Using data gathered from various sources, from tax filings and bank accounts to credit card issuances and mobile phone subscriptions, analysts at Goldman Sachs have found the rapid increase of a demographic in India.

In the recent report titled "The rise of the Affluent India", the analysts have said that people who earn $10,000 annually have grown at a rapid clip. The number of these affluent Indians have grown at 12 percent CAGR over 2019-23 versus the 1 percent CAGR of India's population.

Here are the five charts that illustrate this trend.

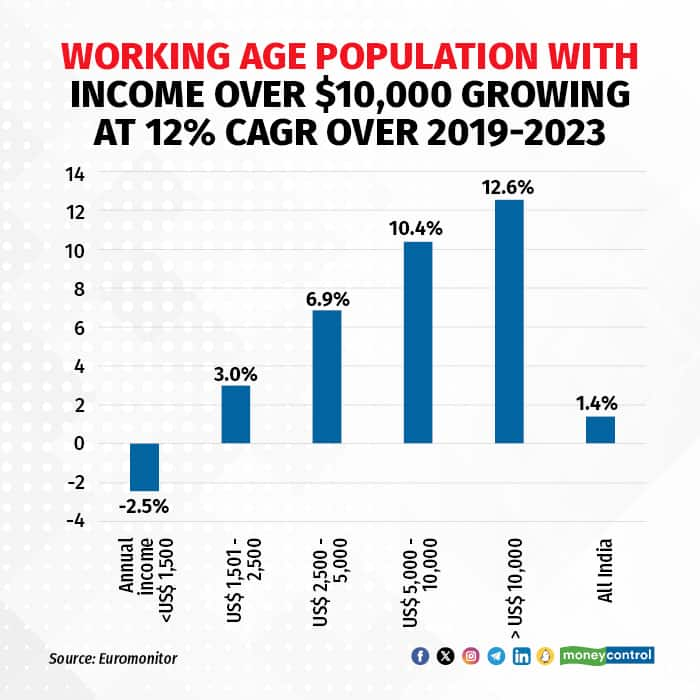

1. The total number of people with an income over $10,000 in the working age population of India has grown at a CAGR of 12.6 percent over FY19 23,as per Euromonitor. This compares with the overall working age population CAGR in India of 1.4 percent over FY19-23.

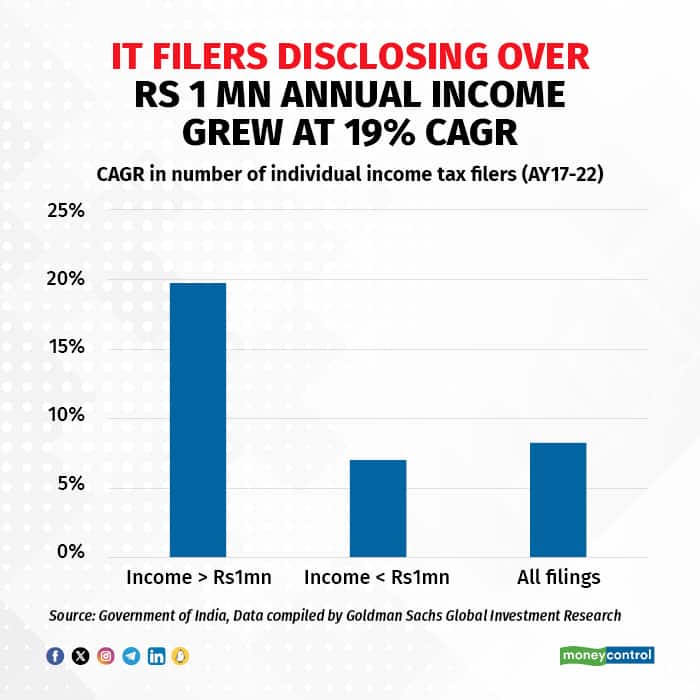

2. The total number of individuals filing income tax returns disclosing income of over Rs 1 million (~$12,000) has grown at a CAGR of~19 percent over AY17-22, compared to the overall growth of income tax filings which has grown at a CAGR of 8 percent in the same period.

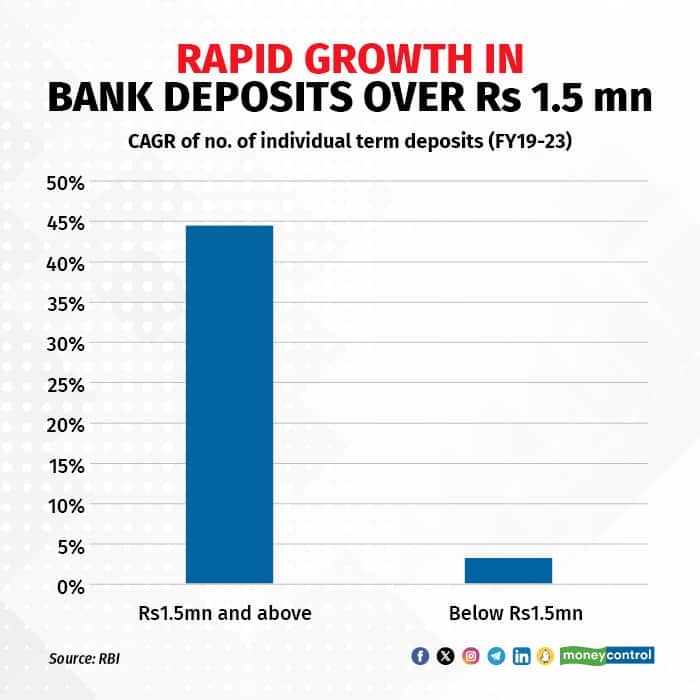

3. The number of individual term deposits in banks above Rs 1.5 million (~$18,500) has grown at a CAGR of 45 percent over FY19-23, while the number of term deposits below the Rs 1.5 million has grown at a CAGR of 3 percent over the same period.

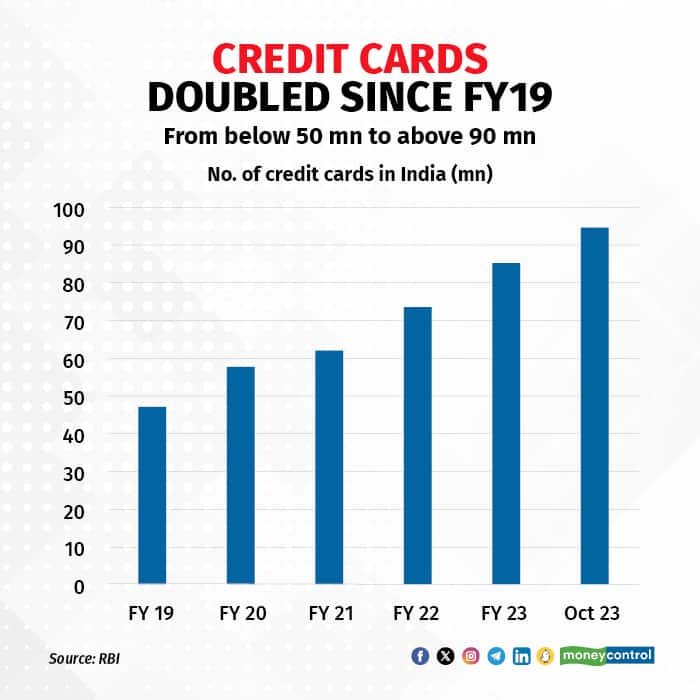

4. The number of credit cards in India has grown at a CAGR of 16 percent over FY19-23, compared to the number of debit cards which grew at a CAGR of around 1 percent in the same period. There were ~85 million credit cards in India in FY23, compared to ~960 million debit cards.

Also read: 8 stocks that stand to profit from ‘Affluent India’, according to Goldman Sachs

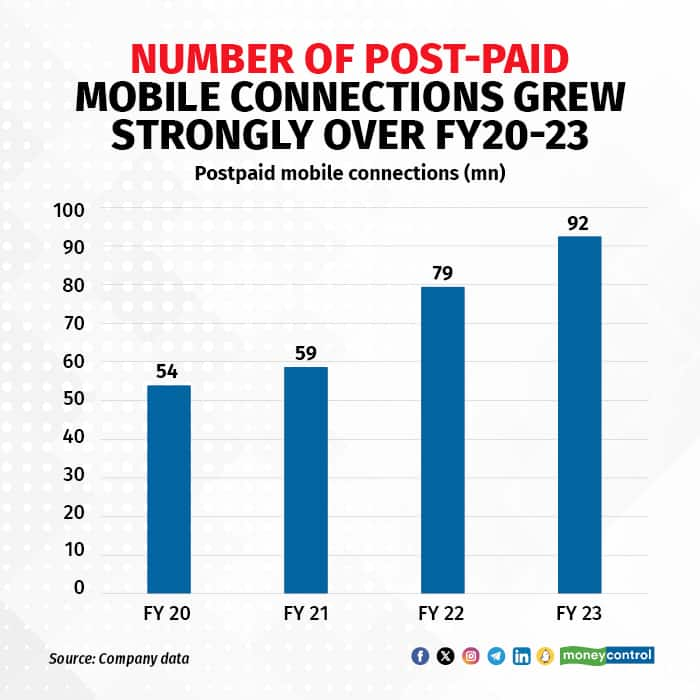

5. The number of post-paid connections rose by nearly 30 percent over FY21-22.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.