Taking Stock: Market at record closing high; Sensex up 196 points, Nifty above 18,850

The BSE midcap index rose 0.7 percent and smallcap index gained 0.2 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 83,216.28 | -94.73 | -0.11% |

| Nifty 50 | 25,492.30 | -17.40 | -0.07% |

| Nifty Bank | 57,876.80 | 322.55 | +0.56% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 816.35 | 23.85 | +3.01% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharti Airtel | 2,001.20 | -93.70 | -4.47% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10426.80 | 144.90 | +1.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9393.60 | -95.20 | -1.00% |

India's macro headwinds are morphing itself into tailwinds which is acting as a strong catalyst for market buoyancy. Markets are also taking a view that interest rates have peaked and the next action will be a rate cut. Also with global cues still not offering growth comfort, India seems to be attracting foreign capital as well.

The Nifty opened on a positive note and witnessed a rangebound day of trade today. It closed on a positive note, up ~40 points. On the daily charts, we can observe that the Nifty held on to the lower end of the rising channel and is slowly inching higher towards the all-time high. The daily and hourly momentum indicators is providing divergent signals which is leading to the range-bound price action.

Prices are trading around the resistance zone of 18780 – 18800 where multiple swing highs are placed. Once this zone is surpassed, we can expect further upside in the index. Crucial support levels to keep handy are 18660 – 18610 and 18880 – 18900 is the crucial resistance level.

As far as Bank Nifty is concerned, the index witnessed rangebound price action and closed with gains of ~90 points. It witnessed resistance from the zone of 43900 – 44000 where resistance in the form of the 20-day moving average (43974) is placed. Overall, the trend is still sideways, and the range of consolidation is likely to be 44500 – 43400.

India’s equity market is driven largely by FPI flows, especially through the passive index flows. The pause in Fed’s rate hike cycle has helped improve global risk appetite, and India has been one of the beneficiaries.

India benefits due to its strong macro-economic outlook and corporate earnings growth, which is expected to record a 14-15% growth in FY24 and FY25, which is quite attractive relative to other emerging markets – especially relative to China. Valuations are now somewhat expensive, which may cap further upside in the short term, but the long term outlook India is still very attractive.

Markets traded dull in a narrow band and ended marginally in the green amid mixed cues.Weak global cues were weighing on sentiment in early trades but noticeable strength in HDFC twins and rotational participation from select heavyweights helped Nifty to settle around the record high. Meanwhile, financials and energy posted decent gains among the sectoral pack while metal, realty and FMCG witnessed profit taking. The prevailing buoyancy continued on the broader front wherein the midcap index gained nearly a percent.

Markets are rewarding handsomely to those who are maintaining a stock-specific approach while the Nifty is hovering around the record high.

Traders should align their positions accordingly and focus more on stock selection and trade management.

It's purely the positive domestic fundamentals that are reflecting in the markets, which drove the Sensex to a new life-time high and pushed Nifty closer towards breaching its previous high. While global macro headwinds still persist, both domestic and foreign investors will continue to bet big on local shares amid improving growth parameters.

The rally did not gather steam as investors traded with caution ahead of the US Federal Reserve Chairman's testimony before the US Congress later today.

Technically, on intraday charts the Nifty is holding a higher bottom formation, which is broadly positive. For traders, 18780 would be the key support level to watch out for and above the same, the index could move up till 18900-18950. However, a quick short-term correction is not ruled out if the index trades below 18780 and slips till 18720-18700.

Despite hitting record highs, the domestic market failed to sustain its upward trajectory due to prevailing concerns over global issues and a delayed monsoon. Furthermore, market volatility was exacerbated by consecutive days of net selling by FIIs, while mid-cap stocks maintained their steady gains. Meanwhile, in the global market, sentiments were dampened as UK CPI inflation came in hotter than expected, adversely affecting investor confidence.

Indian rupee ended higher at 82.04 per dollar on Wednesday versus Tuesday's close of 82.11.

Benchmark indices ended higher on June 21 with Nifty around 18,850.

At close, the Sensex was up 195.45 points or 0.31 percentat 63,523.15, and the Nifty was up 40.10 points or 0.21percentat 18,856.80. About 1,672 shares advanced, 1,750 shares declined, and 118 shares were unchanged.

Power Grid Corporation, ONGC, HDFC Bank, Adani Ports and HDFC were among the biggest gainers on the Nifty, while losers were JSW Steel, Hindalco Industries, M&M, Divis Laboratories and ITC.

Among sectors, the metal index was down nearly 1 percent, the FMCG index was down 0.4 percent and the realty index was down 0.3 percent, while the power index was up 1 percent and the oil & gas index rose 0.5 percent.

The BSE midcap index rose 0.7 percent and smallcap index gained 0.2 percent.

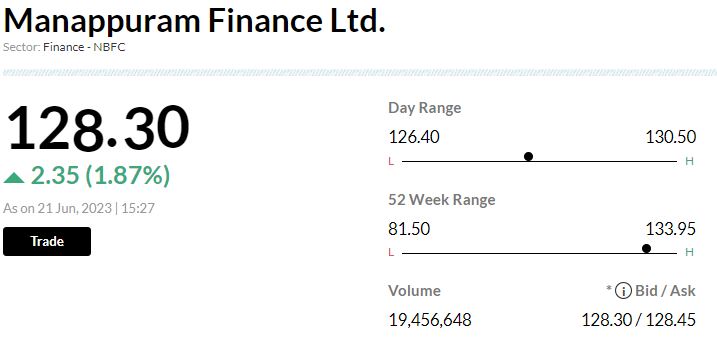

-Overweight rating, target at Rs 160 per share

-Asirvad MFI rights issue approved, MD & CEO reappointed

-Capital infusion approved in Asirvad MFI is Rs 150 crore versus Rs 500 crore indicated by management

-Asirvad MFI's equity capital will increase by 10% on completion of the rights issue

-Re-appointment of MD & CEO alleviates concerns on management transition

Shares of Dev Information Technology hit its 52-week high of Rs 159.70 on June 21 after the Ahmedabad-based IT firm said LT1, a wholly-owned stepdown subsidiary of US-headquartered Lilikoi Holdings Inc, acquired a 51-percent stake in the company. The stock was trading 4.54 percent up at Rs 159 at 12.35 pm on the BSE.

The all-cash deal is estimated to be worth Rs 300 crore, as per reports.

Through acquisitions and in-house expertise, Lilikoi is creating a unique ecosystem to design, engineer, manufacture, and support their IoT devices, and seamlessly integrate various technologies, Dev IT said in a regulatory filing on June 20.

Shares of Thyrocare Technologies surged nearly 5 percent in early trade on June 21, enjoying a positive sentiment after ICICI Prudential Mutual Fund picked up a stake in the company.

With the gains in today's session, the stock has recorded nearly a 12 percent jump in two sessions. The stock also settled nearly 7 percent higher on June 20 post the large deal. Read More

-Buy rating, target at Rs 560 per share

-Delhi government says validity of permits by CNG taxis will now uniformly be 15 years

-Draft scheme sought to mandate aggregators to switch to electric fleets within 7 years

-Final aggregator policy is awaited & there are still uncertainties

-Recent correction improves risk reward