd Bank, Tata Steel, Power Grid Corporation of India, Hindustan Unilever, Maruti Suzuki India, Mahindra & Mahindra, Coal India, Eicher Motors, Sun Pharmaceutical Industries, ITC, and Bharat Electronics.

Apart from Nifty 50 companies, Punjab National Bank, Hyundai Motor India, InterGlobe Aviation, Indus Towers, GAIL (India), TVS Motor Compan, Swiggy, PB Fintech, One Mobikwik Systems, Ambuja Cements, Adani Power, Tata Power Company, LIC Housing Finance, UPL, KEC International, Mazagon Dock Shipbuilders, NTPC Green Energy, Torrent Pharmaceuticals, Waaree Energies, Amber Enterprises India, Bank of India, Varun Beverages, Welspun Corp, Aster DM Healthcare, Indraprastha Gas, Dabur India, Emami, Dr Lal PathLabs, Mankind Pharma, Delhivery, Godrej Properties, Multi Commodity Exchange of India, ABB India, and Federal Bank among others will also release their June quarter numbers.

Overall, experts believe the earnings season so far has been in line with expectations.

Trade Deal Updates

Globally, all eyes will be on further updates regarding tariff trade deals, as August 1 marks the latest extended deadline for all trade partners to reach an agreement with the United States. US President Donald Trump has already threatened to implement significant tariff rates on trade partners if they fail to conclude deals by August 1. This time, the focus will be on the European Union, as the US plans to impose a 30 percent levy on EU imports if both sides fail to agree on a trade truce.

On Friday, Trump told reporters that there is a 50-50 chance of reaching a deal with the EU, although negotiators on both sides remain optimistic about concluding an agreement before the August 1 deadline. He also threatened to impose a 35 percent import duty on Canada—covering goods not included in the US-Canada-Mexico Agreement—if no deal is reached between the two countries before the deadline.

Further, there will be a new round of talks between the US and China this week, as delegates from both countries are scheduled to meet in Stockholm on Monday and Tuesday. Media reports suggest that both sides may be considering an extension of the earlier deadline, which is set to expire on August 12, for their trade truce.

In the case of India, hopes for a mini trade deal with the US now appear to have dimmed, as a team of US officials is scheduled to arrive in the country in the second half of August, according to a senior government official requesting anonymity. The pause on the 16 percent tariffs slated to be imposed on India will end on August 1. Therefore, a key development to watch will be President Trump’s decision regarding countries that are unable to reach a deal by the August 1 deadline.

Nonetheless, Union Commerce and Industry Minister Piyush Goyal said on Saturday that Free Trade Agreements with the European Union, the USA, Peru, and Chile are making "fast progress."

Recently, the US signed trade deals with the United Kingdom, Japan, the Philippines, and Indonesia.

FOMC Meet

The next key factor to watch out for would be the US Federal Reserve's interest rate decision scheduled on July 30. Most economists are of the view that the central bank is likely to hold rates steady at 4.25-4.50 percent for the fifth consecutive policy meeting as Fed officials want to see the impact of tariffs on the economy before making rate cuts, though Fed Chair Jerome Powell facing pressure from the Trump administration to lower rates. Further, the markets will look for cues about any rate cut in the September policy meeting.

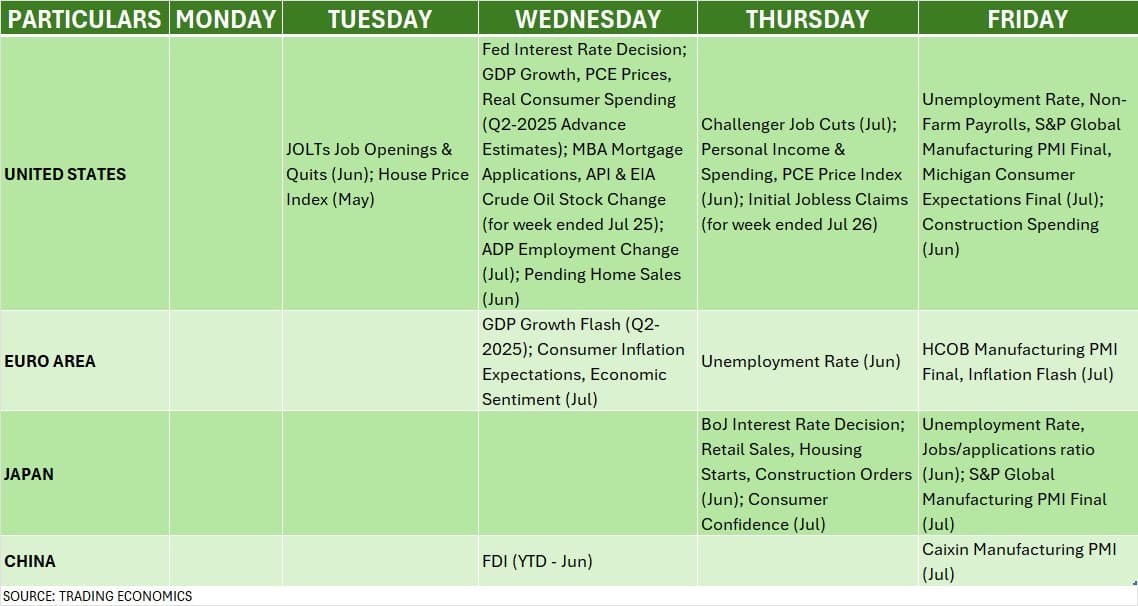

Global Economic Data, BoJ interest rate decision

Apart from the Fed meet, this will also be a data-heavy week for the United States as the advance estimates for the April-June quarter GDP, PCE prices and real consumer spending data along with the monthly unemployment rate, non-farm payrolls, JOLTs jobs openings & quits, personal income & spending, and pending home sales data will be released this week. Most economists expect the unemployment rate to increase in July, against 4.1 percent seen in June.

The focus will also be on the Q2-2025 GDP growth flash data from Europe, and the interest rate decision by the Bank of Japan, along with Manufacturing PMI numbers from several countries scheduled this week.

Auto Sales

Back home, the market participants will keep an eye on the monthly auto sales volume data for July, which will be released in the latter part of this week. Hence, automobile companies like Tata Motors, Maruti Suzuki, TVS Motor, Eicher Motors, Hero MotoCorp, Bajaj Auto, Escorts, Ashok Leyland, and Hyundai Motor India will be in focus. In June, the auto sales performance was mixed.

Domestic Economic Data

Further, the industrial production and fiscal deficit numbers for June, released on July 28 and 31, respectively, will also be watched. On August 1, the market will focus on the HSBC Manufacturing PMI data for July, as according to flash data, the manufacturing activity expanded to 59.2, from 58.4 in June.

On the same day, bank loan and deposit growth for the fortnight ending July 18, and foreign exchange reserves for the week ending July 25 will also be released.

The market participants will also focus on the activity at the FIIs desk, as Foreign Institutional Investors remained net sellers throughout the last week to the tune of Rs 13,553 crore worth of shares, taking the total net outflow for the current month to Rs 30,509 crore (as per provisional data) after net buying in previous four months, though they remained strong buyers in the primary market. The fear of continuation of earnings downgrades after June quarter numbers, and high valuation could be some of reasons behind their selling in India.

However, Domestic Institutional Investors (DIIs) continued to completely offset the FII outflow on a weekly and monthly basis, as they net bought Rs 17,932 crore worth of shares during the week and nearly Rs 40,000 crore of buying in the current month.

Meanwhile, the US dollar index, which was under pressure last week after a consistent uptrend in the previous two weeks, closed 0.8 percent down at 97.67, and is expected to be volatile this week amid the US tariff trade deal deadline and the FOMC meet. The Indian rupee depreciated further for the fourth consecutive week, weakening by 0.39 percent to 86.4570 against the US dollar.

The week ahead is going to be busy for the primary market as a total of 14 public issues worth more than Rs 7,300 crore will hit Dalal Street, and 12 companies are scheduled for market debut this week.

Five companies - Laxmi India Finance, Aditya Infotech, National Securities Depository (NSDL), Sri Lotus Developers & Realty, and M&B Engineering - from the mainboard segment will launch their initial public offerings (IPOs) this week.

In the SME segment, investors will see 9 public issues - Umiya Mobile, Repono, Kaytex Fabrics, Takyon Networks, Mehul Colours, B D Industries Pune, Renol Polychem, Cash Ur Drive Marketing, and Flysbs Aviation opening for subscription.

Apart from the above list, public issues like Brigade Hotel Ventures, Shanti Gold International, Patel Chem Specialities, Shree Refrigerations, and Sellowrap Industries, which launched last week, will remain open this week.

Further, total 12 companies are scheduled for listing this week, including Indiqube Spaces, GNG Electronics, Brigade Hotel Ventures, Shanti Gold International, PropShare Titania, Savy Infra & Logistics, Swastika Castal, Monarch Surveyors & Engineering Consultants, TSC India, Patel Chem Specialities, Shree Refrigerations, and Sellowrap Industries.

Technical View, F&O Cues

Technically, the Nifty 50 is expected to consolidate further, likely with a negative bias, given the weakening momentum indicators. The index has formed bearish candles for four consecutive weeks, breaking below the low of the last long green candle formed during the week ended June 27.

In the coming week, 24,700 is expected to act as immediate support for the index, followed by 24,550—the 20-week exponential moving average (EMA)—which is considered a crucial support level. A break below this could lead to broader selling pressure. On the higher side, 25,000 will be a key level to watch, followed by 25,250, which was the high of last week, experts said.

Given that it is the F&O (Futures & Options) expiry week, some volatility is expected. Monthly options data suggest that the Nifty may trade in the 24,700–25,200 range in the immediate term, with a broader expected range between 24,500 and 25,500.

Meanwhile, the volatility index, also known as the fear index, declined for the sixth consecutive week—falling 1.03 percent to 11.28, marking its lowest closing level since April 2024. While this has brought stability to the market, it also hints at the possibility of a major move in either direction, whether an uptrend or a downtrend.

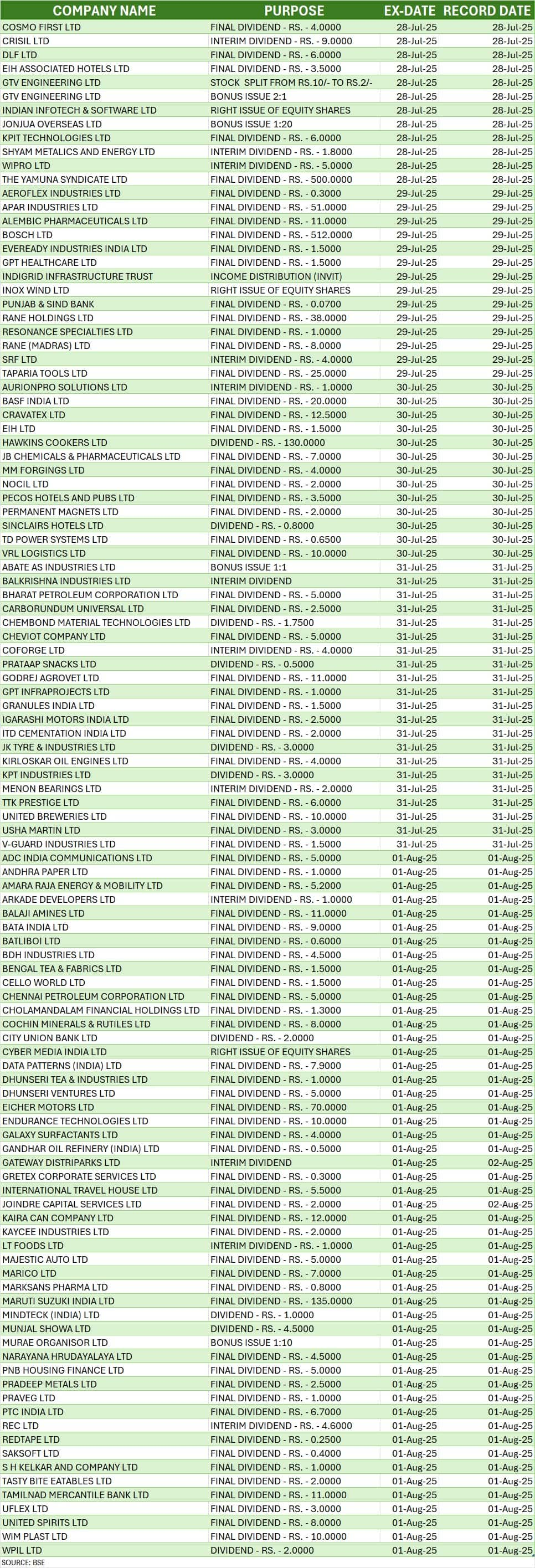

Corporate Action

Here are key corporate earnings taking place this week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.