A turbulent week for investors ended with the Indian equity market marking its worst week since May 2020 amid a global sell-off.

Global stocks also had their worst week since May 2020 on the back of rising fears that rising interest rates and withdrawal of the coronavirus-era liquidity measures by central banks could push the world economy into a recession.

The Sensex and the Nifty plummeted nearly 6 percent each this week as foreign investors continued their selling spree.

Among sectoral indices, Nifty IT, PSU bank and commodities were the worst hit, falling 8.2 percent, 7.7 percent and 7.4 percent, respectively. Nifty FMCG and auto indices outperformed the Nifty 50 but still ended 3.1 percent and 4.9 percent down, respectively.

In the broader market, Nifty smallcap 100 index and midcap 100 indices plummeted 7.9 percent and 6.2 percent, respectively.

“We expect the market to remain under pressure with increasing fears of economic slowdown. Traders should avoid long positions and maintain a sell-on-rise strategy,” Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services, said.

Here are 10 key factors traders should watch out for:

1. Recession watch

Investors will keep a keen eye on economic data points emerging from the US over the next week to gauge the status of the economy as fears rise that the Federal Reserve’s aggressive rate hike stance could nudge the United States into a technical recession over the next 12 months.

2. Oil prices

Much like other risk assets in the world, the price of global crude oil also took a beating last week as concerns grew over a global slowdown and a US recession. The most actively traded Brent futures nosedived 7 percent during the week, reflecting the growing concerns on the demand front. Further weakness in the commodity could ease inflation concerns at home while improving the outlook for sectors like fast-moving consumer goods next week.

3. FII selling

Tightening global monetary conditions and expensive valuations at home have made foreign investors net sellers of Indian equities for straight eight and a half months. Foreign investors have net sold equities worth Rs 31,453 crore, so far, in June in the secondary market and look set to break last month’s selling record of Rs 45,276 crore.

4. Domestic buying

While foreign investors have been on a dumping spree, domestic investors have been scooping stocks at every dip. Domestic institutional investors (DIIs) have net bought local stocks worth Rs 30,312 crore in June, so far, and are on course to match May’s record inflows of Rs 50,835 crore.

5. Retail panic

Traders were of the view that the capitulation in smallcap and midcap stocks this week was a factor for increasing panic among retail investors. The week also saw the rolling 12-month returns of Nifty 50, Nifty Midcap 100 and Nifty 500 indexes, a key barometer of retail investment decisions, turn negative for the first time in a while.

6. RBI MPC meet minutes

Macroeconomy watchers will be hooked to the minutes of the monetary policy committee’s June policy meeting, which will be released next week, for cues to the rate-setting panel’s next move. While the May CPI inflation data should provide some relief to the MPC on the inflation front, the panel is likely to move ahead with more rate hikes.

7. Monsoon watch

The progress of the south-west monsoon into India after making landfall in the last week of May has been disappointing so far. The slow progress and patchy rains in many agriculture-heavy regions of the country could further shake investor confidence in the economy as well as fan concerns over inflation remaining higher for a longer period of time.

8. F&O cues

The positioning of traders heading into next week remains a mixed bag as June 17 saw traders sell both the out-of-money call and put options of the Nifty 50 expiring on June 23. Traders will watch out for the 15,000-strike price put option, which remains a key support level for the index as it has the highest open interest among such contracts of the Nifty 50 index.

9. Technical View

The Nifty formed a Doji candle on the daily scale and a bearish candle on the weekly frame. "Going forward unless the Nifty recovers and sustains above 15,360 levels, the trajectory of this market shall remain sideways with a negative bias. In case, if the index slips below 15,183 in the next session then the weakness shall extend towards 14,900 levels," Mazhar Mohammad, founder and chief market strategist at Chartviewindia, said.

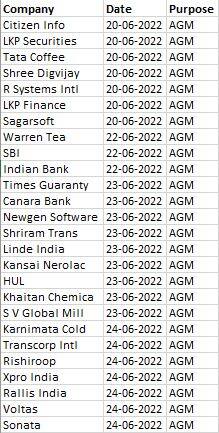

10. Corporate action

Here are the key corporate actions taking place next week

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.