India's banking sector is staring at a bumpy road ahead as COVID-19 will have a serious impact on banks' loan growth, asset quality and earnings, said brokerages and experts.

Experts and brokerages are of the view that the banking sector should be in the focus of policymakers as the sector is suffering the most and will have a contagion effect on all sectors of the economy.

The government and the RBI understand this and have made a slew of announcements to mitigate the pain of this sector.

The RBI governor on March 27 said the central bank was closely monitoring the situation and will step in whenever required.

“Let me assure you that the RBI is at work in mission mode. We have been monitoring the evolving financial market and the macroeconomic conditions and calibrating its operations to meet any need for additional liquidity support as well as to take other measures if warranted,” said the RBI governor.

The impact

Brokerages highlight that the lockdown of the domestic and global economies due to the COVID-19 threat will have a meaningful impact on banks’ loan-book growth.

"We have factored a lockdown of 30-45 days in our revised estimates and cut individual banks’ loan growth in FY21 by 3-5 percent and taken deterioration in asset quality. Our earnings revisions are down between 10 percent and 35 percent," said brokerage firm Phillip Capital.

The uncertain outlook and the country-wide lockdown has made banks vulnerable to a new leg of asset-quality crisis, with the most uncertain part being the lockdown period and the time that the economy would take to return to normalcy.

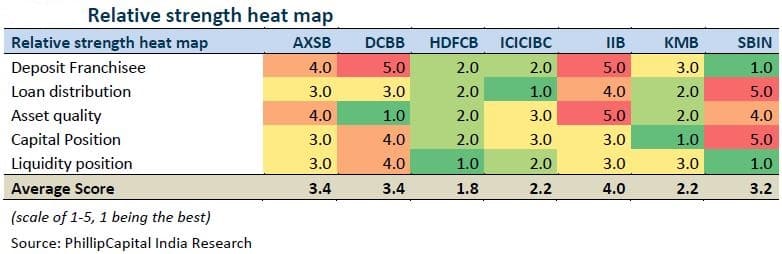

"We believe the impact on asset quality would be the least for HDFC Bank, Kotak Mahindra Bank, and DCB Bank, but it would be relatively high for IndusInd Bank," Phillip Capital said.

Domestic brokerage ICICI Securities, too, believes that the loan-book growth will take a hit.

"With the lack of any major private sector capex in the current fiscal, system credit growth was largely driven by the retail segment, which contributed nearly 91 percent of incremental credit during the year up to January 2020. We believe COVID-19 may further delay private capex revival and also decelerate the retail loan growth trajectory," said ICICI Securities.

"A few banks have already signalled tightening of their retail credit norms. They have also witnessed a decline in credit card spends, which will certainly impact retail loan growth."

Not only the loan-growth, but the current lockdown will also affect cash flows of borrowers, both individual and corporate which may lead to an increase in corporate as well as retail NPAs.

A decline in loan growth and a rise in credit cost will hit the earnings of the banks.

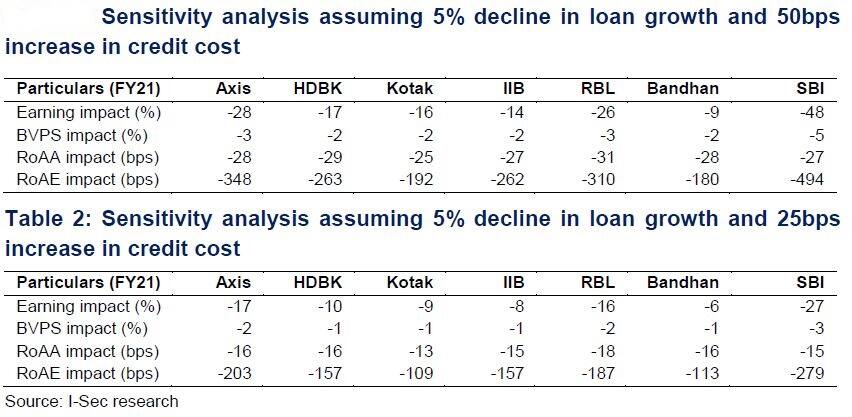

As per the analysis of ICICI Securities, 5 percent decline in loan growth and 50 bps increase in credit cost may adversely impact banks’ earnings by an average of about 22 percent, while 5 percent decline in loan growth and 25 bps increase in credit cost may hit their earnings by an average of 13 percent.

Stocks to watch out for

Banks with stronger business models have a higher ability to sail through this rough tide.

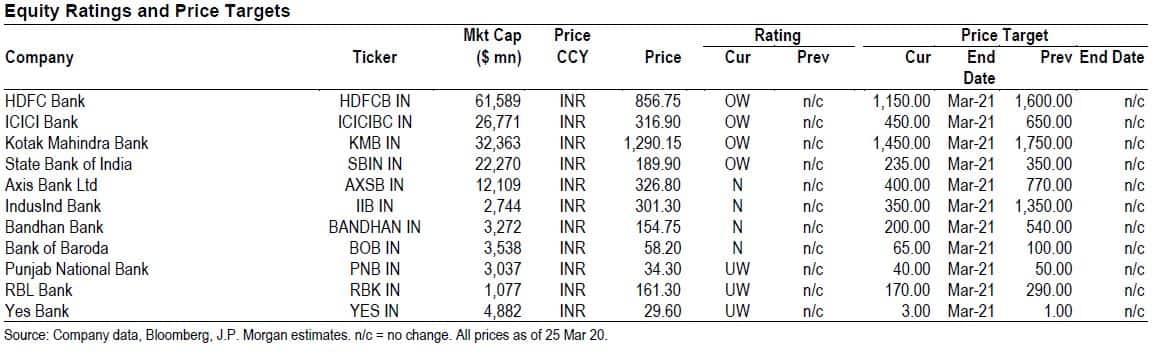

JP Morgan believes HDFC Bank, Kotak Mahindra Bank and ICICI Bank offer safety with a strong funding base and minimal asset quality risk.

"While forward earnings at this time have low visibility, one can only go by a track record of companies over past down cycles and those that have managed such headwinds (2008 global financial crisis, 2013 taper tantrum, 2016 demonetization and 2018 liquidity problems) should stand out relatively better," JP Morgan said.

Phillip Capital has made an assessment of their relative business strength and to gauge which business model has the ability to bounce back faster.

Phillip Capital has upgraded Kotak Mahindra Bank and DCB Bank to a 'buy' with a target price of Rs 1,500 and Rs 107, respectively.

The brokerage has maintained buy recommendations on HDFC Bank and ICICI Bank with revised target prices of Rs 1,110 (Rs 1,420 earlier) and Rs 450 (Rs 660 earlier), respectively.

ICICI Securities prefers HDFC Bank and Kotak Mahindra Bank, who have a proven history to contain NPAs through credit cycles with high-quality underwriting.

"We like HDFC Bank as nearly 80 percent of wholesale lending is to AA and above, nearly 75 percent of SME portfolio is secured and about 75-80 percent of unsecured loans are to salaried customers," ICICI Securities said.

"We will closely monitor BBB portfolio of Axis Bank (13 percent of corporate loans) and corporate & vehicle portfolio of IndusInd Bank from where incremental stress could emerge," it added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.