The market recouped all its losses from the budget day and recorded a new closing high on July 26, ending the week with a percent gains and starting the August series on a healthy note. The recovery was driven by the positive global cues including better-than-expected US GDP numbers, and buying in most of sectors barring banking & financial services & realty, with decline in volatility after the market discounted the Union Budget that maintained fiscal prudence and populism but was hurt by the increase in long term capital gains and short term capital gains, and securities transaction taxes.

Going ahead in the coming week, the market is expected to remain positive along with consolidation and will take cues from the FOMC & Bank of England meetings, monthly auto sales numbers, and the next set of corporate earnings.

The Nifty 50 rallied 304 points or 1.24 percent to 24,835, and the BSE Sensex jumped 728 points or 0.9 percent to 81,333, continuing uptrend for eighth consecutive week. The Nifty Midcap 100 and Smallcap 100 indices outperformed benchmark indices, rising 3.3 percent and 2.5 percent respectively.

"Moving forward, the direction of the domestic market will likely be influenced by the progress of the earnings season. Additionally, global economic updates, including US Fed & BoE monetary policies, US employment data, and Eurozone GDP figures, are expected to impact market trends," Vinod Nair, Head of Research at Geojit Financial Services said.

Here are 10 key factors to watch:

The June quarter earnings season has picked up the pace with 490 companies going to release the quarterly scorecard in the coming week including the Nifty 50 like State Bank of India, Tata Steel, ITC, Tata Consumer Products, Tata Motors, Titan Company, Coal India, Mahindra & Mahindra, Maruti Suzuki, Adani Enterprises, Adani Ports and Special Economic Zone, Sun Pharmaceutical Industries, and Divis Laboratories.

Other important names to focus on will be Bank of India, Bank of Baroda, GAIL India, Hindustan Petroleum Corporation, Indian Oil Corporation, Indus Towers, ACC, Ambuja Cements, Zomato, BHEL, Adani Power, Adani Total Gas, Dabur India, Emami, Bharat Electronics, Colgate Palmolive, CSB Bank, Indian Bank, Quess Corp, Dixon Technologies, Exide Industries, Jindal Stainless, Macrotech Developers, Torrent Power, Varun Beverages, Godrej Properties, Mankind Pharma, Zee Entertainment Enterprises, Escorts Kubota, Kalyan Jewellers, Delhivery, LIC Housing Finance, UPL, and Amara Raja Energy & Mobility will also report their numbers.

Auto Sales

The market will also focus on the monthly auto sales numbers releasing in the later part of the next week. Hence, stocks like Tata Motors, Maruti Suzuki India, Mahindra and Mahindra, Hero MotoCorp, Bajaj Auto, TVS Motor Company, Ashok Leyland, Escorts and Eicher Motors will be in focus.

Domestic Economic Data

Apart from earnings and auto sales, Manufacturing PMI data for July will also be watched, releasing on August 1. The preliminary data indicated the HSBC Manufacturing PMI rose to 58.5 in July, from 58.3 in the previous month, signalling the healthy improvement in the sector.

Furthermore, the fiscal deficit and infrastructure output numbers for June will be announced on July 31, while the foreign exchange reserves for the week ended July 26 will be released on August 2.

FOMC Meet

On the global front, all eyes will be on the central banks’ meetings lined up next week including Federal Open Market Committee. The fed funds rate cut is unlikely in the meeting scheduled on July 31, but the focus will be on the Fed Chair Jerome Powell's commentary as most market participants expect the first rate cut in September from the central bank, while the dot plot suggests one rate cut this year and more in 2025.

Further, the Bank of England and Bank of Japan will also be meeting next week on August 1, and July 31 respectively. According to experts, the Bank of England is likely to announce its first rate cut since 2020, while on the contrary to other central banks thinking of rate cuts, the Bank of Japan may possibly go for a rate hike.

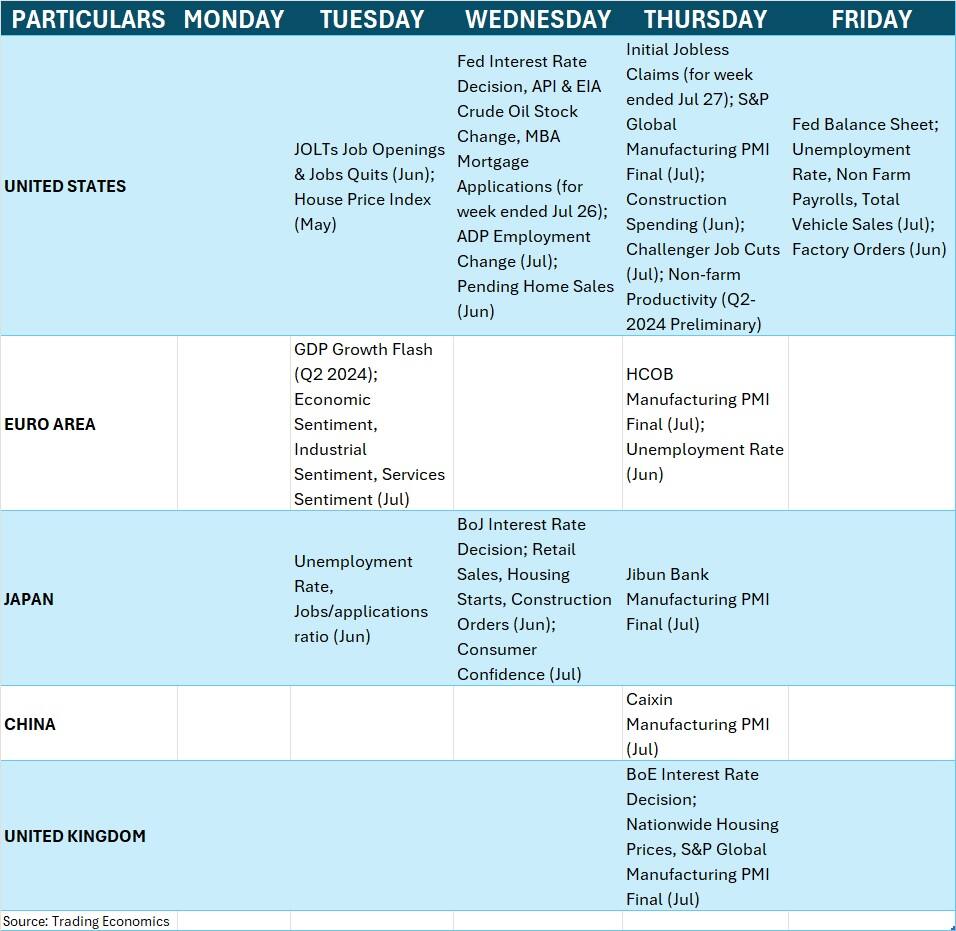

Global Economic Data

In addition, the focus will also be JOLTs job openings and quits, unemployment rate, non-farm payrolls, and factory orders data from the US, while the Manufacturing PMI numbers from the most of key economies, and preliminary estimates for Europe's GDP growth for June quarter will also be watched.

FII Flow and Oil Prices

The market participants will also keep an eye on the FII and DII activity. The mood at the FIIs desk looked cautious last week may be on high valuation concerns and after Union Budget, while DIIs continued their buy on dips strategy, which continued to support the market sentiment.

Foreign institutional investors have net sold Rs 4,721 crore worth shares in the week gone by, however, domestic institutional investors picked shares worth Rs 8,110 crore.

Meanwhile, the stability and decline in oil prices also supported the market last week, as Brent crude futures, the international benchmark for oil prices, dropped 1.8 percent during the week, continuing downtrend for third consecutive week, reaching closer to 200-week EMA (Exponential Moving Average $80.36 a barrel).

The primary market will remain super busy next week as 10 IPOs will hit Dalal Street including three from the mainboard segment. All eyes will be on the SoftBank-backed electric vehicle maker Ola Electric Mobility's IPO, the biggest since LIC IPO in May 2022, opening on August 2. Infrastructure construction company Ceigall India will open its IPO on August 1, and Akums Drugs and Pharmaceuticals public issue on July 30.

In the SME segment, Sathlokhar Synergys E&C Global, Bulkcorp International, Rajputana Industries, Ashapura Logistics, and Kizi Apparels will launch their maiden public issues next week on July 30, while Utssav Cz Gold Jewels will open its IPO on July 31, and Dhariwalcorp on August 1. Furthermore, 10 companies - RNFI Services, VVIP Infratech, VL Infraprojects, Manglam Infra and Engineering, Chetana Education, Trom Industries, Aprameya Engineering, Clinitech Laboratory, Esprit Stones, and S A Tech Software India - will debut on the bourses.

Technical View

Technically, the Nifty 50 turned strong with formation of long bullish candlestick pattern on the daily charts with higher high-higher low, as well as bull candle with long lower shadow, indicating buying interest at lower levels with above average volumes and positive momentum indicators (RSI and MACD). The index also climbed above all key moving averages. Hence, according to experts, the index may move towards 25,000-25,100 in the near term, with key support at 24,600-24,500 zone.

F&O Cues

The weekly options data also suggested the 25,000 is expected to be the next target for the Nifty 50, with 24,500 as a support.

On the Call side, the maximum open interest was observed at the 25,000 strike, followed by the 25,500 and 26,000 strikes, with maximum writing at the 26,000 strike, and then the 25,200 and 25,100 strikes. On the Put side, the 24,500 strike holds the maximum open interest, followed by the 24,000 and 24,400 strikes, with maximum writing at the 24,600 strike, and then the 24,500 and 24,700 strikes.

The volatility cooled down significantly after budget, which dropped below all key moving averages, giving the strong comfort to bulls. The India VIX finished at 12.25 for the week, the lowest level since April, down 17.39 percent from the previous week.

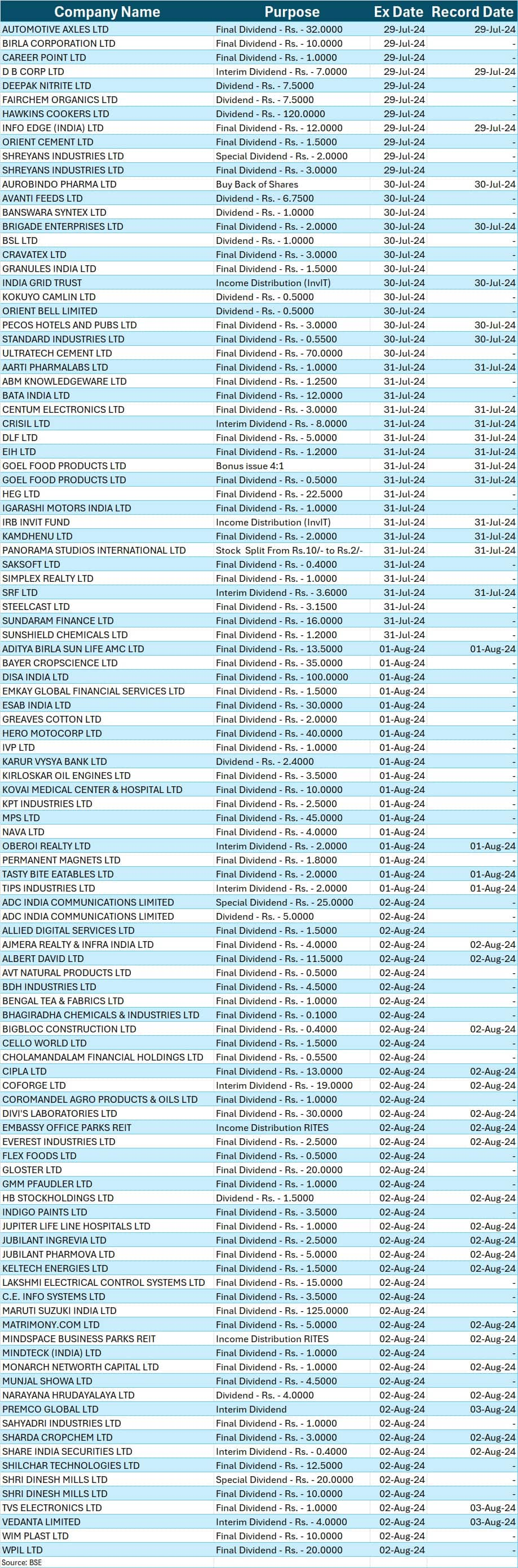

Corporate Action

Here are key corporate actions taking place next week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.