The BSE Sensex touched a new lifetime high of 63,588.31 in morning trade on June 21 after 137 trading sessions, crossing 63,583.10 hit on December 1, 2022. The NSE Nifty soared to 18,875.90, around 10 points away from its record intraday high of 18,887.60 reached on December 1, 2022.

Robust quarterly earnings, unabated buying by foreign investors, improving macroeconomic health and expectations of a longer pause on interest rate hikes by the Reserve Bank are some of the key factors fueling this rally, analysts said.

“The Indian economy stands at a sweet spot of growth and remains the land of stability against the backdrop of a volatile global economy. We continue to believe in the long-term growth story of the Indian equity market, supported by the emerging favourable structure, as increasing capex enables banks to improve credit growth. Our base case Dec’23 Nifty target is at 20,200 by valuing it at 20x on Dec’24 earnings,” said Naveen Kulkarni, Chief Investment Officer, Axis Securities PMS.

Catch all the Market action on our live blog

After a lacklustre start to the year, Dalal Street came under heavy pressure in March as the banking crisis in US roiled the global markets. But the domestic benchmarks made a stunning turnaround from late March, in tandem with fresh FPI inflows and a rebound in risk sentiment.

The Nifty is up over 11 percent from its March lows, gaining 1,875 points.

The Nifty-50 has turned full circle in the last 20 months, as per Motilal Oswal. It has navigated from 18,477 in Oct’21 to an all-time high of 18,813 in Dec’22 before reverting to 18,688 in Jun’23. While the benchmark index has reclaimed the summit again, the midcap and smallcap universes have outperformed the benchmark as compared with the Dec’22 peaks.

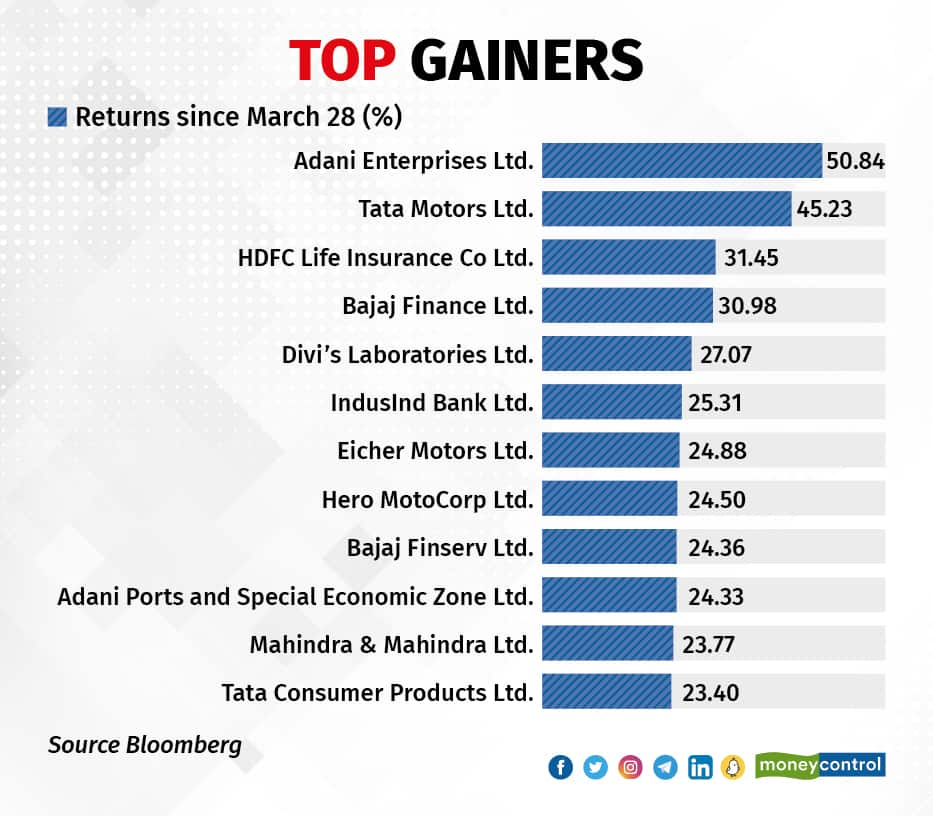

Here are some key highlights of this leg of the bull run:

Adani Enterprises Ltd, the flagship company of the Adani Group, has rebounded in tandem with other group stocks after a late January report by American short-seller Hindenburg Research accused the port-to-power conglomerate of stock manipulation and other wrongdoings, triggering a rout. The group has denied the charges.

The financialsAdani Enterprises has more than doubled its net profit in the March quarter on the back of growth in airports and road businesses.

Net profit in January-March at Rs 722.48 crore compared with Rs 304.32 crore in the same period last year.

The stock too has more than doubled from its 52-week low of Rs 1,017.10 hit on February 3 this year in the wake of the Hindenburg report. However, it is still trading 40 percent lower than its 52-week high of Rs 4,189.55.

Tata Motors touched its 52-week high of Rs 537.15 last month after the company turned profitable in the quarter ended March 2023.

Tata Motors swung to a consolidated net profit for the quarter ended March at Rs 5,407.79 crore, against a net loss of Rs 1,032.84 crore in the same quarter last year.

Revenue from operations came in at Rs 1,05,932.35 crore, up 35.05 percent from Rs 78,439.06 crore in the corresponding quarter last year.

Analysts expect Tata Motors to witness a healthy recovery as supply-side issues ease (for JLR) and commodity headwinds stabilise (for the India business).

“It will benefit from: a) the CV upcycle and stable growth in PVs, b) company-specific volume/margin drivers, and c) a sharp improvement in FCF as well as a reduction in net debt in both JLR and the India businesses,” Motilal Oswal said in a note.

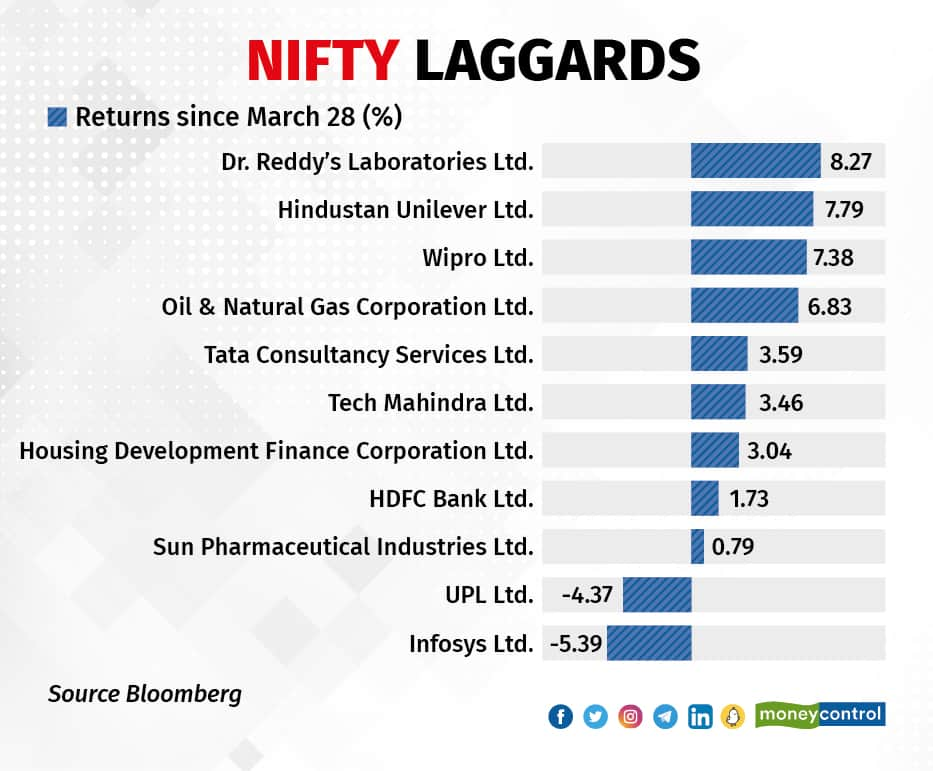

Only two Nifty counters have lost money during this period

Infosys Ltd was hit by a wave of downgrades recently after posting disappointing March quarter earnings.

The company posted full-year revenue growth of 15.4 percent, below its guidance range of 16-16.5 percent. In Q4FY23, the reported revenue amounted to $4,554 million -- a decline of 2.2 percent in absolute terms and 3.2 percent when adjusted for constant currency.

In fact, outlook for the entire domestic IT sector has soured due to reduced client spending and an uncertain demand environment triggered by the US banking crisis and recessionary headwinds in the West.

"Increasing macroeconomic headwinds are expected to present challenges in terms of growth, as enterprises delay decision-making and prioritize cost optimization projects that yield immediate benefits, rather than transformation projects with delayed returns," Nomura said in a report.

Shares of UPL have hit a rough patch after the agrichemicals firm reported a 43 percent drop in Q4 consolidated net profit at Rs 792 crore on “weaker-than-expected performance”.

Revenue from operations came in at Rs 16,569 crore, growing 4 percent from Rs 15,860 crore in the year-ago period.

The company’s EBITDA fell 16 percent year on year (YoY) to Rs 3,033 crore and EBITDA margin slipped 338 basis points YoY to 18.3 percent.

Sectoral Standings

The real estate sector is seeing traction amid expectations of interest rates nearing their peak. Most realty players have posted strong earnings performance as demand remains robust.

“Valuations for most residential real estate stocks have risen to 7-11X implied EV/EBITDA on FY2024 expected pre-sales, at the higher end of the past trading range,” Kotak Institutional Equities said.

“This reflects the strong underlying business performance as well as changing investor interest, with the announcement of ‘rate pause’ addressing potential risks to demand previously seen by investors. We continue to remain constructive on the sector owing to strong operational performance by the players,” it added.

The automotive industry is revving up with exciting new launches that are driving investor confidence sky-high.

That apart, the industry has got some relief as prices of key raw materials such as steel, aluminum, and copper have begun to ease.

“Moderation in steel prices, along with the resolution of the semiconductor shortage, has played a significant role in boosting sales,” said Anil Rego, MD and CEO, Right Horizons, a financial services firm.

Maruti Suzuki raced ahead with a 10.3 percent yoy surge in sales volumes in May, driven by the mid-sized car segment, according to a Motilal Oswal report. Mahindra & Mahindra followed with a 6.8 percent on-year growth, fuelled by three-wheeler sales.

The two-wheeler segment has also witnessed an uptick in sales, climbing 19 percent yoy in May.

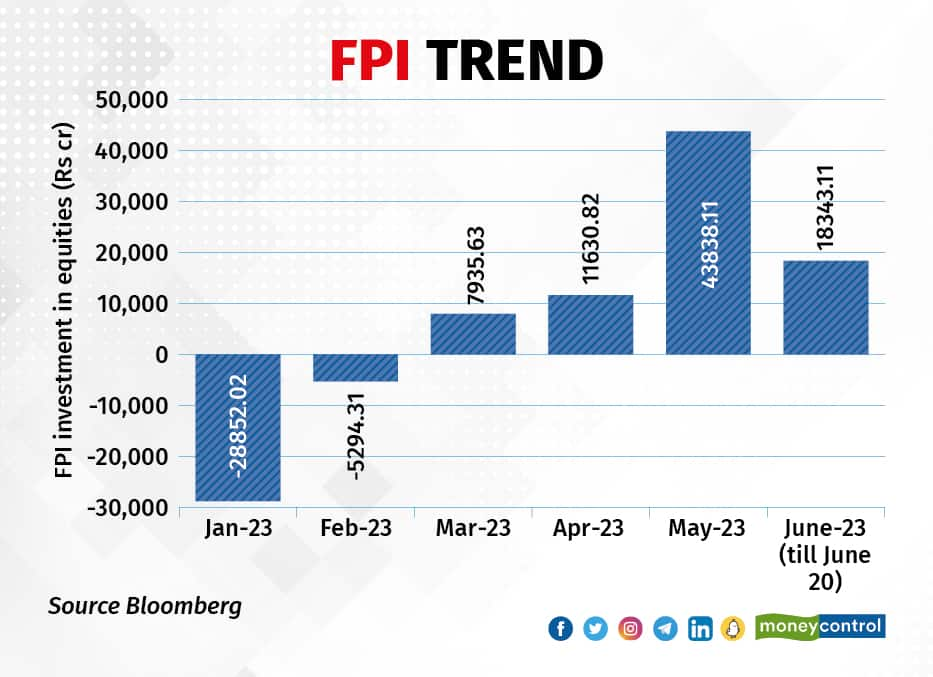

Foreign portfolio investors (FPIs) continued to invest in Indian equities for a fourth straight month as they injected Rs 16,405 crore in June so far on the country’s strong economic rebound and positive growth outlook.

FPI flows touched a nine-month high of Rs 43,838 crore in equities in May, Rs 11,631 crore in April, and Rs 7,936 crore in March, data with the depositories showed.

Before that, FPIs had pulled out over Rs 34,000 crore during January-February. “Considering the current investment trend, it is expected that FPIs will continue to show interest in the Indian market throughout the month,” Mayank Mehraa, Smallcase manager and principal partner at financial consultancy Craving Alpha, said.

The ongoing economic recovery, positive corporate earnings, and supportive policy environment are likely to sustain the inflow of funds, he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.