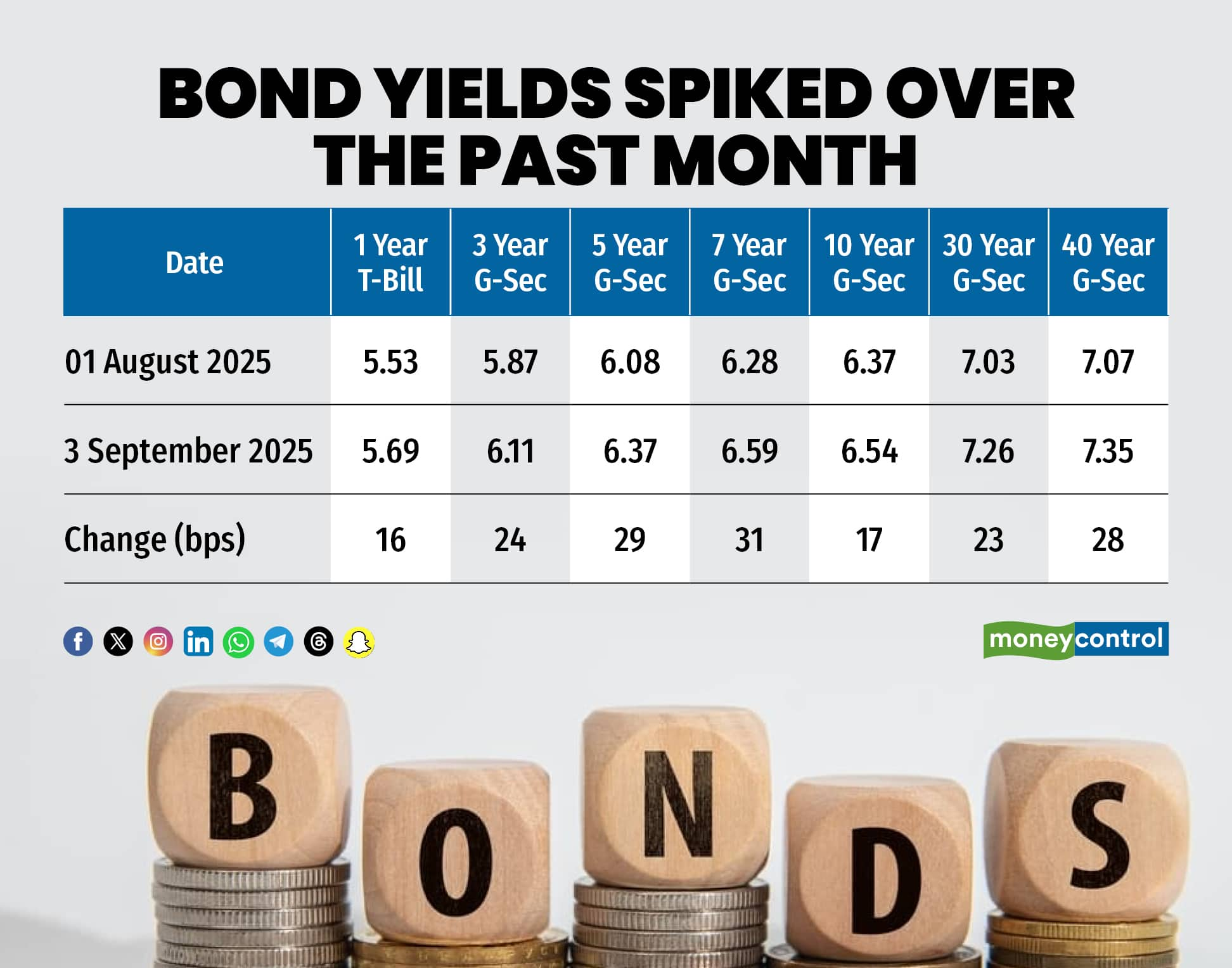

Indian bond yields are likely to moderate going ahead as the net impact of the Goods and Services Tax (GST) rationalisation is lower than expected. Over the past month, the yields on Indian government securities spiked sharply, as concerns over a rising fiscal deficit rose.

Yields across short- and long-tenure bonds rose in August, following Prime Minister Narendra Modi's Independence Day speech, where he announced the Centre's plan to rationalize the GST framework. Concerns over fiscal slippage due to cuts in the GST had sparked selling, while weak demand for upcoming government bonds had also added to nervousness.

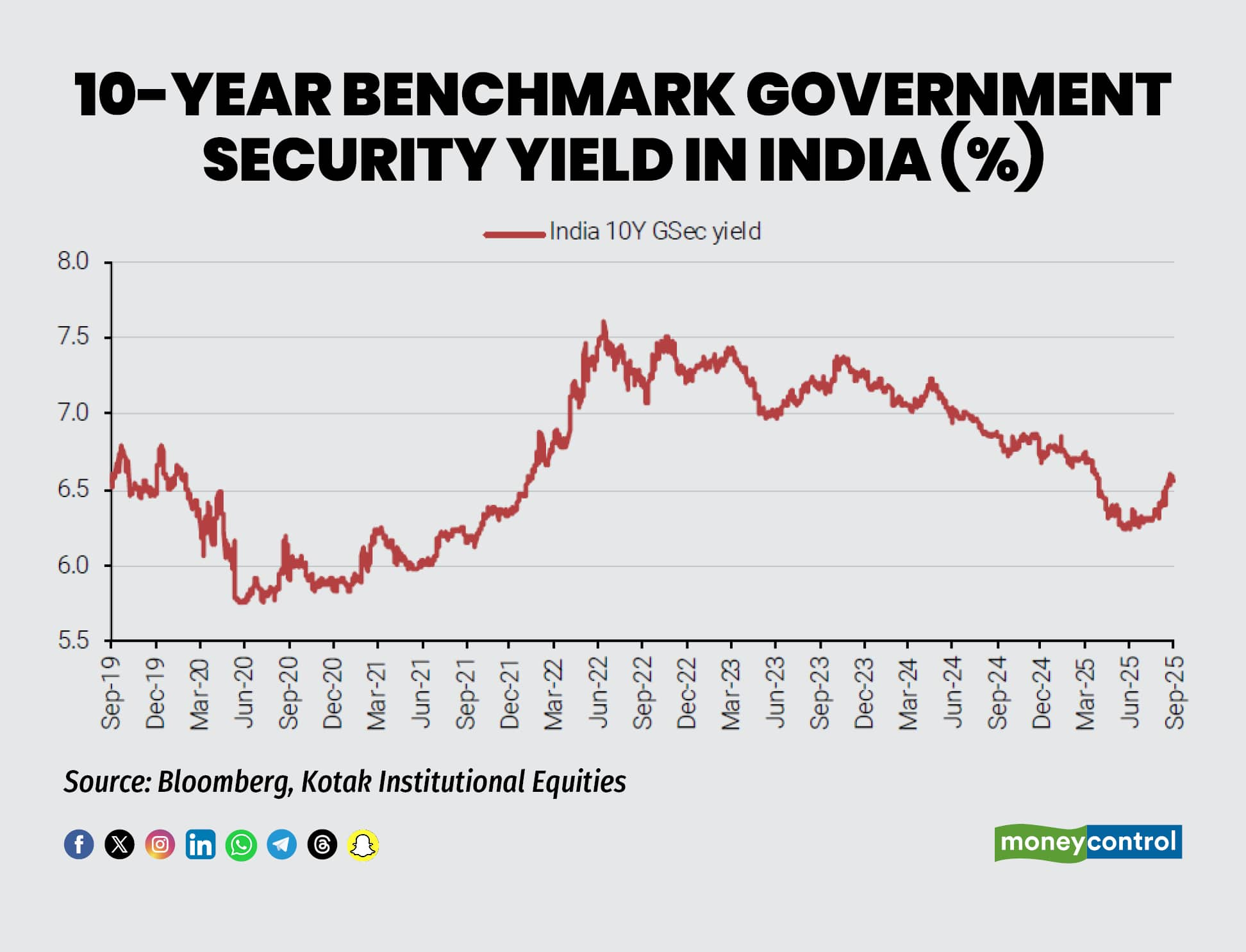

The proposed GST revision added to concerns around the RBI's hawkish policy tilt and a supply-demand mismatch. This had led to the 10-year G-Sec yield moving to pre-Feb policy levels and thus giving up all gains from the RBI's easing actions (100 basis points rate cut and impending CRR cut), with the yield curve also bear-steepening.

Rising yields, instead of attracting inflows, are amplifying fears over India’s fiscal health, which has posed another negative for the rupee.

However, following the 56th GST Council approving the new two-slab structure on September 3, the net impact on GST revenues is likely to be around Rs 45-48,000 crore, against the Rs 60-70,000 crore previously estimated, brokerages believe that the going ahead, there will be no significant upside to bond yields.

"We believe that the fiscal cost can be easily contained, especially for the central government; the recent increase in G-Securities yields could ease marginally in the near term," noted Kotak Institutional Equities.

To that extent, bond yields have slipped in trade today. The 10-year benchmark bond yield opened at 6.533 percent after ending previous session to 6.543 percent, with further downside expected. Further, experts added that investors await a recalibration in duration mix in 2H bond issuance calendar to spur incremental demand.

Tata Mutual Fund expects a gross market borrowing of Rs 14.82 lakh crore in FY2026, with Rs 8 lakh crore in H1, and Rs 6.82 lakh crore in H2. "While the total borrowing amount would remain unchanged, the government is expected to adjust the maturity mix by reducing supply in long maturity bonds and increasing issuance in shorter maturities. This is to bring down long-end yields."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.