Ireland is fast emerging as a popular route to make India investments, thanks to the growing popularity of Irish Collective Asset Management Vehicles (ICAV) funds. These have become the go-to vehicles for US-based investors seeking India exposure due to flexibility these funds offer from a tax perspective.

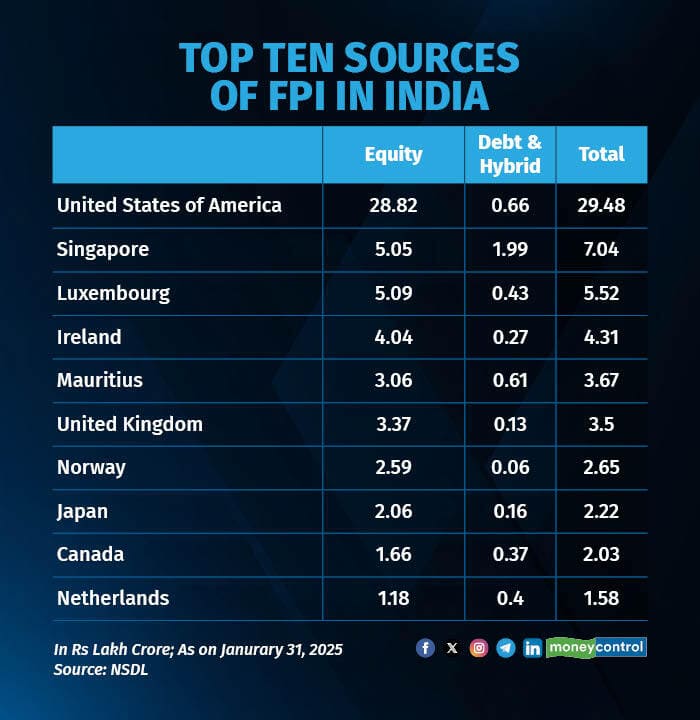

According to NSDL data, Ireland is now the fourth largest destination for India’s foreign portfolio investors (FPIs), up from the sixth position two years ago. Equity assets from Irish funds in India grew more than 80 percent during the period.

Irish Funds owned equity assets worth Rs 4.04 lakh crore as in January 2025 against Rs 2.26 lakh crore in January 2023, data shows. During the period, Ireland displaced Mauritius and the United Kingdom in terms of portfolio value. All foreign funds together own Rs 67 lakh crore worth of securities in India.

The US-Ireland tax treaty is beneficial for US investors. Ireland doesn’t charge any tax at the fund level and instead provides pass-through status, meaning funds are not taxed on capital gains or dividends. Instead the fund transfers the proceeds to individual investors who are liable to be taxed. Also, since the tax liability is on the end US investor, the US investors (individuals) get tax credit which can be used to offset their tax liability in the US.

ICAVs are a special kind of entity that were introduced in Ireland in 2015. ICAVs are allowed to have variable capital and not subject to the compliance requirements of a regular company such as holding mandatory board meetings. These funds need not seek any regulatory approval after getting the ICAV licence. However, only funds that have more than 100 investors are allowed to be ICAVs as per Irish rules, meaning only broad-based funds are eligible.

Several Indian fund managers such as ASK Advisors and DSP have started ICAV funds to cater to global investors wanting to invest in India.

There are 834 FPIs registered from Ireland, of which 146 are ICAV funds. Marquee funds including Amundi, Blackrock and GQG Partners have ICAV funds investing in India, NSDL data shows.

Tax experts say the rise of Irish funds is largely due to the US-based investors preferring the Ireland route to invest in India. This is on account of two favourable tax treaties — India–Ireland Double Tax Avoidance Agreement (DTAA) and Ireland-US tax treaty.

India-Ireland treaty provides for beneficial withholding tax rates of 10 percent for dividends and income. It is also easier for Irish funds to fulfil the conditions of India’s General Anti-Avoidance Rules (GAAR).

In the last few years, Indian tax authorities have gone after funds from jurisdictions like Mauritius and Cyprus for choosing these jurisdictions just to get tax benefits. Ireland is a well-established financial centre with dozens of multinational companies such as Meta and Google having large operations.

Another key feature of this regime is that the proceeds are taxed in the hands of investors only if the investor is domiciled in Ireland. Others have to pay taxes in their home countries. The scheme benefits US- based investors in particular since it effectively means tax implications on investments through ICAV funds is the same as the tax applicable if the investor had put money directly.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.