Despite the challenges faced by the Indian stock markets on a global scale, numerous recently listed small businesses in 2023 have displayed impressive performance. Notably, certain companies have achieved exceptional growth, witnessing their shares more than double in value.

SME firms mopped up Rs 930 crore by way of 49 offerings in 2023 so far, nearly 9 times the 5 mainboard issuances that have hit the market. These five main board IPOs raise around Rs 5,824 crore, according to Prime Database data.

Analysts point out that several SME IPOs have attracted significant oversubscription due to their listing at a substantial premium above the issue price. Despite the inherent risks associated with this segment, such as limited disclosure and concessions granted to the issuing companies, investors with a high appetite for risk have eagerly participated. Many of these investors are high net worth individuals (HNIs) who have previously enjoyed substantial gains from similar IPOs, according to Raj Vyas, Portfolio Manager at Teji Mandi.

Out of 49 SME IPOs, 33 companies are trading above their issue price. For instance, Macfos Ltd, which went public in March 2023 through a Rs 22.55-crore IPO, has witnessed a staggering 210-percent increase from its issue price of Rs 102 per share. Similarly, Quicktouch Technologies Ltd, listed in April 2023 after a Rs 8.86 crore share sale, has surged over 175 percent from its issue price of Rs 61 per share.

Other notable companies that have experienced over 100 percent gains from their issue price include Lead Reclaim & Rubber Products Ltd, Exhicon Events Media Solutions Ltd, MCon Rasayan India Ltd, Quality Foils India Ltd, Infinium Pharmachem Ltd, Innokaiz India Ltd, and Srivasavi Adhesive Tapes Ltd.

Shares of seven other firms, including Systango Technologies Ltd, Shera Energy Ltd, De Neers Tools Ltd, Sancode Technologies Ltd, Retina Paints Ltd, Ducol Organics & Colours Ltd, and Pattech Fitwell Tube Components Ltd, have observed increases ranging from 40 to 95 percent since their listing.

'Essential to remain vigilant'

Two companies such as Patron Exim Ltd and Amanaya Ventures have declined nearly 66% and 41% respectively from its issue price. Other firms such as AG Universal Ltd, Viaz Tyres Ltd, Agarwal Float Glass India Ltd, Aristo Bio-Tech & Lifescience Ltd and Indong Tea Co Ltd are trading lower between 10-18% from its issue price.

However, analysts caution that the limited free float and small market capitalisation of such companies can make the stock prices susceptible to manipulation by a group of individuals with limited funds. In some cases, even the promoters may collaborate with the investors. Deepak Jasani, Head of Retail Research at HDFC Securities, notes that while there are genuine companies with decent promoters that easily attract oversubscription due to their smaller size, it is essential to remain vigilant. He also highlights the influence of a vibrant grey market in this regard.

In the year 2022, approximately 109 SME firms went public, collectively raising around Rs 1,875 crore through IPOs. By comparison, in 2021, 59 SME firms were listed, raising a total of Rs 746 crore.

Amidst the significant short-term returns, analysts remain cautious and emphasise the sentiment surrounding these offerings can quickly change. They warn that even a few disappointing listings have the potential to erode investor confidence.

Given that many of these businesses are still in their early stages, investing in them carries a substantial level of risk, but it also presents the possibility of significant gains. Evaluating the business prospects, quality of promoters, and corporate governance can be challenging due to the limited operational presence of these companies. However, analysts stress the importance of conducting a thorough assessment of these factors, as neglecting to do so could prove costly in the long run.

Investors should also be aware that the minimum investment amount for SME IPOs is significantly higher, around Rs 1 lakh, compared to the approximately Rs 15,000 for regular IPOs. Furthermore, it is crucial for investors to note that while SME IPOs initially experience high liquidity and significant trading volumes, they tend to decline, analysts added.

Financials

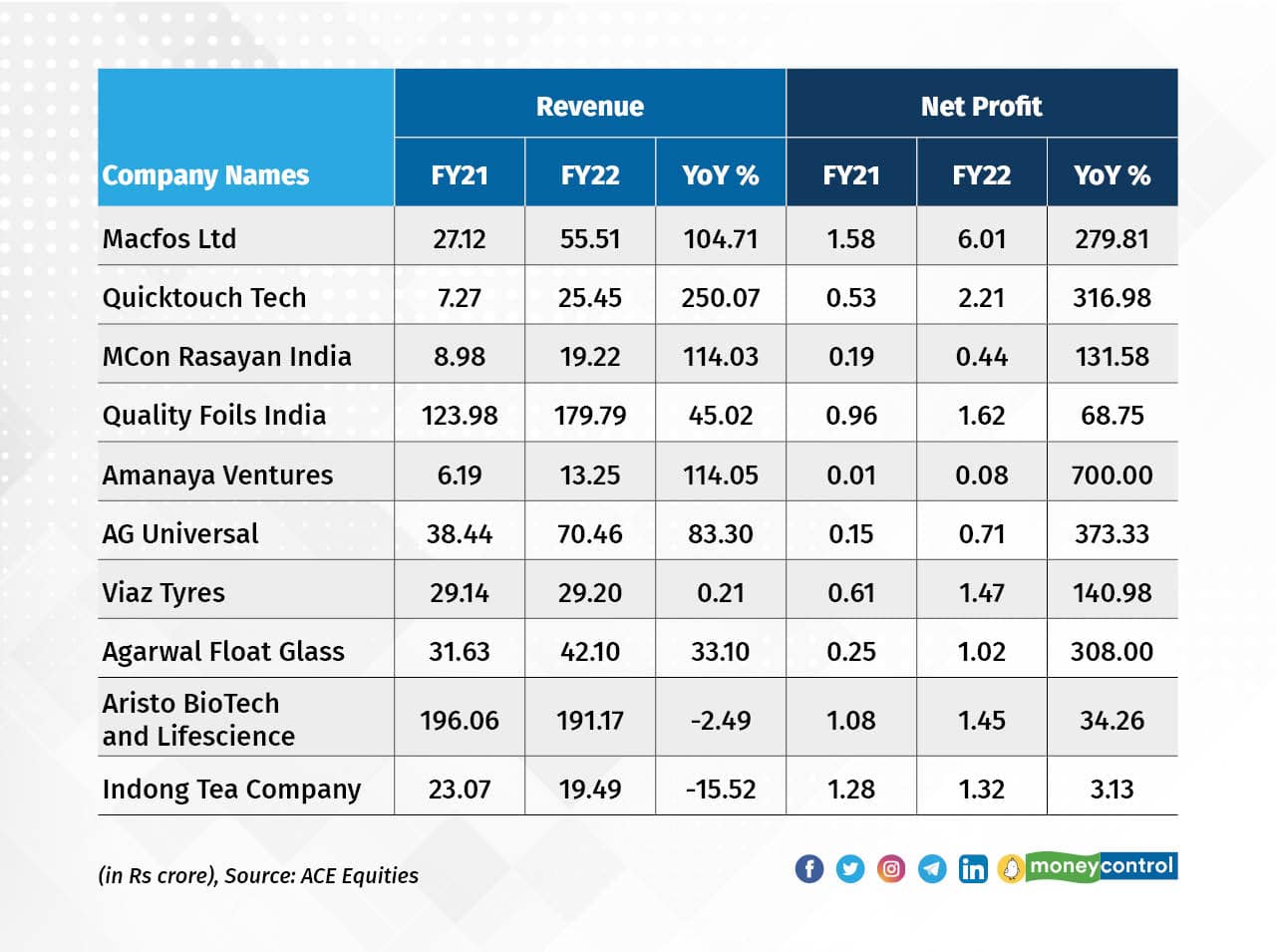

Several companies have experienced significant gains since their listing, although their latest earnings have not been reported. In FY22, Macfos Ltd, a company specializing in robot making kits, e-bike accessories, and drone parts, witnessed a remarkable 104% year-on-year increase in revenue, reaching Rs 55.51 crore. Additionally, their net profit soared by 280% to Rs 6 crore compared to the previous year.

Quicktouch Technologies, an IT solution provider offering services such as software and content engineering, data management, and cloud adoption, also enjoyed a prosperous year. They reported a substantial 250% surge in revenue to Rs 25.45 crore, accompanied by a net profit increase of over 317% to Rs 2.21 crore.

MCon Rasayan India Ltd, specialising in manufacturing construction chemicals and building finishing products, announced a noteworthy 114% rise in revenue in FY22, reaching Rs 19.22 crore. Their net profit experienced a similar surge of 131.5% to Rs 0.44 crore. Quality Foils India Ltd, a steel product manufacturer, saw their revenue rise by 45% to Rs 180 crore, while their net profit advanced by 69% to Rs 1.62 crore. The company specialises in cold-rolled stainless steel precision strips, coil tubs, pipes, and hoses.

Despite a decline of nearly 41% since listing, Amanaya Ventures Ltd exhibited positive financial performance in FY22. They reported a significant 114% jump in revenue to Rs 13.25 crore, along with a net profit increase of 700% to Rs 0.08 crore. A similar situation unfolded for AG Universal, which dropped 18% since listing. In FY22, their revenue experienced an impressive 83% increase, reaching Rs 70.46 crore, and their net profit saw a significant jump of 373% to Rs 0.71 crore. AG Universal specialises in manufacturing and supplying steel products.

Viaz Tyres Ltd witnessed a drop of 17% since listing. However, they maintained a steady revenue of Rs 29.20 crore in FY22, while their net profit doubled to Rs 1.47 crore. The company is engaged in providing auto parts and accessories. On the other hand, Agarwal Float Glass India Ltd, specialising in manufacturing and supplying building materials and construction glass products, faced a decline of over 14% since listing. Despite this, their revenue stood at Rs 42.10 crore in FY22, reflecting a 33% increase from the previous year, and their net profit experienced a significant jump of 308% to Rs 1.02 crore.

Aristo BioTech and Lifescience Ltd, a pesticide manufacturer, observed a slight decline of 2.5% in revenue in FY22, amounting to Rs 191 crore. However, their net profit rose by 34% to Rs 1.45 crore. Since listing, their stock has fallen by nearly 14%. Indong Tea Company Ltd reported a 15% drop in revenue to Rs 19.49 crore in FY22, while their profit rose by a modest 3% to Rs 1.32 crore. The company's stock has lost approximately 12% since listing.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.