I am not shorting the market, however, I am not taking any fresh long position in the market. We are advising our investors to rebalance their 'Asset Class' & 'Sectors' to protect their gains of the last four months, Amit Jain, Co-founder & CEO at Ashika Wealth Advisors said in an interview to Moneycontrol's Sunil Shankar Matkar.

Edited excerpt:

Q: Are you convinced about the current market rally given the rising COVID cases?

Yes, Market rally has been too sharp to be anticipated by anyone. As mentioned in my last interview, behind this liquidity driven rally, there is cohesive effort by Global Central banks to create new money, particularly by the US Federal Reserve. In the current rally, the market has already factored in further stimulus packages by the US Federal Reserve & European Union.

I am cautiously bearish on Markets at Nifty level of 11,300. I am not shorting the market, as by doing so, I am shorting the US Fed, however, I am not taking any fresh long position in the market. We are advising our investors to rebalance their 'Asset Class' & 'Sectors' to protect their gains of the last four months.

Q: Most experts feel the June quarter earnings so far announced by leaders among sectors are either better or inline with expectations. What are your thoughts?

Yes, earnings have been better compared to expectations for Q1, as each analyst was to pessimist in the beginning of April & anticipated complete washout of Q1 earnings. In our view, earnings will continue to be under pressure till Q3, however, we may continue to see divergence in corporate earnings & their stock price performance, due to high liquidity in global markets.

In the ongoing decade, India may be the most favoured market Globally, as there are higher chances that the Global Business Community may follow "economic distancing" with China.

Q: Auto sector index with 60 percent rally from March lows outperformed benchmark Nifty50, but sales so far and June quarter earnings are not so good. What is driving the sector and is it just a hope rally?

The Auto sector has done very well in line with our expectations shared with you in April, when Nifty was near to its bottom. We are continuing to be bullish on the personal mobility sector like two-wheeler & affordable four wheeler segment as during this ongoing pandemics, every individual will prefer personal transport rather than public transport to avoid infections. Hence we may see excellent numbers in personal mobility space once we see more leniency in lockdowns. Markets are discounting these good numbers well in advance.

Q: DIIs so far have been net sellers in July and MFs too. Do you expect the significant fall in inflows into equity funds in July and SIP to moderate further, why?

DIIs were sellers to the tune of almost Rs 10,000 crore in July. At this level of market, risk-reward ratio seems to be unfavourable, hence we may see much lesser long rollovers in August series. Also a lot of good news already factored in, so the market is awaiting for some fresh clues before it decides its direction. In my view we may see less fresh inflows in equity funds at this level of market, however older SIPs will continue to give a cushion to any significant downfall in markets.

Q: What are key sectors one should consider, especially after COVID-19 crisis, and why?

Sectors which seem to be more resilient from a medium-term perspective are:

A) IT companies which focus on artificial intelligence & automation processes: As all businesses will focus on AI & automation in the ongoing decade. In fact we are bullish on this sector even before COVID-19 , now we are even more bullish.

B) Personal mobility space particularly two-wheeler & affordable four-wheelers

C) Healthcare: Post COVID-19, all individuals will focus more on their health & immunity, which otherwise was taken for granted as a God gift. They will incur more money to avoid any healthcare crisis in life. In my view India may be a Pharma & IT hub for the world by 2030.

D) Telecom Sector: As of now there are only two players which exist in the market unlike sixteen players almost a decade back. This lesser competition will improve ARPU along with more data consumptions during pandemic.

We have advised all these four sectors to our investors in March 2020 to have the right entry point. Also we continue to hold the same stance in medium term. At the current market level of Nifty at 11,300 we are not advising any fresh long positions.

Q: What are your thoughts on geopolitical tensions - US-China and also India-China? Will both really hit Indian economic growth or is it just a sentimental effect than fundamental?

In my view, these current geo-political tensions may be very positive for India in the ongoing decade till 2030. As I mentioned in my previous interviews as well, I am extremely bullish on India for this decade. As of now almost all countries are talking about "Economic Distancing" with China due to pandemic & I believe India is the only country which can offer such large scale operations for being the Manufacturing Hub of the World, if we implement due reforms in our Land, Labour, Legal & Tax structures.

Demographically we are well poised to replace China as we have the youngest & cheapest labour available with the largest Democratic & Transparent Economic Structure in the World.

Q: Banking sector is expected to be hit by asset quality stress once the moratorium gets lifted from September onwards. But do you really think it is a big concern and as a result one should avoid the complete sector for investment? Also, what are your thoughts on NBFC?

Today India's banking sector has a loan book of close to Rs 97 lakh crore, out of which 9-13 percent has exposure to those sectors, whose business model has become unviable in the last 13 years. This may be an overhanging sword to Indian banking system going forward. We have already seen Yes Bank & some other cooperative banks gone bust due to the above-mentioned challenges. To share a broader view, the entire banking sector has capital of Rs 11-12 lakh crore, if above mentioned risky sectors has 40 percent NPAs, then half of the banking industry capital shall be wiped out.

Also, above view was before COVID-19 era, hence we advised all our investors to exit banks stocks on January 16, 2020. I believe, post COVID-19 era, this situation may go worse, as we don't have power like the US Fed to print fiat money without depreciating our currency, hence I am very cautious about this sector post loan moratorium period ends. Also, at the current lower level of repo rates, bank treasury income shall also be under check.

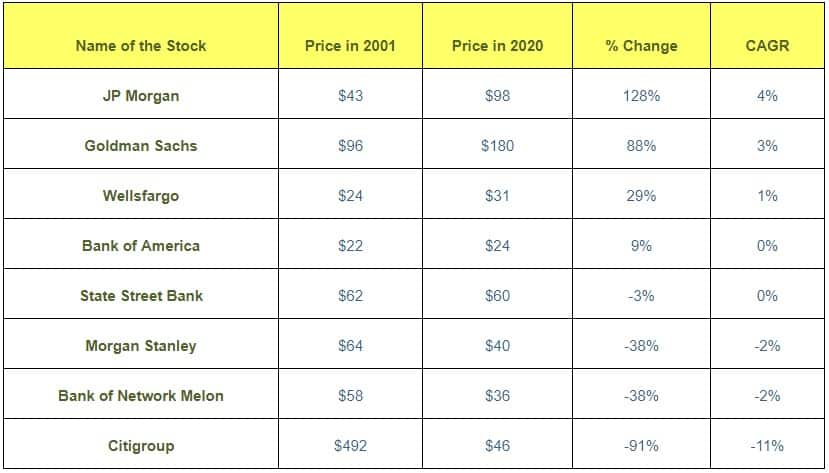

If you see globally banking is a zero-sum game, they grow with an expansionary balance sheet of economy & bust with a decrease in growth rate. What banks' call 'Asset' in a bull phase, it becomes 'Bad asset' in a bear phase. My view is strictly from the sector's point of view, however I am not commenting on their share price by any means, as there are some different factors which play in the stock market. However, for reference, I am happy to share below stock price performance for some of the global banks which still exist after the 2008 financial crisis. For investors quick recap, from 2008 till 2012 almost 400 banks were declared failed in the US Economy by FDIC. Hence one should be cautious of being too casual with banks.

Just to conclude my view on banking sector, if right steps to attract foreign capital are not taken by Government now, then it can be India's 'Lehman moment'. In last 16 years we have seen banking & NBFC stocks done well, however now, it looks, it is time to invest in ARC's from a medium term perspective.

Q: Do you think the demand for consumer staples is back to pre-COVID levels. And is it one of the reasons for the rally in the market?

Consumer staples are an essential product that includes typical products such as foods & beverages, household goods, and hygiene products. If you look at the Quarter 1 results, they have been above par for most of the companies; the liquidity flow has followed its way to the markets as well as in consumers stocks. The demand for consumer staples is not at the level where they were left off in January, However, the revival that looks on the cards is based on the number of things which will be turning up in the coming few months. Any recession including 2008 has managed to have consumer staple businesses rally up and become the alpha generators for the portfolios. The demand for consumer staples is squeaked for now with drop in volumes on YoY growth and performance.

The lockdown has affected the timings and occupancy of the stores but it still manages to be at levels of par in terms of performance. Going ahead, we believe that consumer staples demand revival will be turning up in a few months. However, in terms of investments, the time to invest has already passed & now, it's time to rebalance & switch out to undervalued sectors.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.