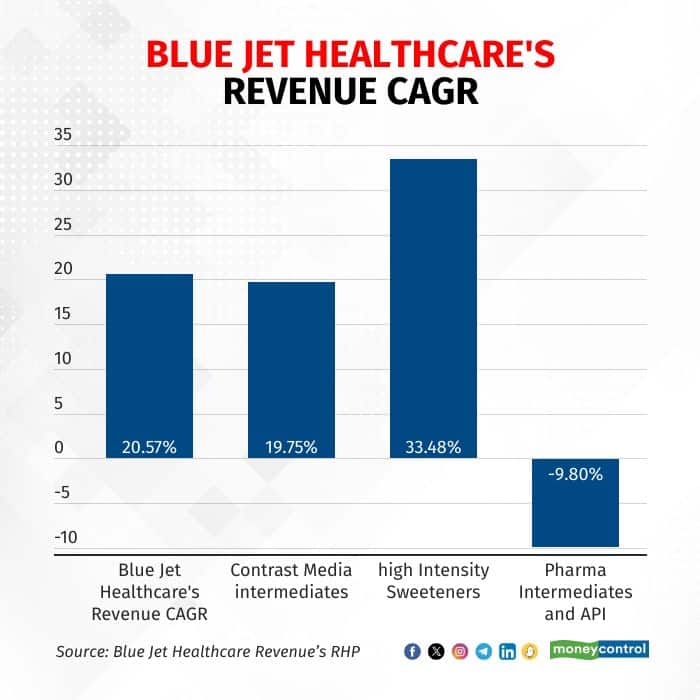

Blue Jet Healthcare, specialty pharmaceutical, expects to continue its revenue momentum exceeding 20 percent over the next year. The growth would be similar to top-line compounded annual growth rate ( CAGR) of 20 percent witnessed in FY21-FY23, said the company’s management in a PRE- IPO Interview ( i.e. Shiven Arora, Managing Director and V K Singh, COO).

Blue-Jet-Healthcares-revenue CAGR

Blue-Jet-Healthcares-revenue CAGR

Shiven Arora, highlighted that Blue Jet Healthcare, a debt-free company with adept capital management, return on capital (ROC) over 30%. He further alluded that the company’s history shows an impressive asset turnover of approximately 5.6 times, and PAT margins positions the company among the top quartile in India's chemical and pharmaceutical sector."

Edited excerpts:

Q) Blue Jet Healthcare is a bit diversified company- operating in niche segments like Contrast media, sweetener, pharma, intermediaries and API business. what's the strategy going ahead?

Shiven Arora:

"Our primary focus has been on regulated markets since the early 1990s. As a company, we specialize in complex ventures with little to no competition and collaborate with multinational generics and global innovators.

"Our strategy remains focused across our three segments. The common thread is our high-quality customer profiles in imaging, pharmaceuticals, and FMCG markets. In contrast media, we've progressed from basic intermediates to advanced ones, significantly improving our net realization per kilogram over the last five to seven years. Both our contrast media and artificial sweeteners segments have shown a robust compound annual growth rate (CAGR) exceeding 25%. We are a debt-free company with strong capital management, boasting return on capital (ROC) figures exceeding 30%. Our historical asset turnover is around 5.6 times and our PAT margins position us in the top quartile among chemical and pharmaceutical companies in India.

Q) How different is your business model from the other chemical and pharmaceutical companies in India, especially the ones with API focus? How different is your strategy as compared to them?

V.K. Singh:

Our strategy is highly distinctive, concentrating on extremely specialized market segments. Within these sectors, we aim for areas with minimal generic competition. For instance, in the realm of contrast media, we operate within a sphere dominated by a handful of prominent innovator companies. The demand for these products exhibits relative inelasticity. Similarly, in the high-intensity sweetener market, we provide well-established, safe products like saccharin, primarily to major- FMCG, global beverage, and pharmaceutical corporations. Our saccharin production occurs in a USFDA approved facility, underscoring our unwavering commitment to quality.

Both of these segments fall under the category of performance chemicals. Our niche-focused approach translates into limited competition from generic players. In our third business vertical, we collaborate with innovators in the chronic healthcare sector, concentrating on products in Phase 3 trials, protected by patents, or granted marketing exclusivity. This shields us from generic competition. Our market segmentation enables us to evade generic competitors, thereby safeguarding our profit margins and securing long-term contracts."

Q) Let's also understand about the scalability of the business in terms of the revenue CAGR, totally a 20.5% revenue CAGR was clocked between FY21 to FY23. How much more scalable is this business?

V.K. Singh:

So, let's just look at the segments first. In contrast media, it's in the med tech industry, the market is growing and the market is growing in high single digits. And if you will see the industry report, the projections are that the market will continue to grow, particularly given the demographic tailwinds that we are seeing, the aging population and the high growth and acceptability of the devices in emerging markets. If you look at the high intensity sweetener segment, then there, again, the younger generations are very conscious of obesity and diabetes and all these things, and therefore, there are demographic tailwinds. And that's, again, a segment that you will see that there is high growth. Again, in the pharma intermediate side, we believe that the focus being the chronic segment, you will see that the growth is much higher than the acute side of the business.

And again, both in the developed markets and emerging markets, there's high growth in that segment. So all these three segments are growing segments. The first segment being in med tech, the second segment being in high intensity sweeteners which are performance chemicals, and the third segment – pharma intermediate segment, again, directed towards the chronic therapy. And all three segments are facing positive demographic tailwinds. So we're on a growth space. And there, given the strategy that we have, I think we have demonstrated over the last four to five years, high growth north of 20%, as you mentioned, and we believe that if we do things the way we are doing, I guess the momentum will be maintained.

Q) The company’s margins have dwindled from 41% to 31% over the last three years, so to say. What explains the slide and what can be expected going forward?

V.K. Singh:

"Indeed, company’s EBITDA decreased, partly due to an industry-wide trend of soaring prices for basic chemicals, resulting in higher raw material costs and reduced gross margins. Additionally, rising freight costs over the past two years added to the profitability challenges. As part of company’s ongoing Capex cycle, it is expanding capacity by 50% over the next 12-18 months, which has led to increased manpower costs.

However, the latest quarter's numbers reflect a positive trend. Raw material prices have softened, though they haven't returned to previous levels, and freight costs are also easing. This is helping restore profitability. Furthermore, we're pursuing vertical integration in the contrast media segment, which should boost profitability. Additionally, the upcoming operation of a solar plant, combined with our existing windmills, will ensure 70-75% of our energy comes from green sources, contributing to cost savings.

While I won't provide specific guidance, the quarterly results indicate that we are progressing back to our previous profitability levels."

Also, 40% may be considered a benchmark, the year impacted by COVID saw significantly lower chemical prices. In our specific segments, we do not view that year as a benchmark or peak. In Q1 FY24, we observed a recovery in margin profiles, returning to the levels of FY22. We also noticed a trend reversal in raw material prices. The ocean freight impact affected not only our company but also exporters in general. However, in the current year, we are witnessing a strong trend reversal, and these margins should be sustainable."

Q) Your Revenue CAGR For API biz was negative to around 9.8%? What explains the drop in the production for API business? Can you give us more reason? And the guidance on how we can look at the segment overall?

Shiven Arora:

See, it's about 5% of our business. So because of the low base effect, even things moving marginally can impact the optics. All I can say is that these candidates that we're working on with are late-stage NCs or gaining marketing authorizations. So these are very high value, low volume intermediates at this point in time. But as we scale up and as these molecules get marketing authorizations in their respective geographies, we could see a traction in this segment.

Q) Talk about your sweetener business in that case, that constitutes around 25% of your sales overall. 33% of your revenue CAGR was achieved from this business over the last three years. How commoditized is this business space? What are the product margins from this segment and your future plans from this business.

V.K. Singh:

"In this segment, while there are several commodity players, we have strategically positioned ourselves in FMCG, specifically in oral care, beverages, and pharmaceuticals. Quality, taste consistency, and similar factors are paramount in this market. As a result, it's a very loyal and less price-sensitive part of our business. Our margins align with those in other segments, and it's not a diluted business, even though we don't break down segment-specific profit and loss. Gross margins are consistent with our other segments."

Q) Let's discuss your geographical mix. Currently, 74% of your revenue comes from the European region, with India and the USA contributing nearly 5% each. What changes, if any, are you planning for this mix in the future? Additionally, how do you anticipate the Russia-Ukraine war impacting your revenue performance?"

Shiven Arora:

"Contrast media and pharma intermediates are primarily geared towards innovators located in Europe and the United States, where the manufacturing hub for these APIs and contrast media is located. Our customers collectively hold about 75% of global market leadership. When we supply intermediates to Europe, our customers distribute them for API and formulation use worldwide. Although our sales may appear concentrated in Europe, this also means we participate in the growth of emerging markets indirectly.

Despite two recent black swan events, namely COVID and the Russia-Ukraine war, these segments, involving essential life-saving scans and image-guided therapies, have proven resilient. Healthcare, which is the core of our business, doesn't seem to be significantly affected by global events. During these periods, we maintained positive growth in both contrast media and other verticals. Therefore, we believe that the healthcare segment we operate in is relatively insulated from such global events."Q) With over 60% of your raw materials coming from China and Norway, what are your risk mitigation strategies for ensuring a stable supply?

V.K. Singh:

So this is true that we are importing several raw materials. About 40% to 45% of this import is for a particular side chain for contrast media, and the new capacity that we are adding will be used to produce that as well. And once that happens, I think our import content will go down significantly and about 90% of our procurement will be local.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.