While the Indian passenger vehicle (PV) market is poised for a 5-7 percent growth during 2023, the luxury segment of that pie is bracing for yet another year of double-digit growth. Having already witnessed robust growth in numbers during the first quarter (Q1) of this calendar year (CY), luxury carmakers, such as Mercedes, BMW, Audi, and Volvo, among others, are hoping to sustain the momentum, thanks to improvement in the supply of semiconductor chips and other components. That will enable the high-end carmakers to grow at twice the rate of the overall PV market.

As per industry estimates, around 34,000 luxury vehicles were sold in India in 2022, which was an increase of around 50 percent from the year before, but still below the all-time high of around 40,000 units in 2018.

Puneet Gupta, Director S&P Global Mobility predicts a near-25 percent growth to 42,000 units this calendar year. He claims that in spite of production issues, India is expected to record highest ever sales of premium cars this year.

Volumes off to a flying start in Q1 CY 2023

Mercedes-Benz India posted its best ever first quarter (Q1, January to March) sales numbers registering 17 percent growth at 4,697 units. The country’s largest luxury car maker, which grew by 41 percent during the last calendar year at 15,822 units, aims to maintain the double-digit growth chart on the back of 10 new launches in 2023.

Watch: Demand for both new & pre-owned luxury cars rise

“We're very happy with our progress so far, and we see that we'll close the year with double-digit growth,” Lance Bennett, VP, Sales and Marketing, Mercedes Benz India, told Moneycontrol recently. He also said, “If you consider the first quarter, we had 17 percent growth, and that too without the (all-new) GLC (SUV). We’re pretty confident that when we get that model, we will continue to sustain the momentum in the third quarter of this year.” He, however, did not share any guidance on the rate of growth for the company, going forward.

Another luxury carmaker, BMW Group India, too posted its best year in 2022, and is looking to replicate the success on the back of the order pipeline it has for the next few quarters. Last calendar year, the group sold 11,981 premium cars of both Mini and BMW brands, registering a growth of 35 percent.

ALSO READ: Indian Uber luxury car market on a superhighway cruise

“Between December (2022) and January (2023), we launched eight products in eight weeks, and that has given us a fast start in 2023. We have now created an order pipeline of demand of more than 5,500 cars. Of course, it will not reflect in our numbers as of now, because the supply will start from the second quarter or perhaps the third quarter of this year,” Vikram Pawah, President & Chief Executive Officer (CEO), BMW Group India, told Moneycontrol recently. He went on to add, “Our intention, very clearly, is to create a record year. But I don't give a prognosis (on growth rates). You will see at the end of the year.”

Pawah acknowledged that supplies of components are a matter of concern, as there are “logistical challenges” and the “semiconductor issue” is not fully resolved yet. “But other than that, from the demand side, we see very robust demand. It's the supply side we need to match up now. And that's why you will see a little bit of delay between demand and supply.”

On similar lines, Audi India witnessed 126 percent year-on-year (YoY) growth in Q1 2023 by retailing 1,950 cars. The German carmaker claimed that it registered a 27 percent growth in 2022 in spite of several global supply-chain impediments, the ongoing semiconductor chip shortage, and a slew of other challenges. It is forecasting double-digit growth in 2023.

As per Balbir Singh Dhillon, Head of Audi India, the “YOLO (You Only Love Once) attitude” coupled with “pent-up demand” after the pandemic were the factors aiding growth. In his view, this year the luxury car segment will top the 2018 record volumes, surpassing it by a significant margin.

“Yes, the semiconductor challenge isn’t over ― it continues to cause supply delays. We expect to end 2023 with double-digit growth. The new technology-rich products, a new electric launch this year in quarter three (Q8 e-tron electric SUV), high disposable incomes in the hands of consumers, and the upcoming festival season will help our growth this year,” stated Dhillon, in response to email queries sent by Moneycontrol.

Swedish luxury carmaker Volvo revealed that it had achieved 38 percent growth in Q1 2023; it projects total sales of close to 3,000 vehicles in 2023. In Q1 2023, it sold 544 cars, of which the XC60 registered a 27 percent growth, and the locally assembled all-electric XC40 Recharge accounted for 25 percent of the total volumes. Furthermore, it expects its electric models to account for nearly 50 percent of the pie in 2023.

“The performance in the first quarter is a good indicator and the company is confident that the coming quarters will show better results,” affirmed Volvo Car India Managing Director Jyoti Malhotra.

Lexus India and JLR India did not share their sales figures till the story was published.

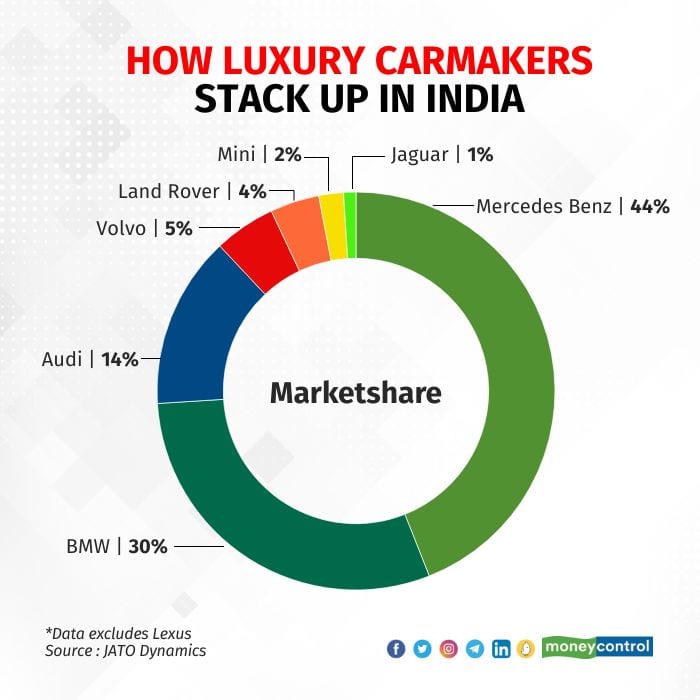

Despite the phenomenal growth in sales of hi-end models, the luxury car market in India accounted for just 1 percent of the overall PV market in 2022. This may go up by just 0.1 or 0.2 percent this year. Industry players reckon that with the rising number of new-age entrepreneurs, millionaires, and female buyers, this segment has the potential to account for 3-5 percent of the overall PV market by the end of the decade.

Ravi Bhatia, Managing Director of JATO Dynamics, opines that this year the luxury car market in India could continue to grow at a steady pace, driven by factors such as the increasing number of affluent consumers, the rising demand for more eco-friendly and technologically-advanced vehicles (electric luxury cars), and the launch of new luxury car models by manufacturers. However, the growth in the market could be impacted by various factors, including changes in government policies, economic instability, and global market trends, he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!