With Indian markets rallying for seven consecutive weeks, all eyes are now on whether bulls can stay in charge one more week. Positive global as well as domestic cues, including dovish Fed stance, FII buying, better macro data all indicate that the rally may well continue, but some consolidation cannot be ruled out, according to experts.

In the week gone by, BSE Sensex gained 2.37 percent and ended at 71,483, after hitting a record high of 71,605, while Nifty50 gained 2.32 percent and closed at 21,456, after hitting a new milestone of 21,492.30.

There was action in broader markets, too. Nifty Midcap 100 gained 2.67 percent while Nifty Smallcap 100 gained 3.35 percent in the week gone by. All sectoral indices ended in the green with Nifty IT adding 7 percent, Nifty PSU Bank and Metal indices rising 5 percent each, and Nifty Realty index gaining nearly 4 percent after Federal Reserve indicated three rate cuts next year.

Going ahead, US Q3-2023 GDP numbers, Bank of Japan's policy decision, minutes of RBI MPC meeting and primary market action will be key to monitor. Take a look at the key factors:

Bank of Japan monetary policy action

While the week gone by was predominantly shaped by developments in US Federal Reserve policy, analysts believe that attention will now shift to the Bank of Japan's policy decision on December 19.

"This becomes particularly crucial as the Japanese Yen experiences strengthening, and any tightening from the Bank of Japan could pose a risk of unwinding the Yen carry trade," Santosh Meena, Head of Research, Swastika Investmart said.

Economists, however, believe Japan's central bank is likely to end the year as one of the world's most dovish. With weak consumption and next year's wage outlook still uncertain, the Bank of Japan is widely expected to maintain its ultra-loose monetary policy.

Also Read: Japan November wholesale inflation slows sharply as cost pressures ease

RBI MPC minutes

On December 22, the Reserve Bank of India will release the minutes of its last policy meeting. On December 8, the RBI, as expected, kept the repo rate, at which banks borrow short-term funds from the central bank, at 6.5 percent, as inflation remain higher than the central bank’s medium-term target of 4 percent.

Announcing the MPC decision, RBI Governor Shaktikanta Das said the rate-setting panel was closely watching the inflation and was willing to act on rate front in keeping with the data.

IPO Street was abuzz in the week gone by as a flurry of companies made a beeline for D-Street. In the mainboard segment, DOMS Industries and India Shelter Finance concluded their public issues, while Inox India's offer is set to close on December 18. All these companies will list on the bourses as per the T+3 listing norms, where T is the closure day of the issue.

Also read: 12 public issues hitting Dalal Street with 8 listings lined up next week

On the same day, IPOs of Suraj Estate Developers, Motisons Jewellers, Muthoot Microfin will open for subscription, followed by Happy Forgings, RBZ Jewellers, Mufti Menswear on December 19. Azad Engineering IPO will open on December 20 while Innova Captab on December 21.

In the SME market, investors can watch out for Sahara Maritime, Shanti Spintex, Electro Force and Trident Techlabs.

Also Read: IPO Weekly Wrap: DOMS, India Shelter Finance, Inox and 8 SME issues in market spotlight

The consensus view on D-Street is that foreign investors are back with a bang. FIIs (foreign institutional investors) have so far bought Rs 29,700 crore worth of equities in December, after having sold about Rs 75,000 crore worth of equities in the past three months.

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services said, "A major development in December, particularly after the state election results, is FPIs turning buyers."

"FPIs have heavily bought stocks in banking and IT segments. FPI buying is likely to sustain, going forward. India is one of the top investment destinations of FPIs. There is a near consensus now in the global investing community that India has the best prospects among the emerging economies for sustained growth for many years to come," he added.

Also Read: IT, pharma likely to be biggest beneficiaries of FII inflows. Here's why

Crude prices

The International Energy Agency has said that global oil demand will grow by 1.1 million barrels per day in 2024, up slightly from its previous forecast of 930,000 barrels per day. According to Sharekhan, crude oil may rise to $75 in the near-term. Support is at $70/$67. Since, India remains net crude oil importer, the prices will be closely monitored.

US Q3 GDP Growth

Global investors will keep an eye on the final GDP numbers by the world's largest economy for the September quarter of current calendar year. In the second estimates published in November, the US economy grew at a 5.2 percent rate, higher than its preliminary estimates of 4.9 percent published in October month. This is better than expectations of around 5 percent by most of economists, and far better than the growth rate of 2.1 percent recorded in the April-June quarter.

Global Economic Data

Further, new home sales, durable goods orders, personal income & spending and housing starts data for November from the US will also be watched. Apart from that, the participants will also focus on United Kingdom's third quarter (2023) GDP numbers as well as inflation numbers for November, and inflation rate in Europe for November.

Here are key global economic data points to watch next week:

Technical view

Nifty is maintaining its bullish momentum, marked by a breakout from a flag formation. Meena of Investmart believes that the immediate target stands at 21,700, with the possibility of further upward movement to 22,000, although some consolidation may follow.

"On the downside, 21,200 serves as immediate support, while 21,000 is a crucial support level in the event of any pullback," he added.

In the case of Bank Nifty, the successful close above the 48,000 hurdle opens the door for additional bullish momentum toward levels of 48,500/48,800.

"Immediate support lies at 47,500, with a critical support zone at 47,000–46,800 in case of a downturn," Meena said.

F&O Cues

The Options data suggested that the Nifty 50 is expected to march towards 22,000-22,200 zone in coming weeks, with support at 21,300-21,000 area, but considering the Put-Call ratio at 1.47 levels (the highest in the last 12 consecutive sessions), up from 1.37 in previous session, the some kind of consolidation and retracement can't be ruled out before getting back into action mode again as the index surged more than 6 percent in current month, experts said.

On the Call side, the maximum open interest was visible at 22,000 strike, followed by 21,500 strike, with meaningful writing at 22,200 strike, then 22,000 strike, while in case of Put, 21,300 strike owned the maximum open interest, followed by 21,200 strike and 21,000 strike, with writing at 21,300 strike, then 21,400 strike and 21,200 strike.

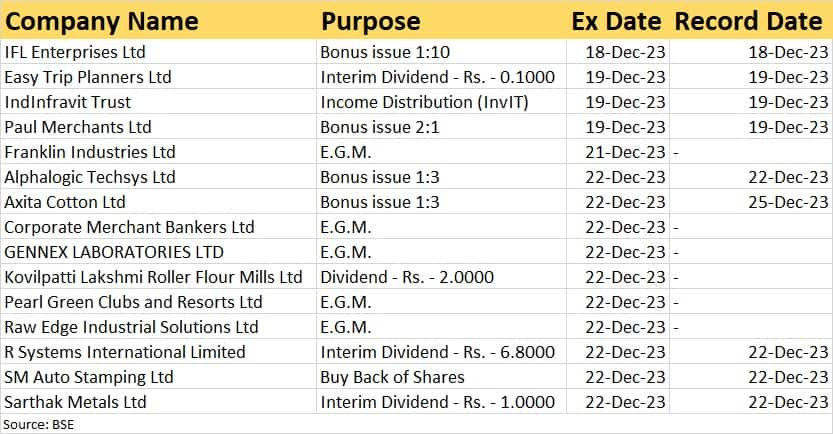

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.