Market regulator Sebi can allow itself a smile.

Its campaign to educate retail investors about the pitfalls of derivatives trading started in January last year appears to be bearing fruit. But this has less to do with growing awareness among investors and more with market forces at work.

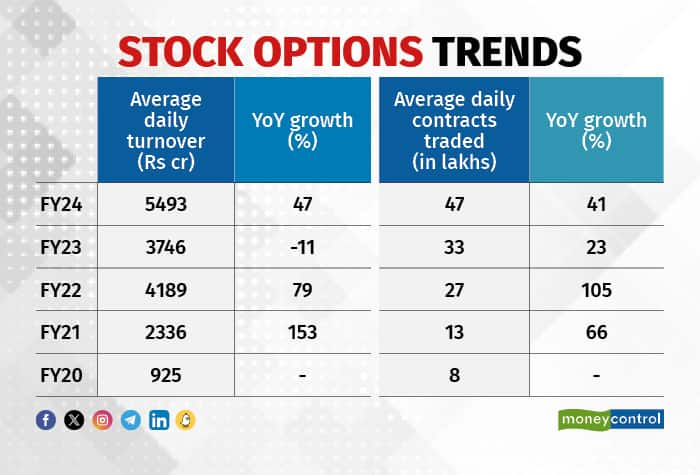

Analysis of the turnover in index options shows that the growth in value of premium turnover (option premium multiplied by quantity traded) has eased significantly this financial year. While options trading turnover (index options + single stock options) as a whole has grown nearly 12 times to Rs 119 trillion between FY20 and FY23, the maximum action has been seen in the index options segment.

Conflicting trends

This growth slowdown is despite a rapid rise in the number of contracts traded because of the introduction of new contracts by the BSE and the NSE. Also, many retail traders who had taken to options trading during the Covid lockdowns are slowly withdrawing from the game because it is no longer as profitable as before, say market participants.

Multiple factors are driving this trend such as low volatility, increased competition, resumption of work from office, more activity in out-of-money options, and tighter regulations.

The upshot of these developments is that of late incremental money is now flowing into the cash market. Options premium turnover premium spiked in December as the Sensex and the Nifty raced to new highs, but it was still below the turnover logged in July. (see chart)

Coming of age

“The options trading market is now beginning to mature,” Shreyas Bandi, independent options trader, told Moneycontrol, “The rapid growth of the past few years is unlikely to be repeated, it will be a steady pace hereon.”

According to Bandi, the fall in premium turnover is also because the market has been less volatile over the last 6-9 months.

Premium turnover is a function of volatility. More volatile the market, more the premium that options writers charge for taking on risk, and hence higher the premium turnover.

"Volatility was high during the early phase of Covid. Over the last year, volatility was low. When volatility is low, you don’t make a lot of money or lose a lot. But if you don’t make money, it is as good as losing money, because there are the fixed costs anyway,” he said.

Shrinking profits

Kirubakaran Rajendra, founder of Squareoffbots.com, which provides algo strategies, says that retail traders have been finding it harder to make profits of late.

"In the initial years, retail traders could make profits with ease because the market was growing, and the space was less crowded. That is no longer the case,” Rajendran told Moneycontrol. "This is becoming a market for the serious traders. Players who do not follow systems trading are finding it tough to manage drawdowns (losses).”

The great post-Covid rush

Originally an instrument to hedge risks, options contracts came to be treated as something of a lottery ticket by rookie traders after Covid when they realised they could earn a huge payoff with a small upfront investment. As the market rose near one way between April 2020 and October 2021, many retail traders made a fortune by blindly buying call options. Stock exchanges fed the frenzy by introducing weekly options contracts, and giving rebates to brokers for generating volumes which, in turn, allowed the brokers to offer zero or near-zero brokerage to derivative traders.

But the days of easy money appear to be over.

“The sudden spikes in less liquid weekly options on expiry day has caused steep losses to many retail traders. Many of them have now reduced their exposure towards options selling, trying to get into options buying or quit the game altogether,” Rajendran said.

No money for jam

According to Ashish Gupta, a Singapore-based derivatives trader, another reason premium turnover has dropped is that some of the time-based strategies which made a lot of money for retail traders from 2020 to 2022 did not work as well in 2023.

The 9:20 short options straddle was one such strategy which involved selling a call and a put option with the same strike price and expiration date at 9:20am. “There are no free lunches and markets won’t leave easy money on the table for too long,” he said.

The rise of high frequency trading firms (HFTs) using sophisticated hardware and powerful algorithms too has been a factor in shrinking profits for retail traders. Algo trading is fast catching on among retail traders as well, further shrinking the space for amateur traders who are not into algo-based trading.

According to NSE data for November, there are about 37 lakh active derivatives traders (those who trade at least one a month), of which 79 percent traded less than Rs 10 lakh. “Automation and back testing of strategies have become common as more people are doing it. So, the edge disappears quickly,” Shreyas said.

Changing tracks

Derivatives market players say that many traders are shifting from derivatives to equities because of the boom in the IPO market and the stunning rise in shares of midcap and small-cap companies.

"Over the last few months, it has been easy for people to double their money by investing in small and midcap stocks. It has been less stressful than having to constantly monitor positions in the options market where profits too have been much lower," said Rajendran.

Rise in contracts traded

So what explains the rise in the number of contracts being traded even as premium turnover has been slowing?

Market players attribute two reasons to it. One, there is still a rush for out of the money (OTM) options contracts on expiry day as new entrants to the options market try their luck. Two, many traders try to reduce their margin obligations by buying offsetting OTM options contracts. OTM contracts are also bought as a hedge.

Road ahead

Market players do not see the index options segment degrowing any time soon, but the growth rate will be slow.

“The addressable market is nearing saturation. Four years back, awareness of options trading was low,” Bandi said. “That is no longer the case because of the explosion of content on derivatives. Today, if the base of new traders is not growing fast enough, it is not because of lack of awareness. Many amateur traders are slowly withdrawing from the market because it is no longer profitable for them. And the ranks are not getting filled rapidly like it used to happen during Covid.”

Players say the constant messaging by brokers and Sebi about nine out of 10 derivatives traders losing money may also be influencing the decision of new entrants to the stock market.

Broking firms may not be too perturbed by this trend as they feel most derivatives traders are likely to remain in the system.

“Most of the new entrants are youngsters in their early 20s. They do not have much capital, they are in the process of creating it,” Angel One founder Dinesh Thakkar had told Moneycontrol some months back when asked about the massive growth in options trading.

“I am sure that at some point they will invest in equities because (a) they would have figured out equity investing by then, and (b) they will realise that wealth can be created only through long-term investing,” Thakkar said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.