Shares of Bajaj Auto gained more than a percent intraday on October 24 after global brokerage houses raised target price on the stock as second quarter earnings beat analyst expectations.

The stock has gained more than 25 percent in the last three months amid hope of recovery in volume growth in the festival season and steps taken by the government. It was quoting at Rs 3,175.00, up Rs 13.65, or 0.43 percent, on the BSE at 1032 hours.

The two and three-wheeler maker reported a 22 percent decline year-on-year in profit at Rs 1,402 crore despite lower tax expenses. Revenue slipped 4.1 percent YoY to Rs 7,707 crore, while operating profit declined 9.6 percent and margin contracted 100bps YoY (but sequentially up 120bps). These numbers were impacted by lower volumes amid subdued demand, but were higher than analyst expectations.

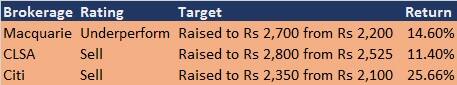

As a result, global brokerage houses raised their price target while maintaining a bearish stance on the stock.

Maintaining underperform call on Bajaj Auto, Macquarie raised its target to Rs 2,700 from Rs 2,200 per share, as operating profit margin improved QoQ despite lower sales volumes.

The brokerage raised its FY20-22 EPS estimates by 8-10 percent to factor in lower tax rate.

The company expects festival season sales to be flat YoY, but things have improved in last one month and margins increased due to price hike and better USD realisations, Rakesh Sharma, Executive Director of Bajaj Auto, said in an interview to CNBC-TV18. The situation was volatile, he said, reserving comments on guidance.

The company was still sitting on 60 days of inventory, but situation was under control, though Q2 was a difficult quarter for domestic motorcycle industry, he said.

Realisations increased 6 percent sequentially to Rs 65,871 per unit in Q2 against Rs 62,187 per unit in June quarter.

CLSA also retained its sell rating as the stock at 18x FY21 estimated PE is expensive. It, however, revised target price upward to Rs 2,800 from Rs 2,525 per share as it raised FY20-22 EPS estimates by 2-3 percent factoring in higher margins.

Exports were moderating as there were more regulatory headwinds coming in for two-wheeler industry, the brokerage said.

Citi also maintained its sell call on the stock, but raised target to Rs 2,350 from Rs 2,100 per share, as Q2 was buoyed by gross margins expansion.

"Margin expansion & benign commodity costs reflected in current valuations, but volume recovery is still uncertain," the brokerage said, adding margin may decline in Q3 if there was heavy discounting.

Citi raised its EBITDA estimates over FY20-22 by 3-4 percent.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!