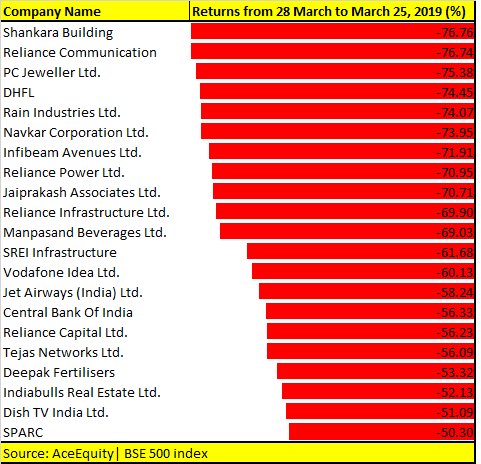

As FY19 is coming to an end, a glance at the stock returns of BSE500 companies showed that nearly 70 percent gave negative returns. Out of those, 21 companies eroded more than 50 percent of investor wealth.

Stocks that fell 50-70 percent in the S&P BSE 500 universe include Shankara Building, Reliance Communications, PC Jeweller, DHFL, Rain Industries, Infibeam Avenues, Reliance Power and Jet Airways.

If you have invested in these stocks, then analysts advise caution because some of them have fallen for some fundamental reasons.

However, there are opportunities in few names that could, in fact, give handsome returns in the near future, they say.

“Most of these stocks have fallen due to valid reasons. As we look through the list, most of them seem avoidable although a few of them, very few represent good value and can actually be multibaggers over the next couple of years,” Sandip Sabharwal, Independent Advisor at asksandipsabharwal.com told Moneycontrol.

If you are holding stocks mentioned in the list then a proper risk assessment is required as you step into FY20. Investors should first analyse detailed reports and financial background of their portfolio.

“If investors are stuck with stocks that have lost more than half of their value, then realise and look into the balance sheet of the company along with the order book and margins of the companies and their ongoing growth in the coming quarterly results,” Debabrata Bhattacharjee, Head of Research, CapitalAim told Moneycontrol.

“For example, Reliance Communications has nothing in its balance sheet except debt burden. Investors should stay away from these type of companies, while on the same side Jet Airways also have debt burden but has a solid revival plan is on the floor that will move stock from Rs 210 to Rs 280—almost 31 percent,” he said.

Bhattacharjee further added that companies that have a full proof plan to get exit from debt burden can move in the near future. “Investors should accumulate or hold companies where management are eager to or have something serious to do for the company,” he said.

However, there are many stocks that are fundamentally strong and have given good returns in FY19. Indian markets gained momentum in FY19 as it hit a record high in August but then the momentum fizzled out as Nifty slipped around 10,000 while Sensex plunged towards 33,000 before bouncing back.

Well, the good part is that as we step into FY20, benchmark indices have recovered most of their losses and are on their way to hit record highs in the next 12 months.

Only three companies in the S&P BSE 500 index rose over 100 percent in FY19: Merck, AstraZeneca Pharma, and Adani Power. Out of 144 companies in the S&P BSE 500 index that delivered positive returns only 13 companies gave over 50 percent returns.

Stocks that rallied more than 50 percent in FY19 include RIL, Suven Life, Divi’s Laboratories, Info Edge, Vinati Organics, Bata India, Bajaj Finance, and NIIT Technologies.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust that controls Network18 Media & Investments Ltd. The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decision.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.