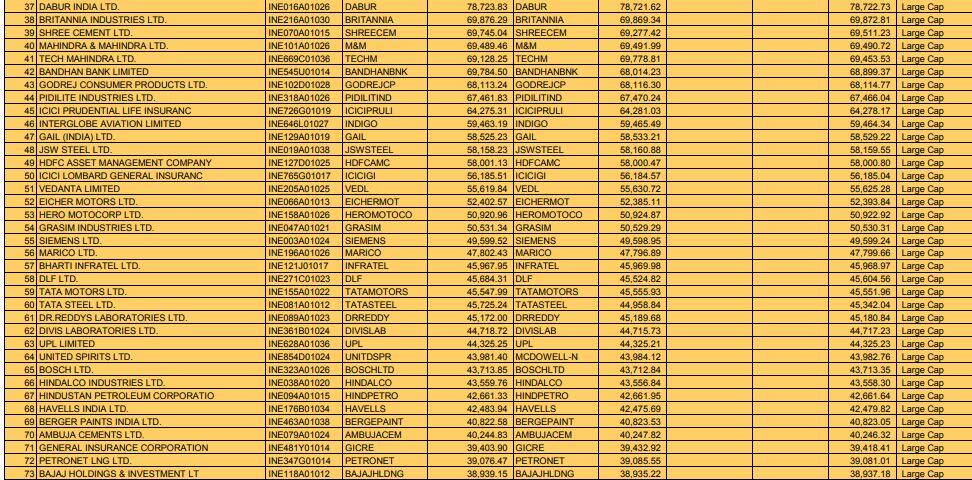

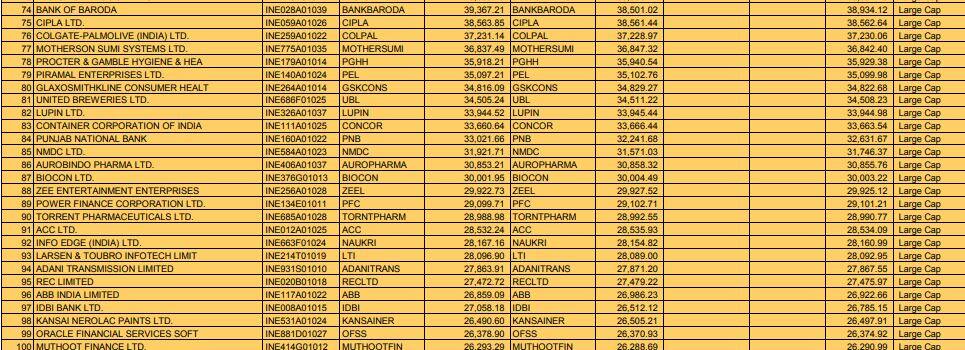

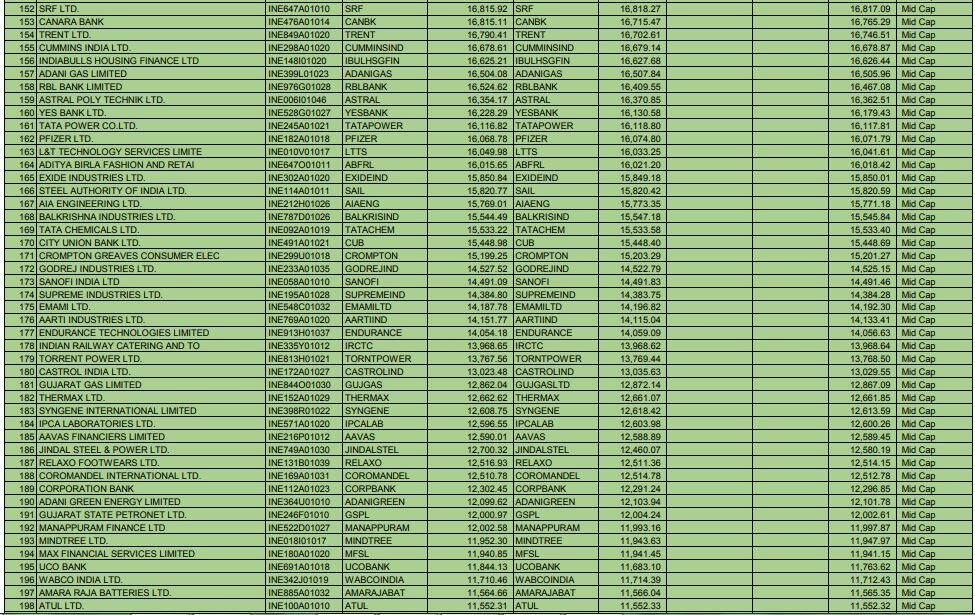

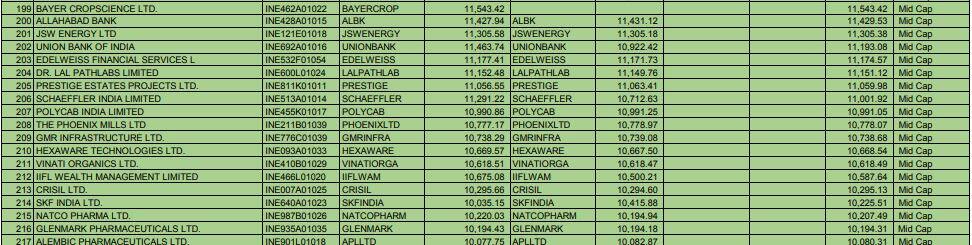

The Association of Mutual Funds in India (AMFI) shifted Info Edge (India), Adani Transmission, RECL, Kansai Nerolac and Muthoot Finance to the large-cap category from mid-cap on January 3.

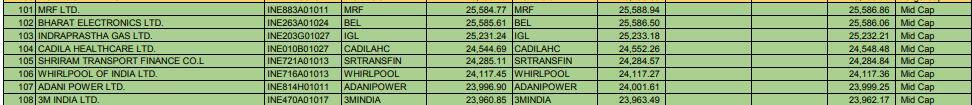

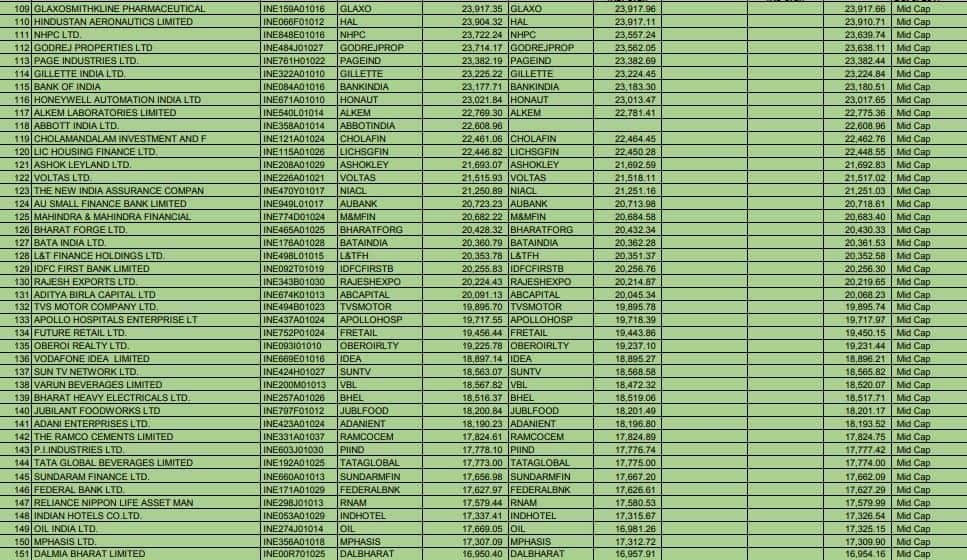

On the other hand, Cadila Healthcare, New India Assurance Company, Vodafone Idea, Indiabulls Housing Finance and Yes Bank have been moved to the mid-cap category.

AMFI carries out this exercise every six months between July and January, as mandated by the Securities and Exchange Board of India (SEBI). In order to ensure uniformity and clarity, the market regulator had in 2017 defined small-caps, mid-caps and large-caps.

Since then, AMFI, in consultation with SEBI and stock exchanges, prepares a list of stocks once in six months based on the data provided by the BSE, National Stock Exchange (NSE) and Metropolitan Stock Exchange of India (MSEI).

Earlier, there was no standard definition to classify companies as large, mid or smallcap. Each fund house would employ its own criteria for deciding the same. This would lead to huge differences in the classification of companies by various asset management companies.

Moreover, for investors, comparing two funds from the same category would sometimes result in an apple to orange comparison.

As per the new rules, the top 100 companies, in terms of market capitalisation, will be considered as large-caps, the 101st to 250th companies will be considered as mid-caps and the 251st onwards will be considered small-caps.

Along with this, SEBI laid down minimum investment criteria for large, mid and small-cap companies. As per these criteria, any mid-cap fund is now mandated to maintain 65 percent of its portfolio in mid-cap stocks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.